Forget NextEra Energy, Buy This Magnificent Dividend King Instead

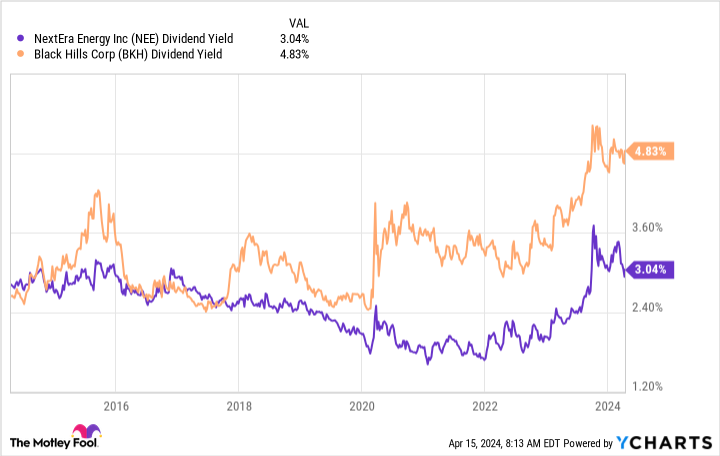

NextEra Energy‘s (NYSE: NEE) dividend yield is near its highest levels of the past decade, which suggests that it is on sale today. But that yield, at roughly 3.3% or so, is still only about average for a utility stock.

If you are trying to maximize current income, this utility alternative is a Dividend King, and it has a much higher yield.

There’s a lot to like about NextEra Energy

But first, NextEra Energy is no also-ran in the utility sector. In fact, with a market cap of roughly $130 billion, it is one of the largest utility companies you can buy.

It operates a regulated utility in the attractive state of Florida, which has benefited for years from net migration, and it also has a fast-growing renewable power business. The renewable power business, by the way, is one of the world’s largest producers of solar and wind power.

There are clearly a lot of reasons to like the stock. These include a 29-year streak of annual dividend increases, an annualized increase of 10% per year over the past decade, a projection for 10% annual dividend growth through at least 2026, and a yield that’s toward the high end of its 10-year range.

The problem, as noted, is that the 3.3% yield is only average for a utility, using the Vanguard Utility Index ETF (NYSEMKT: VPU) and its 3.3% dividend yield as an industry proxy.

So NextEra Energy is really most appropriate for investors who are focusing on dividend growth stocks or growth and income investors. For anyone looking to maximize the income they are generating today, NextEra Energy will be quickly forgotten. Which is where tiny Black Hills Corporation (NYSE: BKH) comes in.

Black Hills: Small but mighty

While Black Hills’ $3.5 billion market cap would be little more than a rounding error for NextEra Energy, the smaller of these two utilities is a giant by a different metric. Black Hills has increased its dividend annually for 53 consecutive years, making it a Dividend King.

NextEra Energy is still over 20 years away from that status. And Black Hills currently offers a decade-high yield, only its yield is roughly 5%. That’s notably above the industry average.

As for dividend growth, Black Hills doesn’t match up to NextEra Energy. But with an annualized payout growth rate of 5% over the trailing one-, three-, five-, and 10-year periods, Black Hills has a strong enough dividend growth story to tell.

While 5% dividend growth is not exceptional in the utility space, it is still a good number and one that will easily keep investors ahead of the long-term rate of inflation growth. That means you get a sizable income stream today, and the buying power of the dividend should grow over time as well. That’s an attractive combination if you are trying to live off the income your portfolio generates.

To be fair, with a slower growth profile, Black Hills will likely have a more challenging time adjusting to rising interest rates. That’s an issue because the company, like most utilities, makes heavy use of leverage to fund its capital-intensive business. It has some large debt maturities coming up that will result in higher costs going forward.

But the balance sheet is investment-grade, and regulators will likely take higher interest costs into account as rate cases come up. In other words, it can muddle through for a bit until the business adjusts to the new rate regime.

Regulators, meanwhile, will have more than just interest rate changes to consider. That’s because Black Hills customer growth is running nearly three times faster than U.S. population growth. So the government will basically be incentivized to provide Black Hills with positive rate-case outcomes to ensure that the utility’s 1.3 million customers have reliable access to the energy they need.

You can do better if you are looking for income

NextEra Energy is a very well-run company, and many investors would do well to buy the stock. But forget NextEra Energy if you are trying to maximize the income your portfolio generates; the 3.3% yield just isn’t compelling enough. A far better option is Dividend King Black Hills and its historically high 5% or so yield.

Should you invest $1,000 in Black Hills right now?

Before you buy stock in Black Hills, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Black Hills wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Reuben Gregg Brewer has positions in Black Hills. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.

Forget NextEra Energy, Buy This Magnificent Dividend King Instead was originally published by The Motley Fool