Even Covid Can’t Justify $18.5 Billion Telehealth Deal

(Bloomberg Opinion) — Not all deals are worth the risk. And yet, many management teams can’t resist the temptation to try building larger empires through big, pricey acquisitions — even ones that might lead them off track. This appears to be the case with the latest proposed merger between two leading digital-health providers.

Early Wednesday, Teladoc Health Inc. said it was acquiring Livongo Health Inc. for about $18.5 billion. Livongo shareholders will get 0.592 share of Teladoc stock for each share they own plus $11.33 in cash, resulting in 42% ownership of the combined company. The transaction is expected to be completed by year-end and is subject to regulatory and shareholder approvals.

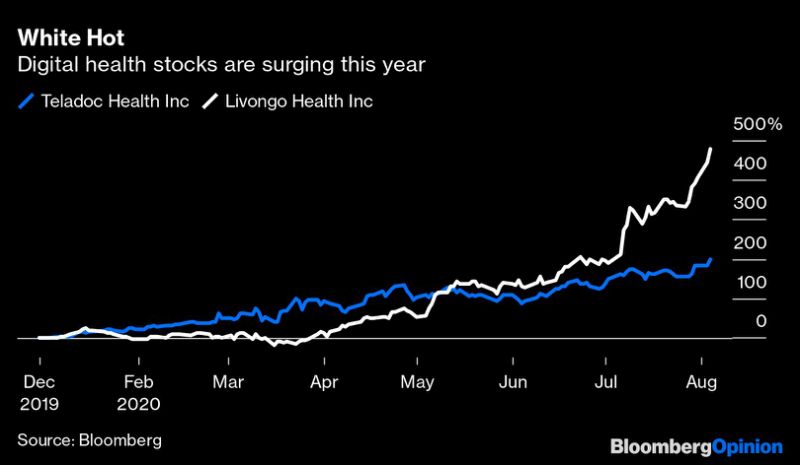

The deal would combine two of the stock market’s best performers in the area of digital health care. Shares of Teladoc — which makes money by charging employers and insurers to access its platform and physicians for virtual visits — have surged as telemedicine is having its moment amid the Covid-19 pandemic. For obvious reasons, patients have embraced its offerings to get health answers without having to venture to an office and risk exposure to the virus. Further, the Trump administration is making telehealth something of a priority, recently moving to make temporary boosts to Medicare reimbursement permanent and working to remove other barriers to its adoption. Livongo’s stock has also soared on rising optimism over its tools and devices that help patients manage diabetes and other chronic conditions.

But does the transaction make sense? First, the valuation is extremely steep. The deal’s terms would value Livongo at roughly 50 times this year’s sales for a company that barely makes any money. Second, there isn’t much in terms of expense synergies to make the price more palatable. The companies say they expect cost savings of just $60 million by the end of the second year, following the merger’s close. On top of that, the revenue synergy expectations may be overly optimistic. Teladoc says a merger would drive increased sales of $100 million in a couple years from cross-selling a broader range of personalized health-care services to the company’s current U.S. customer base of 70 million. But the two companies’ offerings are so different, the forecast may not pan out.

More importantly, the deal may signal the companies’ current growth rates aren’t sustainable going into next year when the health-care industry will likely return to a more normal footing as the pandemic subsides. Hospital capacity for in-person visits and elective surgeries will probably become more available, lowering the need for virtual doctor visits.

The companies are already signaling current trends aren’t likely to last. Teladoc management told investors on a call Wednesday that they expect the combined company to generate 30% to 40% growth for the next three years. While those rates are strong, they would be materially slower than the levels either company has notched lately. Teladoc reported sales growth of 85% for its second quarter, while Livongo posted 125% revenue growth for the same time period.

It’s true that the secular trend for virtual health care is large. But there doesn’t seem to be much strategic rationale for this combination. The question for Teladoc is, if the telemedicine market is so attractive, why not focus on the company’s core offering and avoid the integration and management distraction risks of such a massive deal? It looks like investors are wondering about this and other questions as well, with the stock prices of both companies down significantly after the announcement. This merger has a lot to prove.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tae Kim is a Bloomberg Opinion columnist covering technology. He previously covered technology for Barron’s, following an earlier career as an equity analyst.

Max Nisen is a Bloomberg Opinion columnist covering biotech, pharma and health care. He previously wrote about management and corporate strategy for Quartz and Business Insider.

bloomberg.com/opinion” data-reactid=”42″>For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”43″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.