JPMorgan Wants to Be What’s in Your Post-Covid-19 Wallet

(Bloomberg Opinion) — If history is any guide, JPMorgan Chase & Co. might have just called the end of the coronavirus-induced recession.

The biggest U.S. bank said that starting on Sept. 14 it will offer a new credit card called the Freedom Flex, which gives users 5% cash back on travel purchased through Chase Ultimate Rewards, as well as 3% back on dining and drugstore purchases. A travel-focused offering might seem too soon, but BJ Mahoney, who runs the bank’s Chase Freedom cards, told Bloomberg News’s Michelle F. Davis and Jenny Surane that “we wanted to get the product out there so that, as folks feel like they’re ready to return to travel, we’ve got options for them.”

This is consistent with Chief Executive Officer Jamie Dimon’s long-held strategy of seizing market share when others pull back. In an earnings call last year, he noted that the bank’s popular Sapphire brand was introduced in 2009, just months after the recession ended. “Marketing money is usually better spent in a downturn; the returns on it usually double,” he said. Given the timing of the Sapphire launch in the wake of the financial crisis, unveiling the Freedom Flex now feels significant, even if it was technically in the works before the Covid-19 pandemic.

It shouldn’t be lost on anyone that this rollout also comes just days after Capital One Financial Corp. confirmed it’s cutting the borrowing limits on credit cards of some of its consumers. As Surane reported last week, the third-largest U.S. credit card lender “is watched closely as a harbinger of what’s to come at other major banks.” The move seemed to signal what the largest financial institutions had feared: the failure to extend existing federal aid, which could leave banks on the hook for billions of dollars in bad loans.

To be clear, that’s still a risk. JPMorgan, however, braced for this possibility and then some. As I noted after its second-quarter earnings, the bank’s $10.47 billion in loan-loss provisions seemed high relative to the path of the U.S. economic recovery. Dimon himself admitted that “if the base case happens, we may be over-reserved. I hope the base case happens.”

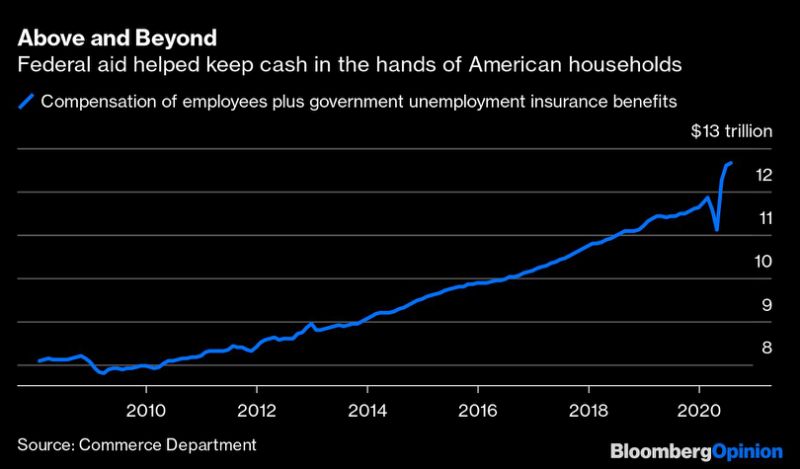

For JPMorgan’s consumer banking division, this is probably the most important chart to understand the coronavirus era:

Thanks to the $1,200 stimulus checks, and more important the extra federal unemployment benefits, Americans as a whole have had far more cash coming in than before the pandemic. And yet they overwhelmingly put away their credit cards: Household card balances plunged $76 billion in the second quarter, the sharpest drop on record, according to the Federal Reserve Bank of New York’s Report on Household Debt and Credit. How to reconcile those two data points? I posited that the lack of big-ticket leisure and travel purchases have kept expenses down overall for many individuals.

Enter the Freedom Flex, which has no annual fee and gives the most cash back for airline tickets, hotels, rental cars and cruises — precisely those large purchases that the pandemic has put on hold. It stands to reason that JPMorgan senses this pent-up demand. At the same time, the bank isn’t oblivious to how long lockdowns and social distancing might last. The new card offers 5% cash back at grocery stores for the first 12 months, similar to how its experience-oriented Chase Sapphire Reserve card pivoted to offer big rewards on groceries earlier this year when customers might have questioned its value. Freedom Flex also provides temporary access to DoorDash Inc.’s subscription service, DashPass, and 5% cash back on Lyft Inc. rides through March 2022.

JPMorgan already leads the credit-card industry, commanding a 23% market share as of the bank’s investor day in late February. But a quick glance at The Points Guy’s list of the best cash-back credit cards makes clear that the bank wants to further erode its rivals’ positions during the pandemic and be what’s in the wallets across America in the post-Covid-19 era.

For instance, American Express Co.’s Blue Cash Preferred Card — considered the best for groceries — offers 6% cash back on grocery-store purchases, up to $6,000 a year. The Freedom Flex reward is 5%, but on the first $12,000. Capital One’s Savor card is billed as the best for dining, with 4% cash back. However, it offers just 2% on groceries and has an annual fee. The no-fee SavorOne card gives 3% back on dining, the same as Freedom Flex. Overall, Freedom Flex is considered “a big upgrade” to Chase’s credit-card lineup.

If JPMorgan succeeds in further building upon its industry-leading position in credit cards, that should help offset what appears likely to be an ultra-low interest rate environment for the next several years, which will pressure the bank’s net interest income. At the same time, it will have to be prudent in doling out the new card, which is probably why its website notes that “credit score can be a determining factor” in qualifying. Dimon said in April that “we know we can handle really, really adverse consequences.” He wouldn’t want to do anything to jeopardize that strength.

But it’s in relatively tough times like these that people take stock of their financial situation and are perhaps more likely to make a change to make their money go further. Dimon will be waiting in his fortress, ready to welcome new entrants to his kingdom.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News. He is also a CFA charterholder.

bloomberg.com/opinion” data-reactid=”50″>For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”51″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.