Robinhood is reportedly under SEC investigation, could pay $10 million fine

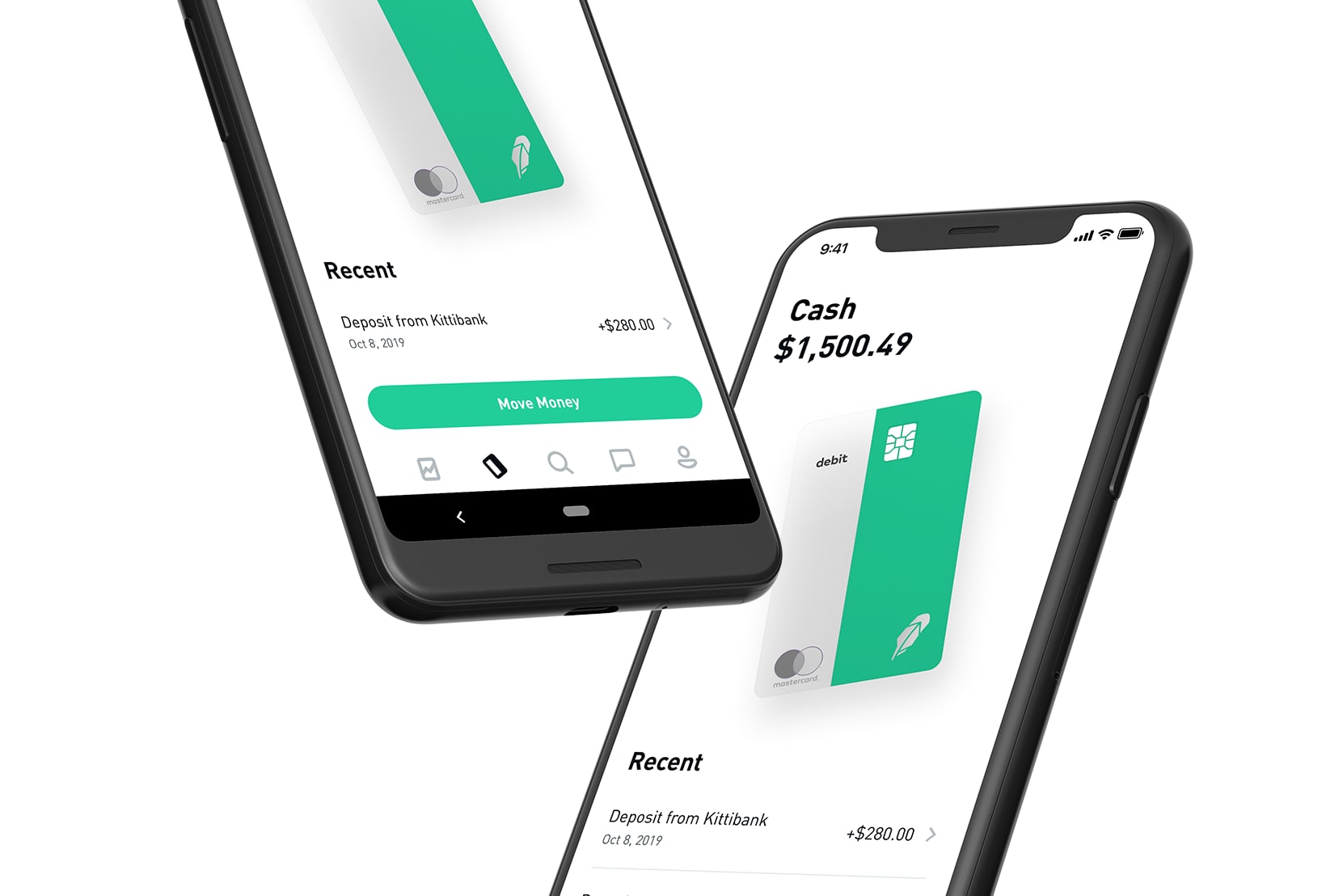

Source: Robinhood

Popular trading platform Robinhood is under investigation related to its disclosures around its practice of selling clients’ orders to high-frequency traders, the Wall Street Journal reported Wednesday.

The Securities and Exchange Commission’s probe into the Silicon Valley start-up is at an advanced stage and could result in a fine of more than $10 million if the company agrees to settle, the Journal reported, citing people familiar with the matter.

Selling order flow is not illegal in itself and most brokerages do it. However, more of Robinhood’s overall revenue comes from the practice than other brokers.

Robinhood made $180 million in trading revenue in the second quarter, roughly double from the prior quarter, as investors flocked to platform seeking to ride the historic market rebound.

“We strive to maintain constructive relationships with our regulators and to cooperate fully with them. We do not discuss or comment on our communications with our regulators,” a Robinhood spokesperson told CNBC.

The SEC declined to comment.

The millennial-favored app, which offers commission-free trades, saw a historic 3 million new accounts in the first four months of 2020.

— Click here to read the original WSJ story.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.