Steel production recovered as auto plants resumed operations, Cleveland-Cliffs CEO says

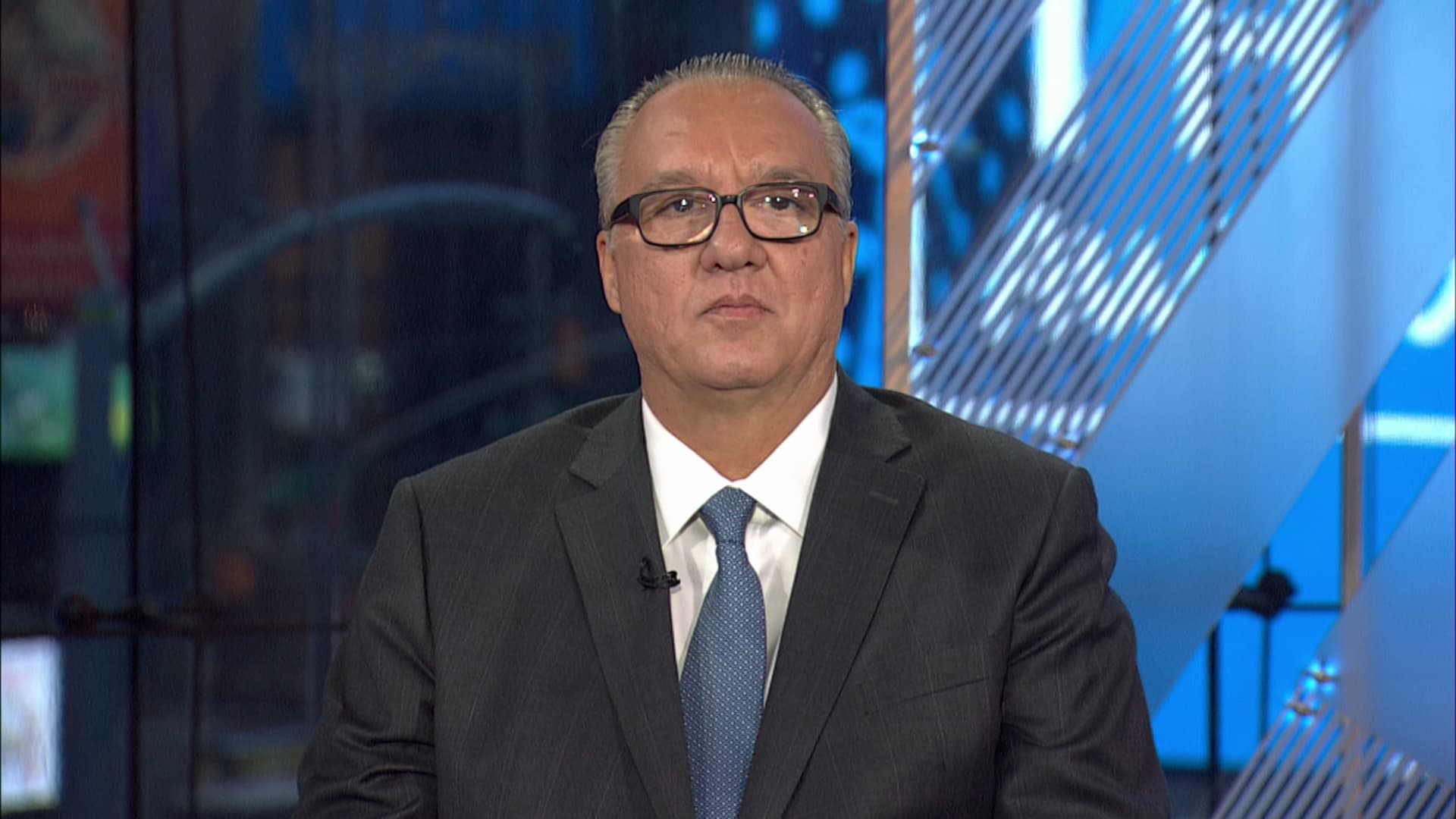

Steel production has rebounded alongside the recovery in automotive production this quarter, Cleveland-Cliffs CEO Lourenco Goncalves told CNBC Monday.

U.S. automakers are sprinting to re-stock showrooms and get back on production schedule after plants were shut down earlier this year as the country took action to slow the spread of a novel coronavirus.

“We have been through a very profitable quarter and very strong in terms of the recovery of demand particularly in automotive,” he said in an appearance on “Closing Bell.”

The U.S. economy quickly fell into a recession as businesses closed up and unemployment shot up across the country, but autos demand, much like demand in the housing market, has been one of the unexpected stronger parts in the economic recovery.

Plants of Detroit’s Big Three automaker are now operating at near full-speed to get back on production schedule and deliver new cars to dealerships as the holiday season approaches. SUVs and pickup truck sales have picked up particularly well among consumer purchases.

Cleveland-Cliffs is the largest U.S. producer of iron ore pellets, which are used in the production of steel. The Cleveland, Ohio-based company announced Monday it would purchase the U.S. assets of ArcelorMittal SA, the world’s world’s largest steelmaker, for about $1.4 billion. The acquisition follows Cleveland-Cliffs’ $1.1 billion purcahse of AK Steel in December.

The steelmaking industry suffered its worst downturn sinec the 2008 financial crisis as demand and prices for the product plummeted from the factory closures.

“Cleveland-Cliffs has a massive exposure to automotive and that affected us very seriously during the second quarter,” Goncalves said. “When automotive shut down in this country, we were forced to reduce our output” but “Q3 has been a completely different story.”

North American car production is down 2 million cars from this time last year in part because consumer demand is outpacing the time it takes to get new vehicles from the plants to showrooms, according to Charlie Chesbrough, a senior economist at Cox Auto.

When automakers report September U.S. auto sales Thursday, analysts estimate that the annualized sales pace will top the rate in August, which came in at 15.2 million vehicles. That number is up from an annualized sales rate of 8.6 million vehicles in April, when the industry hit a pandemic-induced bottom.

Total sales for the month of September are forecast to come in at 1.29 million units, which would be a dip from 1.33 million units sold last month and a slight increase from the 1.28 million units a year ago.

Shares of Cleveland-Cliffs rallied 11.6% in Monday’s session to close at $6.56.