“In about three years from now, we are confident we can make a compelling $25,000 electric vehicle that is also fully autonomous,” said Musk. The Model 3 available now is priced at $37,990.

Production of new cell has already started, with 10 GWh of annual capacity expected before the end of 2021

The steep reduction in the price of the car is likely to come mostly from cutting the cost of batteries in half, Musk said.

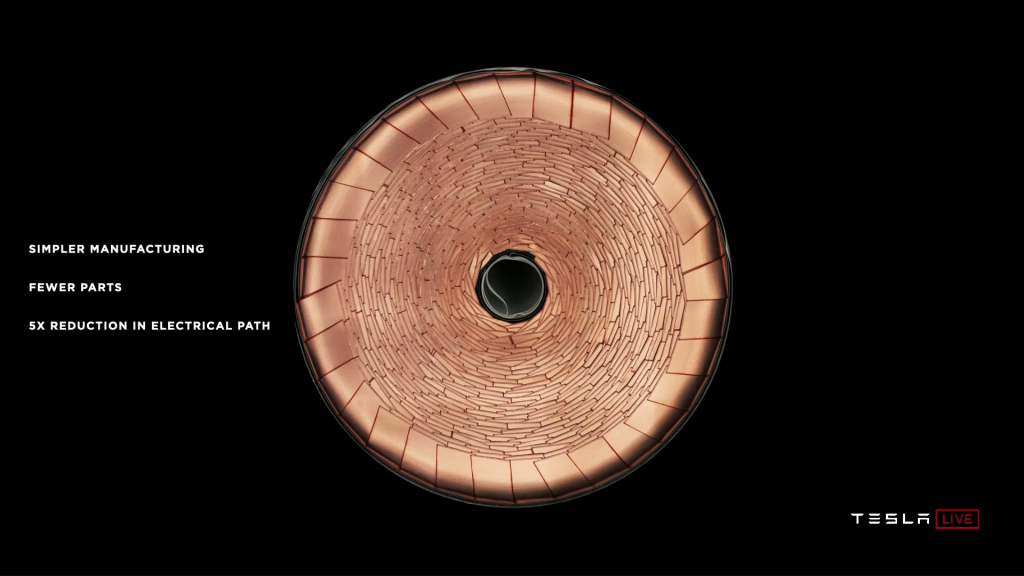

Several years ago, Tesla transitioned from the 18650 cylindrical form factor to the 2170 form factor, yielding a 50% increase in energy per cell. The cell revealed Tuesday would increase the dimensions yet again, bringing the diameter to 46 mm and height to 80 mm.

While the bigger structure alone can cause thermal and rapid charging issues, Tesla claims to have overcome these by using a tabless design to reduce the winding of the cell, thereby increasing production rates.

Production has already started, with 10 GWh of annual capacity expected before the end of 2021.

Analyst Wood Mackenzie said it expects this new development to be implemented in line with guidance. A key question for WoodMac is whether other battery makers will follow.

The 4680 cell design is a much greater change to manufacturing than the move to 2170 was. It may take a lot longer before Tesla’s external battery suppliers get on board with the new form factor, Wood Mackenzie noted.

“In terms of materials, we anticipate the copper and aluminum content within the cell itself may fall by ~20% in this design, according to industry expert estimates. However, the image of the cell clearly shows significant copper use for the end-to-end connections. As such, we expect the volume of copper used per GWh to increase,” BMO Capital Markets said in a note.

Goodbye graphite?

Graphite has been the go-to anode material since the commercialization of the lithium-ion cell in 1991. Since then, the industry has pushed for greater use of silicon in the anode to improve energy density and charging capabilities.

“We still expect graphite-based anodes to dominate in the short to medium term”

Wood Mackenzie

Silicon can store nine times more lithium than graphite, and many companies have been developing innovative ways to increase the amount of silicon in the anode. While the share of silicon has increased over time, electrode cracking and degradation are still key barriers to producing a silicon-dominant anode.

“Tesla claims to have overcome this challenge by removing the graphite entirely and using an elastic, ion-conducting polymer coating as a stabiliser. Other methods have utilized complex and costly designs such as graphene and nanotubes, but Tesla’s method is apparently simpler, cheaper and would even provide a 20% boost in range,” Wood Mackenzie noted.

“It almost seems too good to be true. A transition to silicon-based anodes has always been a risk for graphite demand in the battery sector. Although the risk might seem slightly more tangible now, we still expect graphite-based anodes to dominate in the short to medium term.”

Diversification of the cathode

Research and development in the battery industry has been heavily focused on cathode chemistry in recent years. Slight changes to nickel, cobalt and manganese ratios and the comeback of lithium-iron-phosphate have grabbed headlines.

“The move to high-nickel cathodes has been widely accepted and Tesla confirmed that it was in the same boat. It also shares the same challenges that other battery makers have; more nickel comes at the expense of cobalt, and this means lower stability of the cathode,” said WoodMac.

“To get around this, ‘novel coating and dopants’ were mentioned. However, without further details, we are not convinced the problem has been solved just yet.”

Lithium-iron-phosphate (LFP) was confirmed as an integral part of the company’s portfolio.

“It appears that LFP will be the chemistry used in cheaper models, which will arguably be the best-selling models in the future. We expect LFP to make its way out of China and into the global passenger EV market very soon,” said WoodMac.

Tesla made it very clear that it aims to move upstream into mine production. Not only has the company acquired a lithium deposit in Nevada, but it claims to have developed a novel lithium extraction method.

According to Tesla’s estimates, using its new extraction and processing technology, lithium in Nevada would be enough to support the electrification of the entire US vehicle fleet.

“Lithium stocks [likely] to react negatively,”

Morgan Stanley

“We’re gonna go and start building our own cathode facility in North America and leveraging all of the North American resources that exist for nickel and lithium, and just doing that just localizing our cathode supply chain and production, we can reduce miles traveled by all the materials that end up in the cathode by 80%,” said Drew Baglino, Senior Vice President of Powertrain and Energy Engineering at Tesla.

Many new methods of extracting lithium have been discussed in recent years as the needs of electrification have been realised. Most have numerous challenges.

“It would be surprising, although of course not impossible, for Tesla to discover the ‘Holy Grail’ of extraction so soon,” said WoodMac.

Tesla said it will source spodumene from its own mine in Nevada without intermediaries.

“This means not only more supply, but also potentially lower costs that could spread across the industry,” Morgan Stanley stated.

Production

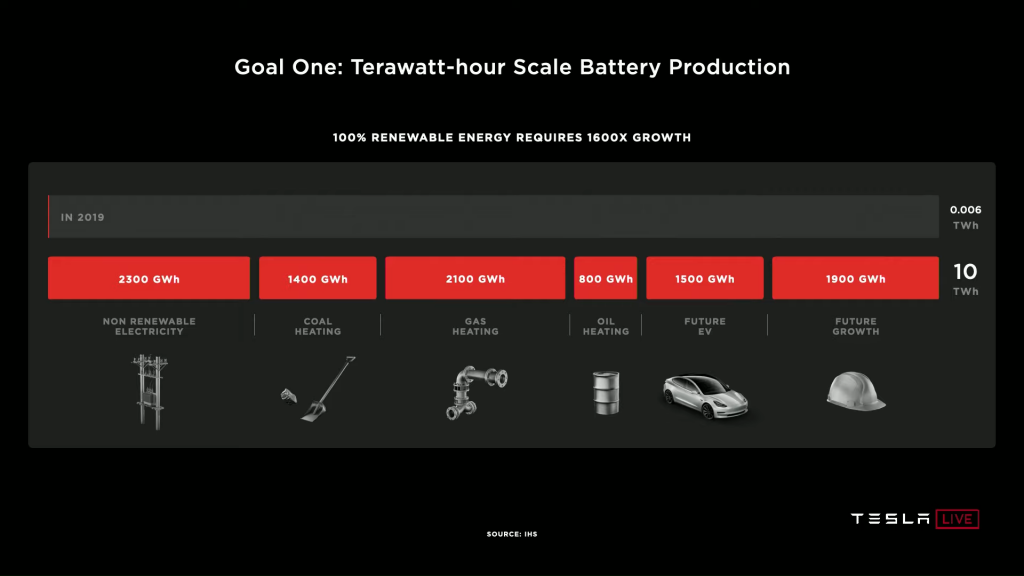

Tesla aims to reach 100 GWh of inhouse lithium-ion battery cell production capacity by 2022 and 3000 GWh by 2030, which is far greater than any major battery manufacturer has announced.

“We estimate the total planned cell manufacturing capacity, excluding Tesla, to be 1,300 GWh by 2030. Tesla’s announcement is more than twice the total global pipeline capacity.” said the Wood Mackenzie Battery Raw Materials team.

Musk plans to increase production to 20 million vehicles a year, up from a forecast of 500,000 this year

Currently, Tesla, and its partner Panasonic, produce NCA cells in Reno, Nevada. After a ramp up of nearly three years, annual capacity now stands at around 35 GWh.

“To make the near-term 100 GWh target, Tesla needs to triple its inhouse production in just 2 years. To make the capacity 100 times greater, simply scaling up the assemble lines is not an option. This would require a significant amount of investment, land, and labour for production.”

With improved battery cell designs and simplified manufacturing processes, Tesla hopes to attain “terawatt hour scale” manufacturing of batteries. One terawatt hour is 1,000 gigawatt hours or a trillion watt hours. Tesla achieved annualized production of 20 gigawatt hours at its Nevada battery factory in 2018, according to the company’s website. At that rate, it was already the highest volume battery production factory in the world, Tesla claims. By 2022, Tesla aims to be producing 100 gigawatt hours annually and, by 2030, 3 terawatt hours.

Timeline

Musk sees a cheaper car as critical for his long-term ambition of making the gasoline-powered internal combustion engine obsolete and for his plans to increase production to 20 million vehicles a year, up from a forecast of 500,000 this year.

If the planned innovations pay off, vehicle range could increase 54%, cost could decrease 56% and investment in gigafactories could decline 69%, said Andrew Baglino, Tesla’s senior vice president for powertrain and energy engineering.

“The real key takeaway is that if everything goes to plan, it will only be after 2023 that Tesla will be able to make the low-cost electric vehicle needed for mass-market adoption. In a much less extravagant way, VW revealed a similar timeline only last week.” concluded Wood Mackenzie in its report.

Tesla shares fell as much as 7.7% in postmarket trading Tuesday after closing at $424.23. Midday Wednesday, company’s stock was down nearly 9%.

“The challenge with the stock is that everything they are talking about is three years away,” Gene Munster, managing director of Loup Ventures told Reuters.