Treasury yields fall as equity rout drives investors into safe bonds

Treasury yields fell on Tuesday as a continuing sell-off in equities pushed investors into safer assets.

The yield on the benchmark 10-year Treasury note dipped 4 basis points at 0.678%, while the yield on the 30-year Treasury bond was also 6 basis points lower at 1.411%. Yields move inversely to prices.

The stock market added to its big losses last week as investors continued to dump high-flying tech shares. The Nasdaq Composite fell another 3% on Tuesday after the tech-heavy benchmark suffered its worst week since March.

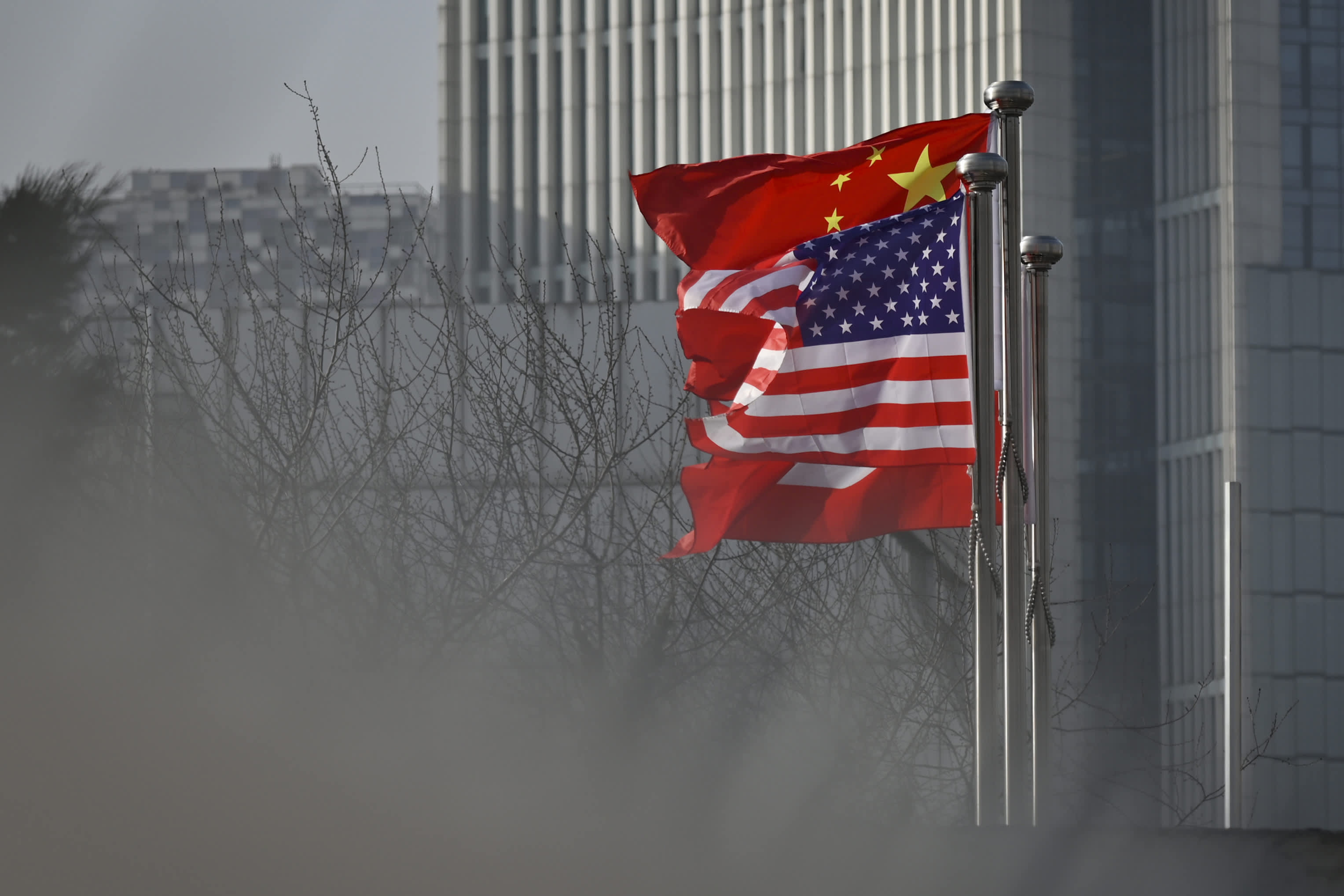

Investors also closely monitor U.S.-China tensions and looked to whether tech shares could recover from their recent downturn.

On Monday, President Donald Trump again raised the idea of separating the world’s two largest economies, claiming the U.S. would not lose out financially if the country stopped doing business with China.

His comments followed the possible U.S. blacklisting of China’s largest chipmaker, Semiconductor Manufacturing International Corp (SMIC). Shares of the company plunged over 23% on Monday in response to the news.

Chinese Foreign Ministry spokesman Zhao Lijian responded to accuse the Trump administration of “blatant hegemony,” adding Beijing was “firmly opposed” to such actions.

On the data front, the NFIB survey will be released at around 6 a.m. ET. The Census Bureau’s latest quarterly financial report and consumer credit data for July are both scheduled to follow later in the session.

The U.S. Treasury will auction $54 billion in 13-week bills, $51 billion in 26-week bills, and $34 billion in 52-week bills on Tuesday. It will also auction $30 billion in 119-day bills, $30 billion in 42-day bills, and $50 billion in three-year notes.