10-year Treasury yield rises above 0.8% as traders monitor stimulus talks

Treasury yields rose slightly on Wednesday as investors remained focused on the progress for a fresh round of fiscal stimulus.

The yield on the benchmark 10-year Treasury note climbed to 0.804% while the yield on the 30-year Treasury bond rose slightly to 1.612%. Yields move inversely to prices.

The 10-year yield on Tuesday closed above 0.8% for the first time since June. Meanwhile, the long-maturity 30-year rate has broken out of its 200-day moving average, a widely watched momentum indicator.

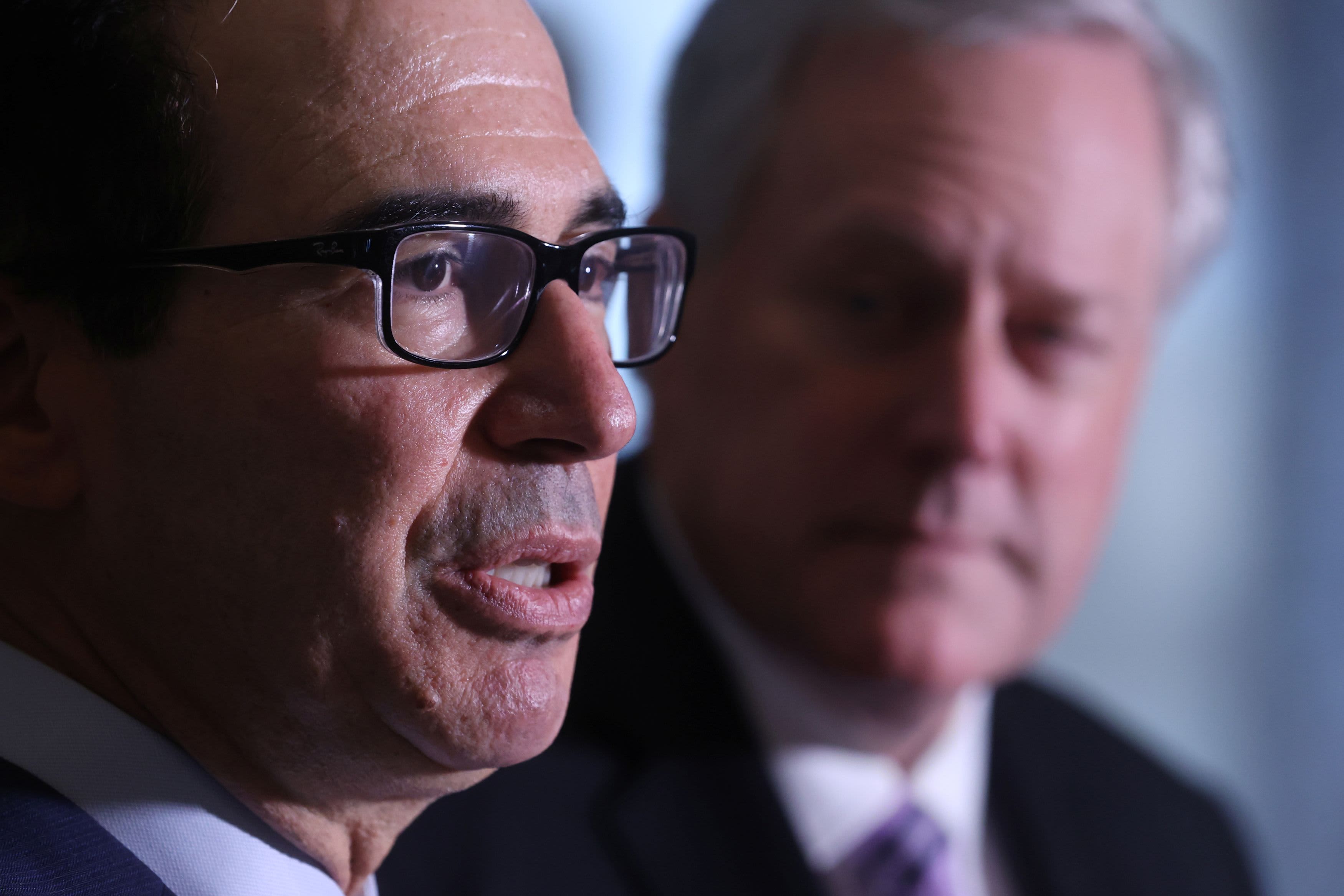

Yields ascended to four-month highs overnight with the benchmark yield hitting a high of 0.834% amid optimism toward a stimulus agreement in Washington. White House Chief of Staff Mark Meadows said Tuesday evening that Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi had made “good progress” toward a deal on a new coronavirus aid bill, although Meadows warned the two sides “still have a ways to go.”

Following Pelosi and Mnuchin’s meeting on Tuesday, Meadows told CNBC’s “Closing Bell” that the two will talk again on Wednesday, and that he hopes to see “some kind of agreement before the weekend.”

President Donald Trump has said he is willing to accept a large relief package despite opposition from within his own Republican party, while Pelosi told Bloomberg TV on Tuesday that she is “optimistic” about a potential accord.

“A 1% [10-year] yield is possible soon if a fiscal deal gets passed,” Peter Boockvar, chief investment officer at Bleakley Advisory Group, said in a note on Wednesday.

The benchmark 10-year rate has bounced from its all-time low hit in the depth of the pandemic. The rate reached a record low of 0.318% on March 8 amid a historic flight to bonds.

There are no major economic data releases scheduled for Wednesday, though Federal Reserve Board Member Lael Brainard is set to speak at 8:50 a.m. ET before Cleveland Fed Governor Loretta Mester at 10 a.m.

Auctions will be held Wednesday for $25 billion of 105-day Treasury bills and $30 billion of 154-day bills, along with $22 billion of 20-year bonds.