People are living longer, yet their retirement accounts are struggling to keep up.

About 1 in 5 Americans over the age of 70 has less than $50,000 in savings, according to a 2020 study by TD Ameritrade.

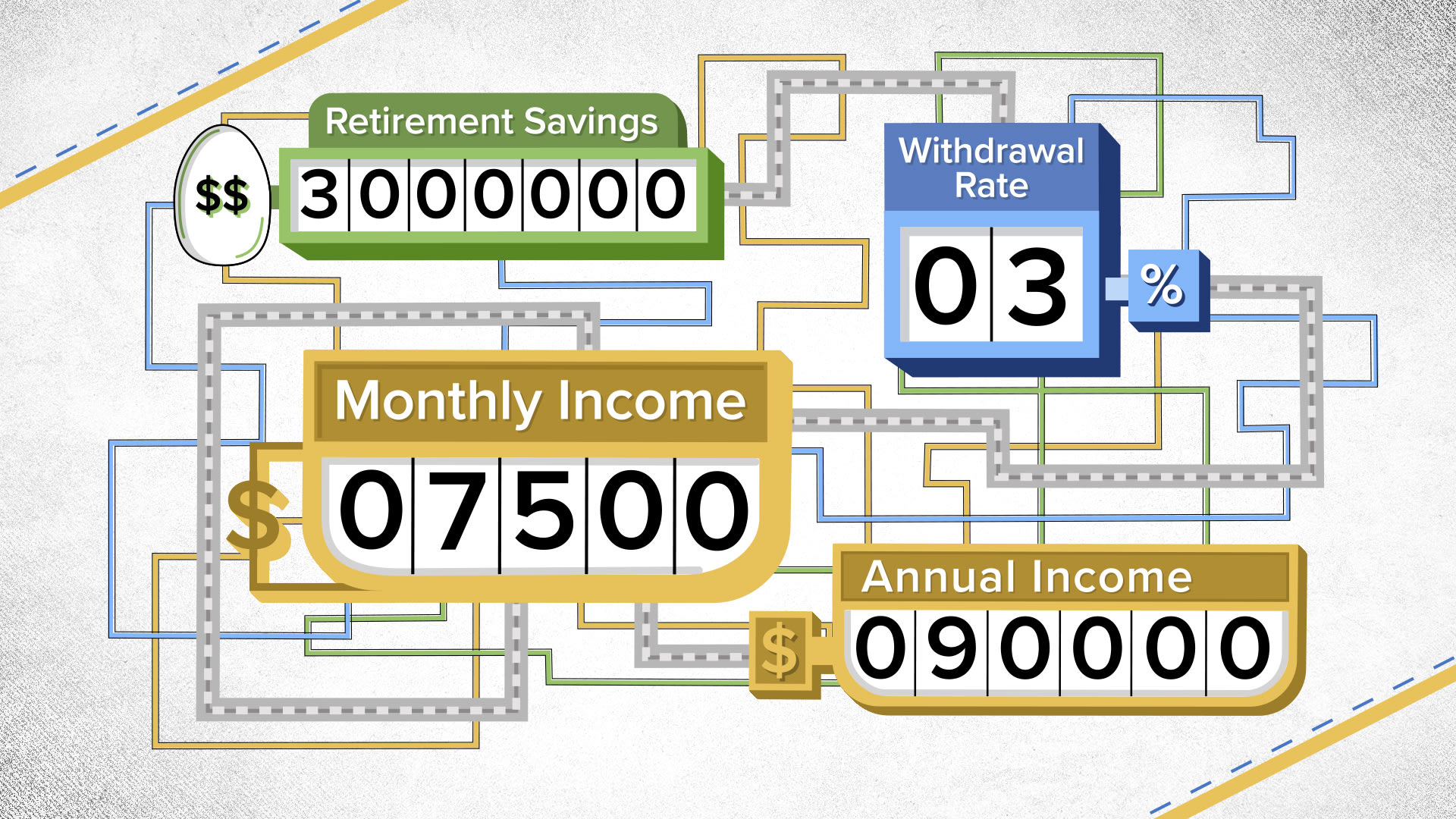

To make your nest egg last, you should aim to spend around 4% of your savings per year in retirement, according to financial advisor Winnie Sun, co-founder and managing director of Sun Group Wealth Partners. That percentage can change, however, based on several factors such as if your home isn’t paid off or if you have high health-care costs, Sun said.

This strategy also assumes that you have a balanced portfolio, focusing more on bonds and cash-type investments for your short-term needs. This allows your accounts to grow for the future, according to Sun.

Check out this video to see a few different case studies of how much spending money you’ll have if you retire with $3 million.

More from Invest in You:

‘Predictably Irrational’ author says this is what investors should do during pandemic

Coronavirus forced this couple into a 27-day quarantine on their honeymoon cruise

How to prepare for a family member with COVID-19

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.