Retiring doesn’t always mean you won’t have a job.

Nearly 60% of baby boomers in the workforce plan to keep working in some fashion after they retire, according to a study from Voya Financial.

If you prefer a work-free retirement, however, you’ll need to have enough money in savings to cover your future spending.

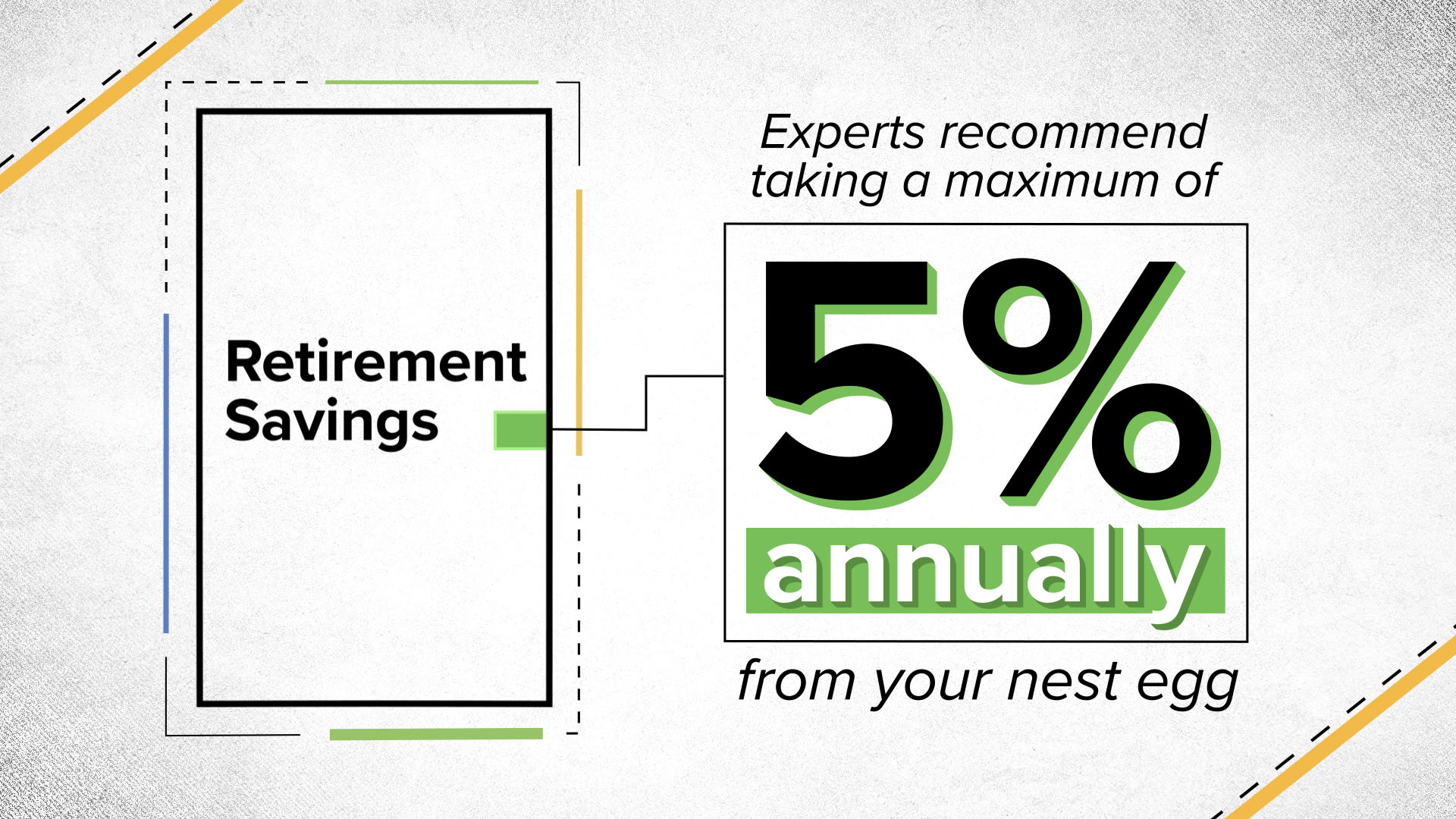

To make your nest egg last, you should aim to use around 4% of your savings per year in retirement, experts say. That percentage can change, however, based on several factors, such as if your home isn’t paid off or if you have high health-care costs, according to financial advisor Winnie Sun, co-founder and managing director of Sun Group Wealth Partners.

This strategy also assumes that you have a balanced portfolio, focusing more on bonds and cash-type investments for your short-term needs. This allows your accounts to grow, according to Sun.

Check out this video to see some case studies of how much spending money you’ll have if you retire with $4 million.

More from Invest in You:

‘Predictably Irrational’ author says this is what investors should do during pandemic

Coronavirus forced this couple into a 27-day quarantine on their honeymoon cruise

How to prepare for a family member with COVID-19

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.