Most Americans are not on track to retire as millionaires.

In fact, only 12% of Americans in their 60s say that they have more than $1 million in savings, according to a 2020 TD Ameritrade report.

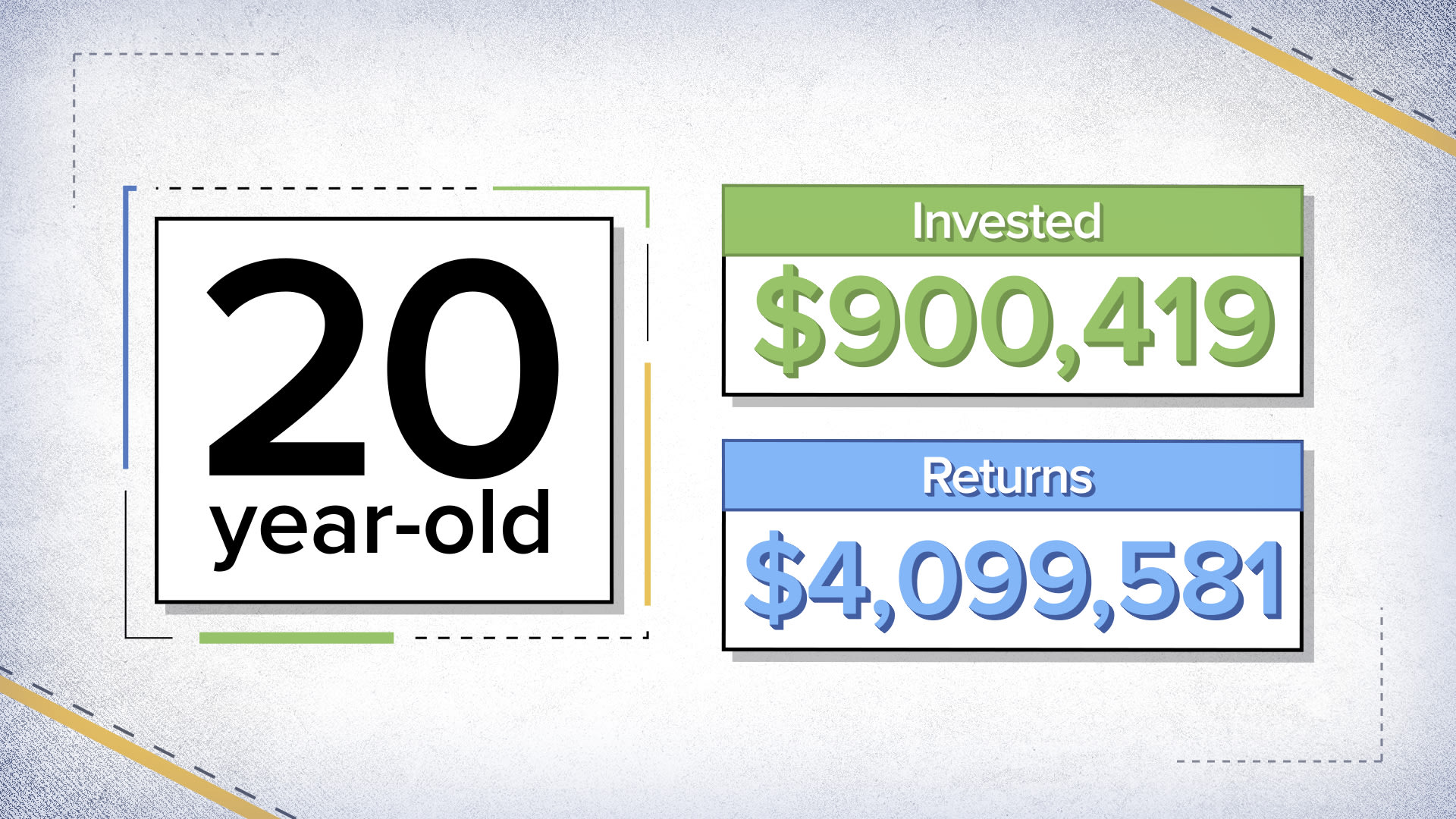

But what if you could retire with $5 million by the time you were 67? The good news is that it is possible with persistent monthly saving.

Personal finance site NerdWallet crunched the numbers, broken down by age group, to demonstrate how much you’ll need to stash away every month.

First, let’s go over how it got there. The math assumes you are starting with no money in savings, that your investments will earn 6% annually and that you retire at 67.

You will need to take advantage of tools like your employer’s 401(k), which is a tax-advantaged retirement savings account, or a Roth individual retirement account or traditional IRA. Investment options include low-cost index funds.

Now let’s dive into the figures. This video takes a look at how to make it happen.

More from Invest in You:

Here’s how not to make the most common money mistake of all

How mutual funds work — the $18.7 trillion industry fueling retirement in the U.S.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.