Levi’s e-commerce business is ‘profitable a year ahead of schedule,’ CEO says

Where the pandemic has weighed down on Levi Strauss & Co‘s revenue, it has propped up an emerging part of the longtime denim company.

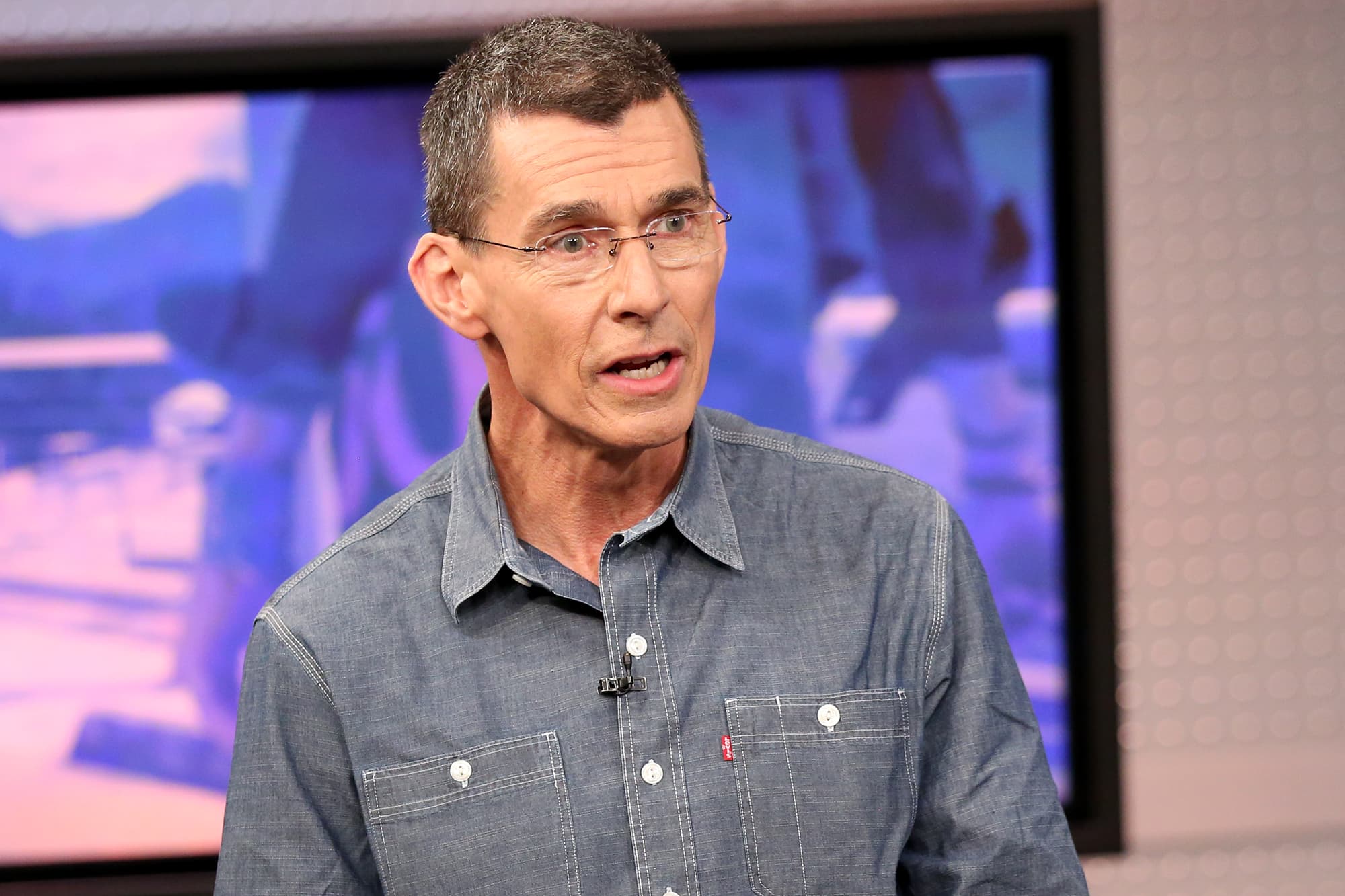

Despite a double-digit drop in revenue in the third quarter, Levi’s managed to not only turn a profit but also make its e-commerce business profitable, CEO Chip Bergh told CNBC’s Jim Cramer Wednesday.

“We’re going to see e-commerce continue to grow,” he said in a “Mad Money” interview. “We’re profitable a year ahead of schedule, despite all of the accelerated investments that we’ve made.”

Levi’s total revenue plunged almost 27% during the three-month period ended Aug. 23, but some of the lost business was offset by 52% growth in the company’s e-commerce sales. E-commerce made up 8% of the apparel company’s $1.06 billion in revenues, double its rate from a year ago, Bergh said.

Seven in 10 of the shoppers on the jean maker’s website were first-time shoppers, he added.

The $1.06 billion that Levi brought in smashed the $822.2 million that Wall Street analysts expected. The company was also expected to turn in losses of 22 cents per share, but the company showed earnings of 8 cents per share. The profit was a reversal from when Levi recorded a loss during the early months of the pandemic.

Levi’s has invested heavily in both online and brick-and-mortar operations as the retailer looks to build up its direct-to-consumer services. The company also built out its omnichannel capabilities, which Bergh said has benefitted greatly from the pandemic environment.

“The pandemic has compressed what might have taken 5 or 10 years and it’s compressed it into a very, very short window, and I have to say the acceleration of our e-commerce business has been one of the beneficiaries of that,” he said.

Outside of the impact of coronavirus on sales, fashion trends further influenced by the new normal have also been a positive for Levi.

While office dress codes have become laxer in recent decades, especially powered by casual workplaces in the tech industry, the work-from-home reality has had a particular impact on the fashion industry. Business and professional attire is less needed when working remotely over Zoom, which has led to depressed sales in the suit category. This summer saw the bankruptcies in holding companies of suit retailers like Men’s Warehouse and Jos. A Bank.

Clothing sales have been down overall, but consumers are not only spending money on athleisure and loungewear. Denim has also benefited from trends toward casualization, Bergh said.

One area of growth was in women’s shorts, he added.

“The women’s shorts business was up double digits,” he said. “Our total U.S. women’s wholesale business grew double digits this past quarter and our women’s bottoms business on a global basis drove 50% of the total online growth that we saw this past quarter and our online business was up more than 50% as a percentage of our business so really strong results.”