Biden’s tax plans would stifle innovation and sink economic growth

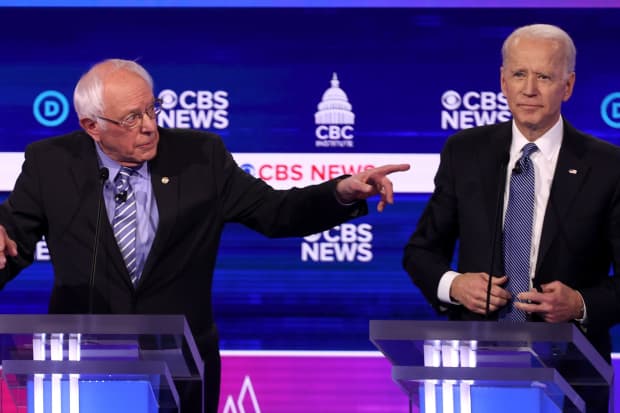

Sen. Bernie Sanders and Joe Biden at a Democratic presidential primary debate in February.

Win McNamee/Getty Images

Joe Biden’s best friend could be a Republican Senate. It would permit him to return to his moderate left-of-center roots, and unshackle him from the more radical agenda he embraced to win peace with Bernie Sanders, other primary rivals and their constituents.

Compromising—for example, offering the Republicans a deal on torts reform for a public-option health insurance plan—could get to the root of critical national problems. If run like the British Health Service, new competition could pressure private insurers to cut overhead and unburden health care from excessive litigation.

The success of the auto industry is still central to Middle American prosperity, and we lag China and Europe in creating markets and infrastructure for electric vehicles. It’s also a major driver for the next generation of energy technologies—hydrogen and high-storage batteries.

Biden’s $2 trillion plan

Biden wants to devote $2 trillion over four years to accelerate the transition to EVs, carbon-free buildings and green power but much of the required technology is not here yet. Reckless spending could leave the nation in 2030 with an obsolete, an internationally uncompetitive fleet of vehicles, structures and power grid that kills jobs.

Even greater harm could result from his plans to increase taxes on only those earning more than $400,000.

Levying a to 39.6% top marginal rate, the 0.9% Medicare surcharge on high incomes, imposing the full Social Security tax and some tightening of rules for many deductions would raise effective federal rate on wages for those earning at least $400,000 to more than 56%. Adding in state and local taxes in places like New York City and California would take top marginal tax rates to about 70%.

Taxes such as those impose a mighty disincentive among highly skilled professionals to work more, longer, innovate or assume additional responsibility to advance within their organizations.

Negative effect on startups

Perhaps the most profound negative effect on growth would be for startups and venture capital in the high-tech sector. The Biden plan would apply a top federal rate of 44% tax on capital gains instead of the current 23.8%.

Among venture capitalists in California or New York City marginal state and local taxes on higher incomes would raise the overall marginal rate to about 57%.

Angel investors pour seed money into many unproven ideas in the hope that a few will create an attractive product with the promise of big sales and earnings growth, and then either go public or be acquired by a big tech company like Facebook FB,

Often wealthy folks don’t spend all their gains—except maybe to put it into mansions that fall to their estates—because they keep reinvesting. In the end, the death tax kicks in. Applying Biden’s proposed 45% estate tax and the additive tax effect on the value of the estate from taking a risk on a successful startup becomes as much as 76%.

That’s not all. Biden’s tax plan is likely to yield about $2.8 trillion in revenues over 10 years—far less than his spending ambitions in green energy, higher education, day care and the like.

Waiting to make up the difference are Democrats, including the ranking Democrat on the Senate Finance Committee, Oregon Sen. Ron Wyden, who would apply the capital-gains tax to stocks and other assets each year before those are realized through sales.

Flee to tax havens

On the demand side, the Biden plan would raise corporate tax rates. That would have a big impact on the ready cash high-tech companies have to acquire maturing startups.

Technology companies now compose almost 40% of the S&P 500 SPX,

The Tax Foundation and others estimate the Biden plan hit on growth would lower household incomes for the rich and poor alike by 2030, and the Hoover Institution puts the average annual loss at $6,500. My eyes bulged with skepticism when I read such a huge loss but those returned to their sockets when I worked out those enormous capital-gains tax rates.

Peter Morici is an economist and emeritus business professor at the University of Maryland, and a national columnist.