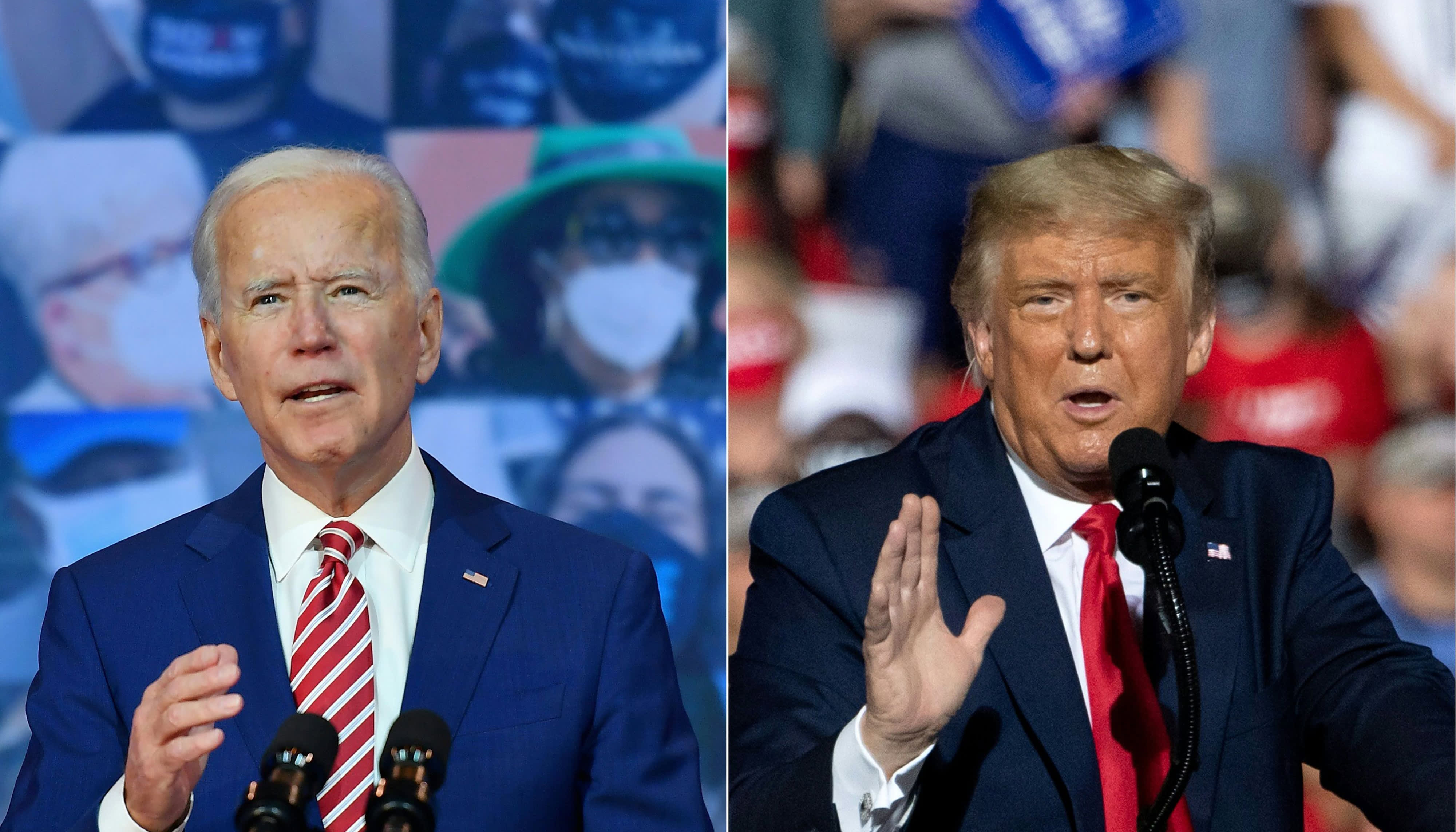

Democratic President-elect Joe Biden delivering remarks on Covid-19 at The Queen theater on Oct. 23, 2020 in Wilmington, Delaware and U.S. President Donald Trump addressing supporters during a Make America Great Again rally in Gastonia, North Carolina, Oct. 21, 2020.

Getty Images

The Chinese yuan, which has steadily strengthened this year, spiked even further in the days leading up to and after Joe Biden’s projected election victory.

Analysts have flagged that a Biden win is likely to be more bullish for the Chinese currency. And indeed, investors seem to think so.

As Biden’s victory seemed to grow increasingly likely last week, the offshore yuan rallied to below the 6.60 mark. It hit a 28-month peak on Monday after he became the projected winner and appreciated even further after.

“Ostensibly, (offshore yuan) reactions suggest that a Trump victory is deemed to be far more negative for China, in contrast to a Biden Presidency, seen to lend some semblance of stability and interim relief,” Vishnu Varathan, head of economics and strategy at Mizuho Bank, wrote in a note late last week.

He noted U.S. President Donald Trump takes a “unilateral, zero-sum game approach that has turned increasingly antagonistic and unpredictable.”

While Biden shares concerns about the geopolitical and technological threat that China poses, the former vice president is “likely to adopt multilateral and rules-based engagement,” Varathan wrote.

The Trump administration has taught China a lesson in economic security.

Raymond Yeung

ANZ Research’s chief economist for greater China

Still, analysts say that the outlook for the yuan isn’t purely strength gained on optimism for the Biden administration, but includes a myriad of factors, including geopolitical motivations, a weaker dollar and China’s economy.

The Trump effect

Even before Biden’s win, China has been advocating for greater use of the yuan globally.

ANZ Research’s Raymond Yeung, chief economist for greater China, attributed that to the Trump effect.

“The Trump administration has taught China a lesson in economic security,” he said in a report late last week. “This concern covers not only the supply of chips for Huawei but also the ability of some entities to transact in the USD-centric financial system.”

The trade spat between both countries has expanded into technology, as Washington increasingly targets Chinese tech giants, from phone maker Huawei to video-sharing app TikTok.

The attitude toward China in Washington is unlikely to change much with a Biden administration. While Biden has slammed Trump’s trade war with China for hurting businesses, he has also said that the U.S. must “get tough on China.”

U.S President Donald Trump returns to the White House after news media declared Democratic U.S. presidential nominee Joe Biden to be the winner of the 2020 U.S. presidential election, in Washington, U.S., November 7, 2020.

Carlos Barria | Reuters

Under the Trump administration, the U.S. moved to restrict Chinese companies from listing on American exchanges, fueling concerns about financial decoupling as tensions continue to rise.

Analysts have said China has been seeking to reduce its reliance on the dollar to manage its risk. Many companies have corporate debt denominated in the dollar, making them highly exposed to the greenback. Beijing has gradually reduced its purchase of U.S. Treasurys and pushed for much of its trade and other cross-border settlements to be conducted in the yuan — using its Belt and Road vehicle to do that.

Yeung noted that the share of global trade that’s being settled in the yuan has gradually increased since Trump took office. Around the beginning of 2017, more than 16% of global trade was denominated in yuan and by the middle of this year, that figure jumped to nearly 22%, according to Yeung.

With more U.S.-listed Chinese companies flocking back home to Shanghai or Hong Kong to launch secondary listings, a “significant portion” of those flows have been conducted in the yuan rather than the dollar, according to ANZ Research.

Overall, cross-border settlements using the renminbi (RMB) — another name for the yuan — amounted to 19.67 trillion yuan ($2.97 trillion) in 2019, increasing 24.1% from the previous year, according to a 2020 report by the People’s Bank of China (PBOC). In 2019, the RMB settlement between China and countries in its mammoth Belt and Road initiative accounted for 13.9% of total global settlement – a year-on-year jump of 32%.

The report said that, by the end of 2019, China had signed bilateral local currency swap agreements with 21 countries as part of its Belt and Road initiative. The ambitious project aims to build a complex network of rail, road and sea routes stretching from China to Central Asia, Africa and Europe. It is also aimed at boosting trade.

Yuan strength will depend on weaker dollar

The strength of the yuan will also depend on the performance of the dollar, which has weakened in the past few months.

“This is very much going to be determined by how the U.S. dollar behaves over the next 6 to 12 months,” said Wayne Gordon, senior investment analyst at UBS Global Wealth Management.

“Generally speaking, you would expect the dollar would start to weaken on the back of stronger global growth, and emerging market growth begins to recover. Obviously, people start to look for higher yields elsewhere,” he told CNBC’s “Street Signs Asia” on Tuesday.

The record spreads between Chinese and U.S. treasury yields have been flagged as bullish for the yuan. With Chinese treasury yields higher as compared to those in other major markets. That could draw investors to Chinese government bonds, leading to an inflow into the yuan, which would bode well for the exchange rate.

But volatility from uncertainty may linger after the U.S. election, and the dollar — a safe-haven currency — could reverse direction, according to Mizuho Bank’s Varathan.

“So it stands to reason that despite the conditions for an underlying weak USD trend lining up, the potential for outbursts of USD strength from haven demand cannot be dismissed lightly; especially as US political uncertainty takes time to unpack,” he said.