Biogen's $15 Billion Alzheimer's Surge Tarnishes FDA

(Bloomberg Opinion) — It’s hard to focus on anything besides the election and pandemic. But one of the most important drug debates in years is taking place this week, and it has nothing to do with President Donald Trump or Covid-19.

On Friday, a panel of experts convened by the Food and Drug Administration will review the possible approval of Biogen Inc.’s Alzheimer’s drug aducanumab. It would be the first medicine approved to slow the memory-loss disease instead of just treating symptoms, making it all but guaranteed to be a blockbuster. Its promise comes with controversy, however. Biogen halted two identical trials of the drug last year, declaring them failures, only to resurrect one study as a success months later after a re-analysis. It is attempting an unusual push for approval with limited and contradictory evidence.

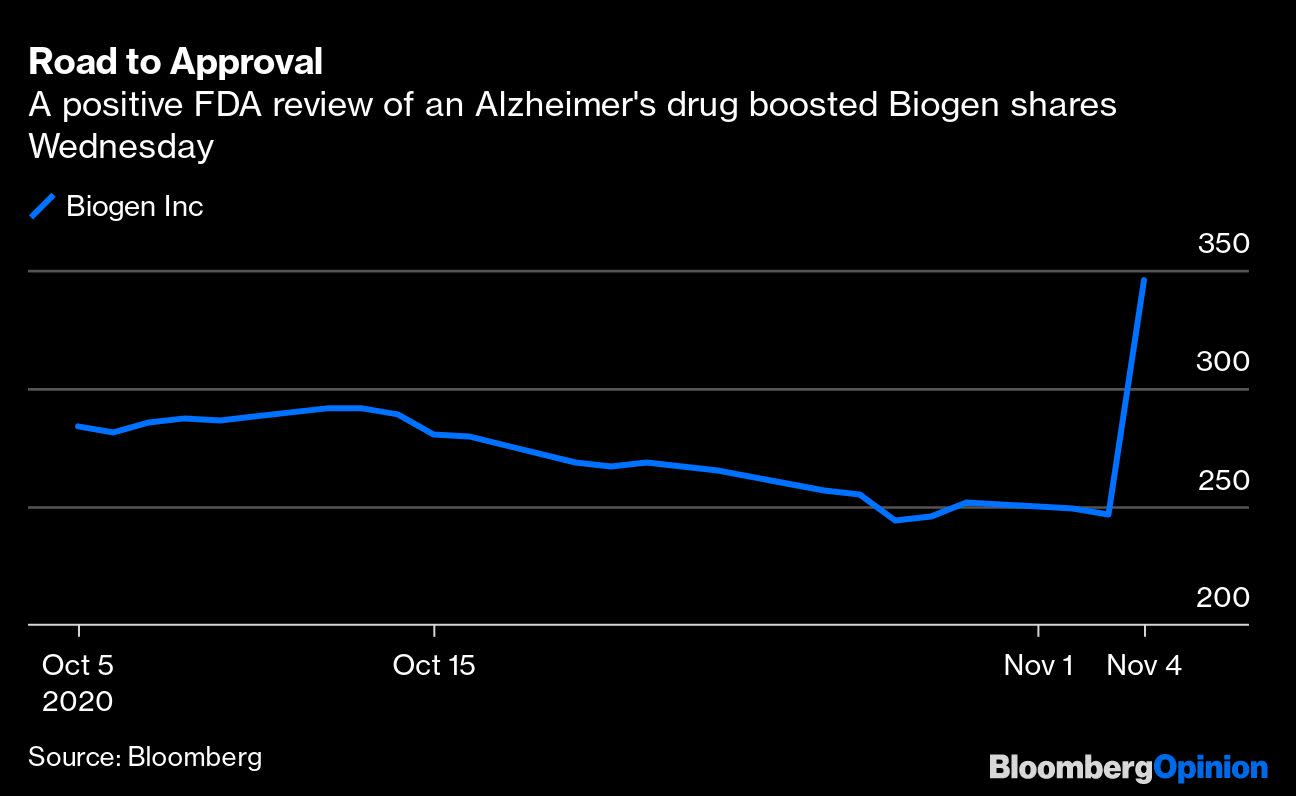

Against this backdrop, it came as somewhat of a shock Wednesday when the FDA released a favorable review of the drug ahead of Friday’s panel, sending Biogen shares surging more than 40% and adding more than $15 billion to the company’s market value. But while the desire to give Alzheimer’s patients hope is understandable, approval would be a mistake. The FDA would be substantially lowering its standards when it should be doing the opposite.

Biogen has plenty of excuses for its mixed results in the two trials even thought they were largely the same. It suggests, for example, that the failed trial was disproportionately affected by a small group of participants with rapidly progressing Alzheimer’s. The FDA appears quite sympathetic. Its briefing documents for Friday’s panel refer to the one successful study as “robust and exceptionally persuasive” and play down the contradictory flop.

The agency usually tends to pick apart after-the-fact data slicing instead of helping it along. But the more skeptical parts of the FDA staff’s statistical analysis that highlight serious inconsistencies and biases in the data are buried under positive messages. The desired outcome is clear.

Everyone who isn’t a Biogen investor should hope that the panel pays attention to the statistics and denies a rubber stamp Friday. Panel recommendations on new drugs aren’t binding but the FDA usually follows them, and a rebuke could help the agency come to its senses before its ultimate decision, due by next March.

The evidence is too muddled to justify giving this medicine to millions. There needs to be another study to confirm whether aducanumab truly works. Approval would also make it harder to recruit patients to other studies of Alzheimer’s treatments, encourage companies to come to the FDA with weak data and make it harder to say no when they do.

The agency’s reputation eroded this year after ill-advised emergency authorizations of hydroxychloroquine and convalescent plasma to treat Covid-19. As it attempts to rebuild trust ahead of the evaluation and rollout of a Covid-19 vaccine, it should demonstrate that there’s still a high bar instead of further tarnishing its image.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Max Nisen is a Bloomberg Opinion columnist covering biotech, pharma and health care. He previously wrote about management and corporate strategy for Quartz and Business Insider.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.