Dow futures rise more than 100 points after Tuesday’s rally as traders await U.S. election results

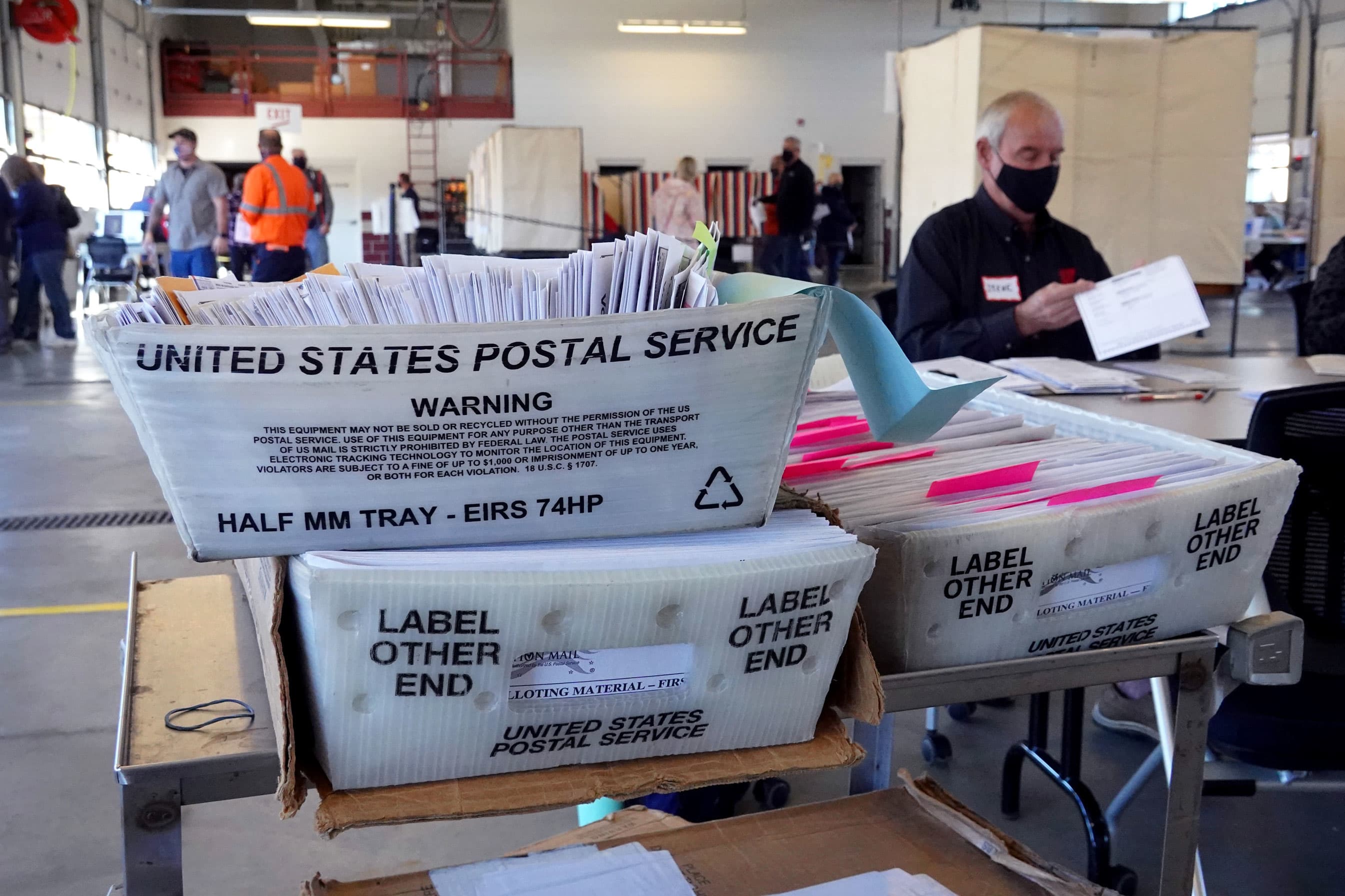

Election officials count absentee ballots at a polling place located in the Town of Beloit fire station on November 03, 2020 near Beloit, Wisconsin.

Scott Olson | Getty Images

Stock futures rose on Tuesday night following a sharp rally during regular trading while investors awaited the result of the presidential election.

Dow Jones Industrial Average futures traded 145 points higher, or 0.6%. S&P 500 futures gained 0.6% and Nasdaq 100 futures advanced 0.4%.

Polls in Georgia, Indiana and Kentucky were scheduled to close at 7 p.m. ET. In Pennsylvania and Florida — two key battleground states — polls are expected to close at 8 p.m. ET.

Traders added risk in other markets as well overnight. U.S. oil futures gained 1.8%, while futures on the 10-year Treasury fell.

Earlier in the day, the Dow popped more than 500 points, or 2.1%. The S&P 500 gained 1.8% and the Nasdaq Composite advanced 1.9%. Those gains added to Monday’s strong performance.

This week’s market moves come as investors hoped a delayed, or contested, U.S. presidential election result would be avoided and a clear winner would emerge Tuesday night.

“This most recent uptick in prices seems to be a ‘clarity rally’ as investors look forward to finally having the election uncertainty overhang removed,” Adam Crisafulli, founder of Vital Knowledge, wrote in a note Tuesday.

Former Vice President Joe Biden was ahead of President Donald Trump in the polls leading up to Tuesday. Wall Street is also watching some key Senate races, which could lead to Democrats taking control of Congress.

Investors are betting that a so-called blue wave — a scenario in which Democrats win the White House, obtain a Senate majority and keep control of the House — could facilitate the passing of new fiscal stimulus as the economy continues its recovery from the coronavirus pandemic.

“I think that no matter who wins, you have a quick dip and you have to buy,” CNBC’s Jim Cramer said earlier on Tuesday.

The S&P 500 lost 0.4%, on average, the day after presidential elections, according to Baird.

Chao Ma of the Wells Fargo Investment Institute thinks investors with a longer time horizon should not worry too much about the election’s impact on the broader market.

“The history of the economy and the S&P 500 Index suggests that a president’s party affiliation has made little difference when it comes to long-term returns,” said the firm’s global portfolio and investment strategist. “The long-term drivers of the S&P 500 index have been the economy and business earnings, and we expect that to continue to be the case … beyond the 2020 elections.”

One year out from a presidential election, the S&P 500 averaged a return of more than 8%, according to the Baird data back to 1960.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.