In mid-October, the company announced that it would be going ahead with the construction of the Magino project in Ontario, 40 km northeast of Wawa. With a two-year construction period, the company anticipates the first gold pour in the first half of 2023.

In tandem with the announcement, the producer announced debt financing for the project, for a total of up to $175 million. This includes a $50-million bought deal offering of senior unsecured convertible debentures and an extension and expansion of an existing $75 million credit facility to $125 million.

While a 2017 feasibility study estimated the initial capital cost for the project at $321 million, more recent cost estimates pegged the initial outlay at between $360 million and $380 million.

The 2017 feasibility outlined a 10,000 tonne per day open pit operation with a 17-year mine life, producing an average of 150,000 oz. of gold in the first five years at all-in sustaining costs of $711 per oz. The resulting project net present value estimate, at a 5% discount rate, came in at $288 million.

Magino includes a past-producing underground mine, which generated 803,135 tonnes at 4.43 grams gold per tonne. This site is adjacent to Alamos Gold’s (TSX:AGI; NYSE: AGI) Island Gold mine.

In July, Argonaut closed a C$126.5 million bought deal financing.

This year, the company expects to generate 200,000-215,000 oz. of gold-equivalent at AISCs of $1,225-1,350 per ounce. This total includes contributions from the El Castillo, San Agustin and La Colorada open pit mines in Mexico, as well as from the Florida Canyon heap leach site in Nevada. Argonaut added this last asset to its portfolio last year, through an all-share merger with Alio Gold.

In November, Argonaut announced the discovery of four new, high-grade gold zones at Magino – the zones (Scotland, #42, Sandy and South) are either below or adjacent to the planned pit. Drill highlights included 7 metres of 14 grams gold per tonne from Scotland starting at 431 metres; 8 metres of 9.3 grams gold from #42 starting at 365 metres; 9 metres of 5.4 grams gold at Sandy from 741 metres; and 7 metres of 4.2 grams gold at South from 884 metres.

Argonaut Gold has a C$711.9 million market capitalization.

Canada Nickel

Canada Nickel (TSXV: CNC; US-OTC: CNIKF) wholly owns the Crawford nickel-cobalt sulphide discovery north of Timmins in Ontario. The junior is working to deliver a preliminary economic assessment of the project by year-end, which would be followed by a feasibility study by the end of 2021.

In October, the company published an updated resource estimate for Crawford, with a total of 657 million measured and indicated tonnes grading 0.26% nickel, 0.013% cobalt, and 6.58% iron and 646 million inferred tonnes grading 0.24% nickel, 0.013% cobalt, 6.81% iron, 0.024 gram palladium per tonne and 0.013 gram platinum per tonne. These resources are contained within the Main and East zones and include both a higher-grade shell (at a 0.25% nickel cut-off) as well as a lower-grade domain (based on a 0.15% nickel cut-off).

According to the company, this puts Canada Nickel in the top 10 of the world’s nickel sulphide resources.

The known nickel resource covers over 4 km of strike; the higher-grade core has been traced for 1.8 km of strike, is 150 to 220 metres wide and up to 650 metres deep. This includes 201 million tonnes of material grading 0.34% nickel.

Shortly after the resource update, Canada Nickel also announced, based on the results from four drillholes, a new discovery at Crawford – the West zone. While assays are pending, all four holes hit mineralized dunite along a width of 800 metres and along 425 metres of strike, within a 2.5 km by 400 to 800-metre wide geophysical anomaly, approximately 850 metres northwest of the Main zone. The gravity anomaly associated with the West zone appears to be larger than that for the Main zone.

Next to the Main and East zone nickel mineralization, the company has outlined a platinum group metal (PGM) zone, which has been traced from near surface to a depth of over 400 metres and along several kilometres of strike. Drill intersections from this zone included 7.5 metres of 2.6 grams palladium and platinum starting at 123 metres.

Canada Nickel has also established NetZero Metals, a division aimed at developing a zero-carbon footprint operation. This division is looking at various technologies throughout the mining, milling and processing steps, which could minimize – and absorb – carbon dioxide.

Canada Nickel has a C$171.7 million market capitalization.

Marathon Gold

Marathon Gold (TSX: MOZ) aims to deliver a prefeasibility study for its flagship Valentine Lake gold project in central Newfoundland in the first half of next year.

The wholly owned project is made up of four mineral deposits – two of which include mineral reserves – along a 20-km long trend. According to Marathon, its project is the largest undeveloped gold resource in Atlantic Canada.

Total measured and indicated resources at the site stand at 54.9 million tonnes grading 1.75 grams gold per tonne for a total of 3.1 million gold ounces. Inferred resources add a further 16.8 million tonnes at 1.78 grams gold totalling 960,000 ounces.

In April, the developer released the results of a prefeasibility study on Valentine, which defined a 12-year open pit mine, producing an average of 175,000 oz. of gold annually in the first nine years. With an initial capital cost of C$272 million and average life-of-mine, all-in sustaining costs of $739 per oz., the net present value estimate for the project, at a 5% discount rate, came in at $472 million with a 36% internal rate of return.

In September, Marathon filed the Environmental Impact Statement (EIS) for Valentine with the Impact Assessment Agency of Canada (IAAC) and the Newfoundland Ministry of Environment, Climate Change and Municipalities (NLDECCM). By November, the company announced that the EIS had been accepted for a formal review by the federal assessment agency. The reviews are expected to take 12 months. Permitting would take place once the EA process is successfully completed.

Marathon continues to focus on exploration across its project site. The 52,000-metre 2020 exploration program included 8,000 metres of infill drilling at the Berry zone, which lies within the 6-km-long Sprite Corridor between the Marathon and Leprechaun deposits.

In November, the company released assay results for 15 drillholes completed as part of its Berry infill work. Highlights included 42 metres of 3.7 grams gold; 24 metres of 1.68 grams gold; and 10 metres of 3.52 grams gold. Results from this program will be used to complete an updated resource estimate for Berry.

Marathon Gold has a C$497.3 million market capitalization.

Max Resource

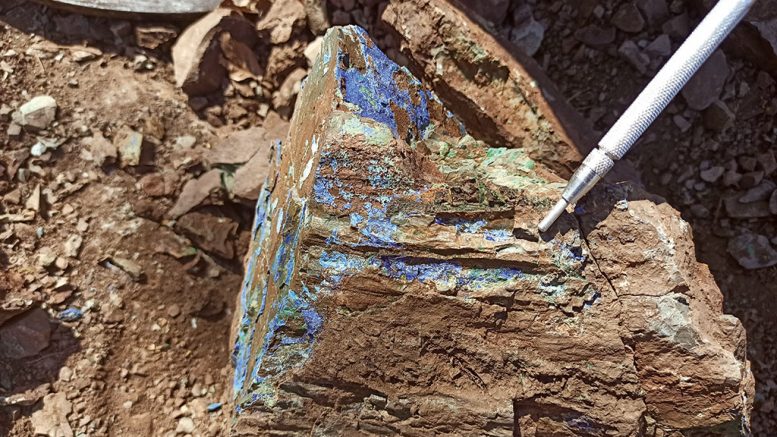

Max Resource (TSXV: MXR) is advancing its wholly-owned Cesar copper-silver project, which covers 500-sq-km in northeastern Colombia. The property is 420 km north of Bogota and occurs along the copper-producing Andean Belt.

Cesar appears to have geological similarities to KGHM’s (US-OTC: KGHPF) Kupferschiefer project in Poland, the largest silver and sixth-largest copper producing deposit in the world.

Cesar lies within a 200-km sediment-hosted copper-silver belt, and consists of the AM North, AM South and Cesar South stratabound zones.

The AM North zone is 11 km long and remains open. Assays include varying intervals with values between 4% to 34.4% copper and 28 grams to 305 grams silver.

The AM South zone, 40 km south-southwest of AM North, covers 16 sq. km and occurs on the same mineralized trend. In October, the company reported 25-metre outcrop sample assays from this area, which, when combined, averaged out to 250 metres of 3% copper and 29 grams silver.

Earlier this month, Max expanded its land holdings by 340 sq. km by acquiring the Cesar South project, 200 km along trend from the principal Cesar holdings. Reconnaissance rock grab sampling completed along 15 km of strike at Cesar South identified copper values between 0.3% and 11.4% and silver values between 3 grams and 656 grams per tonne. According to the company, this new area of mineralization suggests that stratabound copper-silver is present at the southern and northern margins of the sedimentary basin, over 200 km, with potential for continuous mineralization.

Max Resource also has an exclusive option to earn a 100% interest in the 19.8-sq.-km RT gold property in Peru, 760 km northwest of Lima. There are two mineralized systems occur at the site: the Cerro zone, a bulk tonnage gold-bearing porphyry, and the Tablon zone, a gold-bearing massive sulphide zone, 3 km to the south-east.

In October, Max Resource closed a $6.5 million non-brokered private placement.

Max Resource has a C$37.6-million market capitalization.

Roxgold

Roxgold (TSX: ROXG; US-OTC: ROGFF) is a West Africa-focused gold producer with assets in Burkina Faso and Cote d’Ivoire.

The company’s 1,100-tonne-per-day Yaramoko underground mine complex in Burkina Faso, 200 km southwest of Ouagadougou, is expected to produce a total of 120,000-130,000 oz. of gold this year at all-in sustaining costs of $930-$990 per ounce.

In November, Roxgold added near-surface, open-pittable reserves and resources to its mineral inventory at Yaramoko. The miner now has 820,000 tonnes of probable reserves at 7.2 grams gold per tonne, which contain 190,000 gold oz., in the open-pit category above the operating underground mine, which could support an open pit operation once the underground mine is completed.

According to John Dorward, Roxgold’s president and CEO, these open pit additions are the first phase of Roxgold’s plans to extend the Yaramoko life. In November, the company started a 14,500-metre underground drill program at the 55 Zone, focused on upgrading and extending resources at depth.

In addition to Yaramoko, the company also holds the Seguela project in Cote d’Ivoire.

In April, the company published the results of a preliminary economic assessment on Seguela. The study outlined an open pit operation producing an average of 103,000 oz. of gold a year over an eight-year life at all-in sustaining costs of $749 per ounce. Due to the high-grade nature of the Ancien deposit, in its first three years, this operation would produce 143,000 oz. per year at AISCs of $600 per ounce.

With an initial capital outlay of $142 million, the project has an after-tax net present value estimate, at a 5% discount rate, of $268 million and a 66% internal rate of return, based on a gold price assumption of $1,450 per ounce. A feasibility study is now underway, with results expected in the first half of next year.

In October, Roxgold announced exploration results from the high-grade Koula prospect at Seguela – reverse circulation highlights included 4 metres of 108.9 grams gold; 9 metres of 49.3 grams gold; and 9 metres of 30.1 grams gold.

On the earlier-stage exploration front, Roxgold also holds the Boussoura project in Burkina Faso, 180 km south of Yaramoko. In September, the company announced that drilling hit broad intervals of mineralization at the Fofora area. Highlights included 4.8 metres of 26.9 grams gold and 9 metres of 10.7 grams gold.

Roxgold has a C$589.5-million market capitalization.

Skeena Resources

Skeena Resources (TSX: SKE; US-OTC: SKREF) is advancing the Eskay Creek and Snip gold projects in B.C.’s Golden Triangle. The developer is working to deliver a prefeasibility study for Eskay Creek by the summer of 2021.

In November 2019, Skeena tabled a preliminary economic assessment for the past-producing Eskay Creek, which suggested a nine-year open-pit operation producing gold and silver in concentrate. The study outlined life-of-mine average annual gold-equivalent production of 306,000 oz. at all-in sustaining costs of $615 per oz., with pre-production capital outlays of C$303 million. The associated after-tax net present value estimate, at a 5% discount rate, came in at $638 million with a 51% internal rate of return, based on $1,325 per oz. gold and $16 per oz. silver.

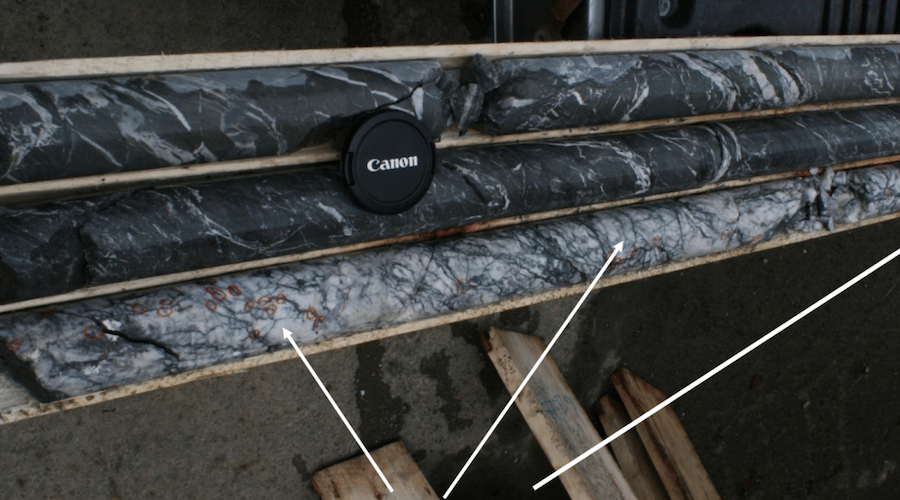

With a 88,000-metre infill and exploration drill program underway, Skeena expects to release an updated resource for Eskay in the first quarter of 2021.

In November, the company released infill results from the 21A and 22 zones at Eskay Creek. Notable intercepts from 21A included 31.1 metres of 5.15 grams gold per tonne and 21 grams silver per tonne; and 18.3 metres of 36.66 grams gold and 7 grams silver. Highlight intercepts from 22 included 48.7 metres of 6.89 grams gold and 122 grams silver; and 29.6 metres of 3.11 grams gold and 106 grams silver.

Eskay Creek generated 3.3 million oz. of gold and 160 million oz. of silver between 1994 and 2008, from material with a head grade of 45 grams gold and 2,224 grams silver.

In October, the company closed a transaction with Barrick Gold (TSX: ABX; NYSE: GOLD) to acquire a 100% stake in Eskay Creek. In exchange, Skeena issued the major 22.5 million units (made up of one share and half a warrant) and granted the producer a 1% net smelter royalty on the Eskay land package, half of which can be repurchased.

The company also wholly owns the past-producing Snip gold project. Hochschild Mining (LSE: HOC) has the option to acquire 60% of this asset. In July, Skeena released a maiden resource for Snip, with 539,000 measured and indicated tonnes grading 14 grams gold containing 244,000 gold ounces; and 942,000 inferred tonnes at 13.3 grams gold for a further 402,000 gold ounces. A 5,000-metre drill program started at this site in October.

In November, Skeena closed a $46 million common share overnight marketed public offering.

Skeena Resources has a C$499.1 million market capitalization.

Sokoman Minerals

Sokoman Minerals’ (TSXV: SIC; US-OTC: SICNF) most advanced asset is the 24.5-sq.-km Moosehead orogenic lode gold project in north-central Newfoundland, where a phase six, 10,000-metre diamond drill program is underway. Moosehead lies along the Trans-Canada highway and is on the same trend as Marathon Gold’s (TSX: MOZ) Valentine Lake project and is adjacent to New Found Gold’s (TSXV: NFG) Queensway project.

Mineralization at the site has been defined over 500 metres of strike to date, 200 vertical metres and over thicknesses of up to 10 metres.

As part of its first phase of drilling at the site, which started in June 2018, the junior discovered a high-grade zone of mineralization in the Eastern trend. The discovery hole returned 11.9 metres of 44.96 grams gold per tonne from 109 metres.

With five drill programs completed at the site since 2018, the mineralization remains open.

In September, Sokoman started the Phase 6 drill program and 15 holes have been completed to date, testing targets along the Western and Eastern trends. Drilling along the Eastern Trend included deeper holes, to test areas below 200 vertical metres at its north end.

In November, the explorer reported high-grade intercepts from a new, near-surface splay off the main part of the Eastern Trend – two drillholes were collared south of the 2018 discovery hole. The results included 4.6 metres of 47.2 grams gold from 64 metres, 8.1 metres of 68.7 grams gold from 111.2 metres; and 1.8 metres of 11.85 grams gold starting at 54.5 metres and 4.3 metres of 2.94 grams gold from 183.8 metres. Both holes hit two intervals of mineralization.

According to Tim Froude, Sokoman’s president and CEO, the latest results “continue to demonstrate the high-grade nature of the gold mineralization at the Moosehead project.”

The Moosehead drill program is ongoing with one rig. The company expects the drilling to continue into next year, as several targets require winter conditions for access and is also applying for permits for drilling on the ice.

Sokoman Minerals has a C$20.8 million market capitalization.

Surge Copper

Surge Copper (TSXV: SURG) wholly owns the 727.1-sq.-km Ootsa property, which includes three copper-gold-molybdenum-silver porphyry deposits (Ox, East Seel and West Seel), adjacent to Imperial Metals’ (TSX: III) Huckleberry mine.

The road-accessible property includes total measured and indicated resources of 224.2 million tonnes,grading 0.22% copper, 0.021% molybdenum, 0.15 gram gold per tonne and 2.8 grams silver per tonne (0.37% copper-equivalent). Additional inferred resources add 5.2 million tonnes at 0.18% copper, 0.019% molybdenum, 0.09 gram gold and 2.6 grams silver (0.29% copper-equivalent).

A 2016 preliminary economic assessment for the project outlined a 12-year contract mining and toll milling open pit operation. The 5.6-million-tonne-per-year mine would produce a total of 324 million lb. of copper, 185,000 oz. of gold, 15.8 million lb. of molybdenum and 3 million oz. of silver over its lifetime, at an all-in sustaining cash cost of $2.09 per lb. of copper.

With an initial capital outlay of C$64 million, the after-tax net present value estimate for the development came in at $186 million, at a 5% discount rate and based on $3 per lb. copper, with an 81% internal rate of return.

Shortly after closing a $6 million non-brokered flow-through private placement and a $500,000 non-brokered private placement in October, the company started a 10,000-metre core drilling program at the Seel Trend within Ootsa. Two drills are working at the site – one is testing potential extensions of the deposits, with a second testing targets along the Seel trend. New targets include the East and West anomalies.

The East anomaly covers an area of 900 metres by 400 metres; the West target includes a geophysical and copper-in-soil anomaly over an area of 1,000 metres by 200 to 300 metres.

The seven km Seel trend is one of two porphyry trends at the site. The Ox-Huckleberry trend extends over seven km at Ootsa.

In November, Surge released assay results for the upper portion of the first hole from this year’s drill program at Ootsa – the upper part of the drillhole hit 176.1 metres of 0.72% copper-equivalent and was drilled through the East Seel deposit. Assays from the lower part are expected in the coming weeks.

Surge Copper has a C$50.8 million market capitalization.

(This article first appeared in The Northern Miner)