Gold price: ETF inflows continue for 11th straight month

Gold ETFs have now added more than 1,000 tonnes in a year for the first time ever, surpassing the 2009 record of 646 tonnes.

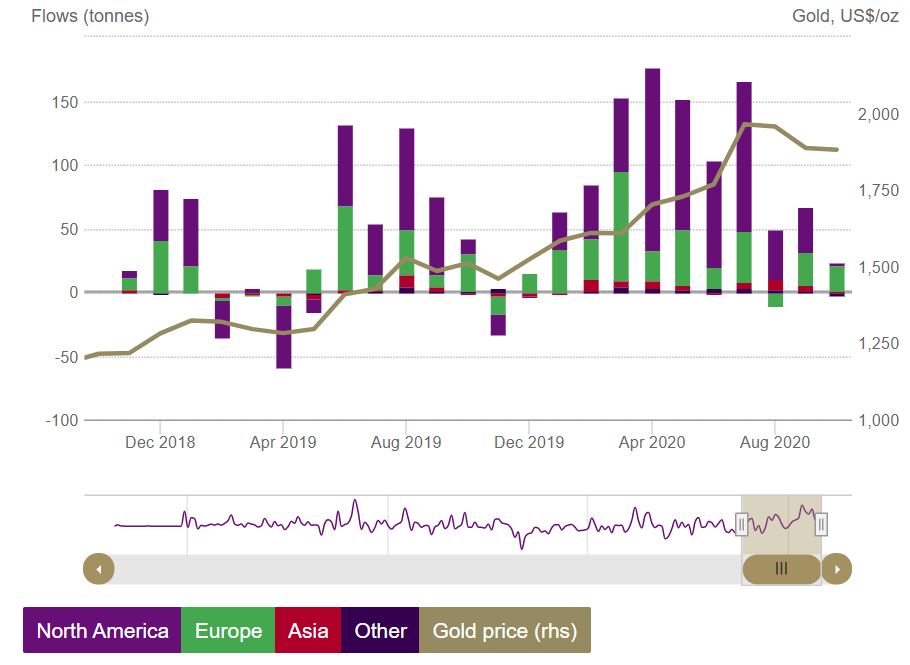

Net inflows of 1,022 tonnes ($57.1 billion) so far in 2020 have driven global gold ETF holdings to a new all-time high of 3,899 tonnes ($235 billion in AUM).

European funds drove nearly all net inflows for the month of October, with total holdings increasing by 20.2 tonnes ($1.4 billion).

North American funds and funds listed in Asia saw holdings rise by 1.8 tonnes ($166 million) and 1.1 tonnes ($76 million) respectively. The remaining regions had outflows of 2.8 tonnes ($144 million).

Gold price surging

Meanwhile, gold prices jumped to a six-week high on Thursday as Democrat Joe Biden inches closer to a victory in the US presidential election.

Spot gold was up 2.2% at $1,947.61/oz by 12:50 p.m. ET, having surpassing the $1,950/oz mark earlier in the day. US gold futures surged 2.8% to $1,948.90/oz.

“If the Democrats win the Senate and Biden becomes the president we would see a much larger stimulus package than both parties will probably agree on right now,” Commerzbank analyst Daniel Briesemann said in a Reuters interview.

Gold is considered a hedge against likely inflation fueled by the unprecedented money printing by central banks to rejuvenate the global economy.