Nio’s quarterly loss narrows more than expected, stock swings to gains

Nio said it delivered 12,206 vehicles in the third quarter.

AFP via Getty Images

Nio Inc.’s U.S.-listed shares swung to a gain of nearly 2% in premarket trading Wednesday, after the Shanghai-based electric-car maker reported better-than-expected quarterly results.

Nio’s NIO,

Nio said it lost RMB1.047 billion ($154.2 million), or 14 cents per ADR, in the third quarter, which compared with a loss of RMB2.52 billion in the year-ago period.

Excluding non-recurring items, such as stock-based compensation expenses, Nio’s adjusted net loss came in at $147 million, or 12 cents per ADR, the company said.

Analysts polled by FactSet expected a net loss of 20 cents per ADR for the quarter.

Revenue rose 146% to RMB4.526 billion, or $666.6 million, the company said. The FactSet consensus called for revenue of $664 million. Sales guidance for the fourth quarter was also above expectations.

Nio said it delivered 12,206 vehicles in the third quarter, including 8,660 ES6 models. It compared with 4,799 vehicles delivered in the third quarter of 2019 and 10,331 vehicles delivered in the second quarter of 2020, the company said.

“In view of the growing market demand for our competitive products, we are motivated to continuously elevate the production capacity to the next level,” founder and Chief Executive William Bin Li said in a statement. “We expect to deliver 16,500 to 17,000 vehicles in the coming fourth quarter.”

Nio said its vehicle margin rose to 14.5%.

Besides the delivery outlook, the company also guided for fourth-quarter revenue between RMB6.258 billion ($921.8 million) and RMB6.435 billion ($947.9 million), which would represent an increase of about 119.7% to 126% from the fourth quarter of 2019. The analysts surveyed by FactSet expect a fourth-quarter revenue around $813 million.

Nio did not directly address the impacts of the coronavirus pandemic on its business.

Don’t miss: Nio soars to record after JPMorgan selects it as a ‘long-term winner’ in China’s EV market.

On the days of the previous eight quarterly reports since Nio went public in September 2018, the stock had dropped six times, by an average loss of 13.1%. The two times the stock gained included a 3.6% rise after first-quarter 2019 results and a 53.7% gain after third-quarter 2019 results.

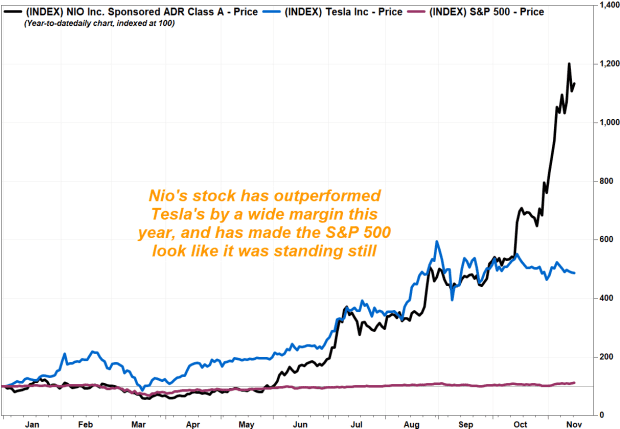

Nio’s stock has skyrocketed 1,033.83% year to date through Monday, while shares of U.S.-based EV rival Tesla Inc.’s stock TSLA,