The senior, 5-year facility includes a $20-million tranche advanced at closing, with additional tranches available to the company once certain conditions are met. Interest rates are the greater of either the 3-month LIBOR rate and 1.5% plus 7% and 5.75% annually.

All of the interest costs are capitalized till June 2022, with principal payable in 10 quarterly installments starting in September 2023. A fixed, $13 per ounce production payment is due on the first 450,000 oz. generated from the project – these payments may be stopped early by paying a termination fee. After December 2023, the company may start prepaying the outstanding principal and interest amounts.

The facility may be drawn until the end of June 2022, for a project completion no later than September 2023.

Ascot expects Sprott to purchase 10% of the shares to be issued in a financing, which would be part of Ascot’s minimum equity requirement of $25 million that makes up part of the financing package.

The convertible 3-year facility, which may be extended to four years once project constriction permits are in place, is made up of two tranches that total $25 million. The first, $10-million portion, will be advanced at closing while the second $15 million would be issued once certain conditions are met. The facility accrues interest at 8% annually and all of the interest is capitalized until the project has completed construction. A 1.5% commitment fee is due on closing with a 1% prepayment penalty after December 2022.

This second facility may be converted into Ascot common shares on pre-specified terms.

“We are very pleased with the financial commitments that Sprott and Beedie Capital have made towards the development of the project,” Derek White, the company’s president and CEO, said in a release. “We have achieved our objective of securing a flexible financing package on terms that are competitive and protect the upside for our shareholders. The optionality of repayment of both the Senior Facility and the Convertible Facility in a rising gold price environment provides the company financing flexibility. Combined with the equity financing completed in June, this package secures approximately $45 million of immediate funding enabling us to order long lead-time equipment, undertake pre-construction activities, advance permitting and refinance our existing convertible note.”

The definitive documentation for the financing has been signed, with the first $20 million from the senior facility expected on Dec. 10.

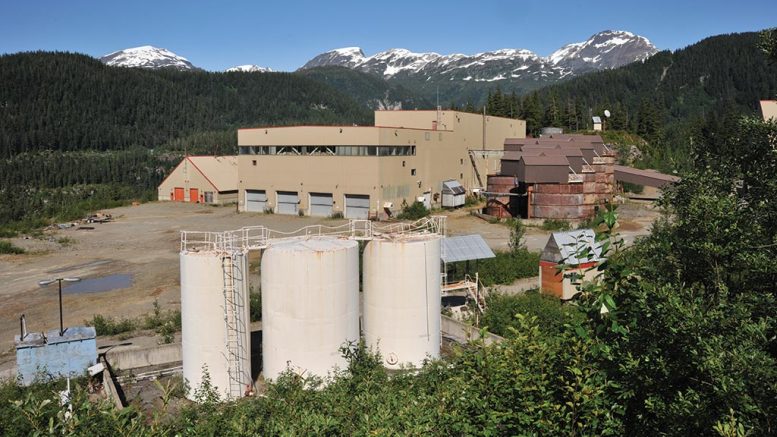

A feasibility study from April 2020 on a development of both the Premier and Red Mountain projects outlined an eight-year mining operation producing an average of 132,375 oz. of gold and 370,500 oz. of silver annually at all-in sustaining costs of $769 per oz. With an initial capital cost estimate of C$146.6 million, the net present value for the project, at a 5% discount rate, stands at C$341 million with a 51% internal rate of return.

(This article first appeared in the Canadian Mining Journal)