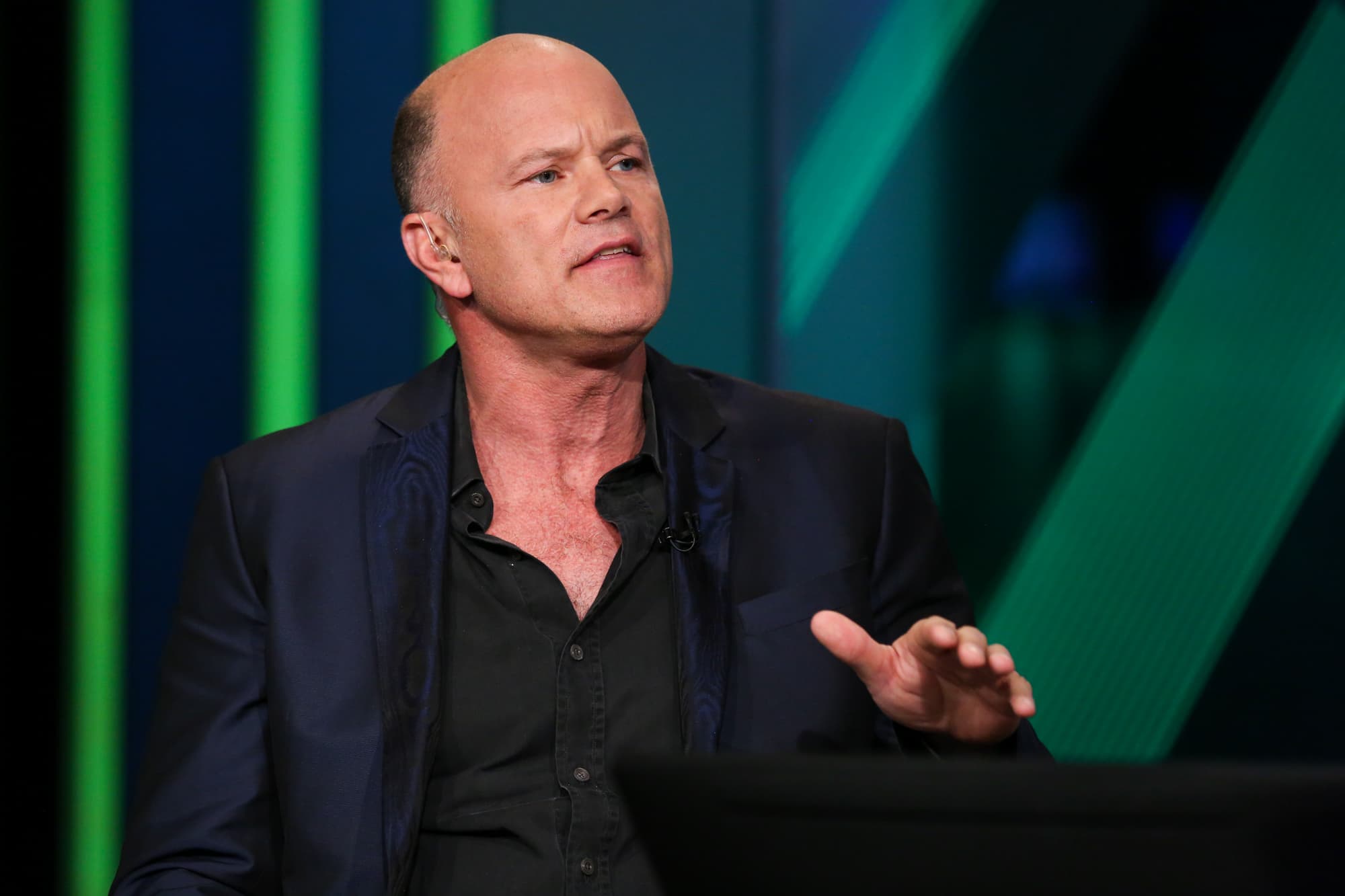

Bitcoin barely flinched after the Trump administration proposed new cryptocurrency regulations a week ago, a telltale sign about investor sentiment on the digital coin, Galaxy Digital founder and CEO Michael Novogratz told CNBC on Thursday.

“It tells you about how powerful this bull market is,” he said on “Squawk Box.” “They are throwing lots at the system, and it’s not actually impacting it.”

The Financial Crimes Enforcement Network, a Treasury Department division known as FinCEN, on Friday revealed new disclosure rules affecting private wallets and financial institutions intended to crack down on criminal activity involving cryptocurrency. Since then, the price of bitcoin has generally sustained its position above $23,000, according to data from Coin Metrics, despite potential risk.

Hoping to increase transparency, the guidelines require customers to be identified on transactions of more than $3,000 on self-hosted crypto wallets. Crypto platforms would be required to report transactions on unhosted wallets that top $10,000 within 15 days.

While bitcoin is not the direct target of and Galaxy does not expect to be affected by the changes, Novogratz said it reflects a common theme in the way the Trump administration governs. He also cautioned that it could cast a cloud over the crypto industry.

“I’m hoping, you know — we get a change of the guard in 20 days — I’m hoping we can get some more open-minded regulators,” Novogratz said, referring to the incoming Biden administration.

Novogratz is a billionaire former hedge-fund manager and philanthropist. He is a frequent donor to Democratic politicians, including a $200,000 donation to the Biden Action Fund in June.

The proposal was brought by the Treasury Department about a month before the Trump administration will transition out of the White House. It provided a 15-day comment period on the potential changes, which has been criticized for being rushed, including by Novogratz, who advocates for a 60-day period.

“It’s kind of endemic of the Trump administration trying to jam in legislation, and quite frankly there are a lot of unintended consequences,” he said. “This is anti-dollar … and it’s anti-innovation. It’s going to push a lot of the cool stuff that’s happening in crypto offshore.”

The continued rise in bitcoin is being powered by a wave of institutional investors, a market-moving force, who are betting on cryptocurrency. Novogratz said he’s seeing “no slow down” in bitcoin adoption among Galaxy’s clients. Since falling below $5,000 during the historic coronavirus-induced meltdown in assets, bitcoin broke above $20,000 for the first time last week.

Earlier this month, Novogratz said that there has been a shift in crypto ownership from individual investors to big funds. In 2017, he noted, nearly all transactions were by individual owners. He expects to see less volatility in digital coins as more institutional investors enter the market, helping to carry bitcoin to about $60,000 next year, more than double current levels.

Novogratz, however, hopes it doesn’t come at the cost of innovation.

“Lots of these crypto companies both onshore and offshore are willing to push regulation and build great innovation,” he said. “I would love an administration, I would love a regulatory framework that embraces that, not fights that.”