U.S. stocks posted slight gains in thin trading on Thursday to wrap up the holiday-shortened week.

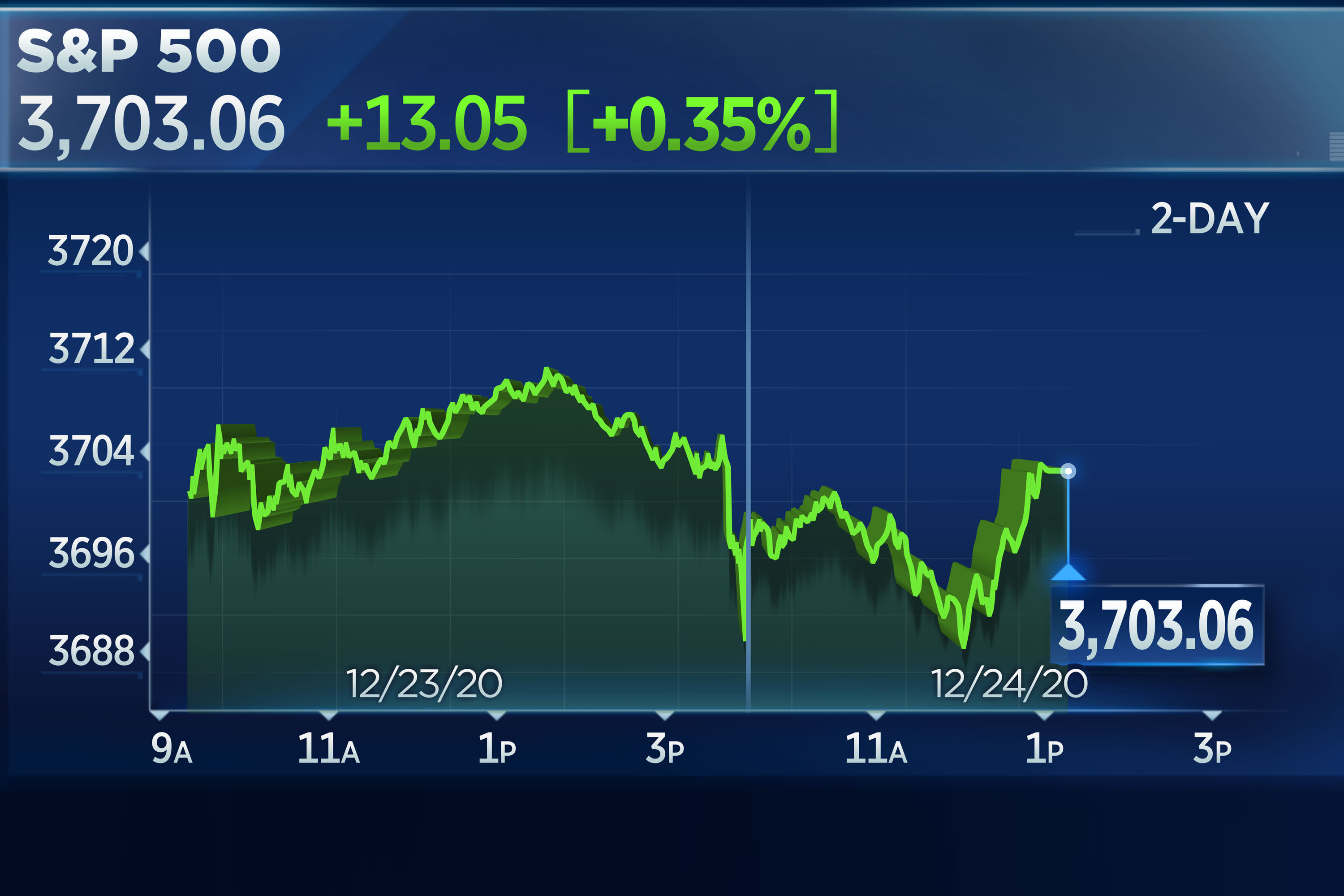

The Dow Jones Industrial Average climbed 70.04 points, or 0.2%, to 30,199.87, while the S&P 500 gained 0.4%, or 13.05 points, to 3,703.06. The Nasdaq Composite rose 0.3%, or 33.62 points, to 12,804.73. Technology was the best-performing sector, rising 0.8%, while energy lagged.

Trading volume was low on Christmas Eve. The market closed early at 1 p.m. ET on Thursday, and will be closed on Friday in observance of Christmas.

Shares of Alibaba dropped more than 13% following news the China-based e-commerce giant is the target of a new antitrust investigation by the Chinese government.

House Republicans on Thursday blocked Democrats’ attempt to pass $2,000 direct payments as the fate of a coronavirus relief package passed by Congress hangs in the balance. The move came after President Donald Trump slammed the $900 billion bill, calling it an unsuitable “disgrace” because it calls for $600 rather than $2,000 checks.

The S&P 500 registered a 0.2% loss this week amid profit-taking action into the year-end. Policy uncertainty also dampened investors’ spirits in the holiday week. The 30-stock Dow eked out a 0.1% gain for the week.

The Nasdaq rose 0.4% this week, while the Russell 2000 advanced 1.6% for its eighth straight week of gains — the longest weekly winning streak since Feb. 2019.

“Markets don’t care too much about Trump’s criticism of the stimulus bill as a formal veto is considered unlikely, [and] the joint stimulus/budget legislation passed both the House and Senate with veto-proof majorities,” Adam Crisafulli of Vital Knowledge said in a note. “Even if Trump were to successfully veto the measure, Biden will be president in only 27 days and can sign it then.”

Investors also closely monitored progress on the vaccine rollout. The CDC said just over one million shots had been administered as of Wednesday, roughly 19 million doses shy of earlier projections from public health officials for December.

Elsewhere, the European Union and the United Kingdom on Thursday struck a historic trade deal, more than four years after the U.K. voted to leave the bloc.

With just four trading days left in the year, the Nasdaq is on pace to be the clear winner, currently up more than 42%. The Dow and S&P 500 are up 5.8% and 14.6%, respectively.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.