Citi downgrades U.S. stocks but says ‘buy the dip’ when corrections come

Financial markets have shrugged off the violence and chaos on Capitol Hill, with both the Dow DJIA,

But investor optimism could be tempered as we continue into 2021, as Citi’s global strategy team said that global stocks will be flat over the year, in our call of the day.

The investment bank’s strategists have predicted just a 2% increase in the benchmark MSCI All Countries World Index 892400,

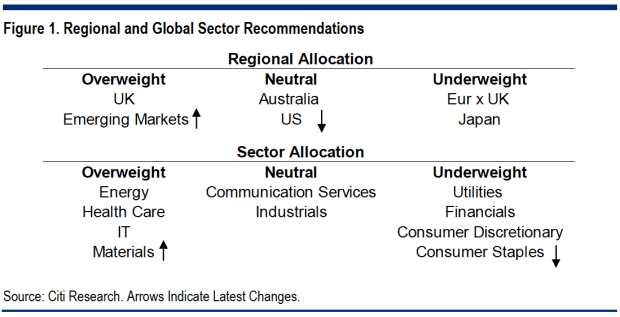

Lowering the temperature on their long-held bias toward growth stocks, which has historically kept their rating on the U.S. market overweight, is part of the rationale behind downgrading the U.S. market to neutral.

They also viewed the U.S. fiscal deficit as a threat to the dollar, which they expected to weaken this year, boosting emerging markets and commodity stocks.

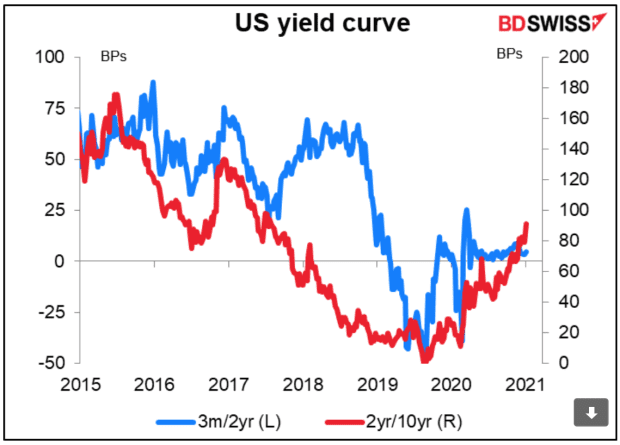

But bond yields could be lifted, helped by a recovery in the global economy, with Citi projecting that the 10-year U.S. Treasury yield (currently at 1%) will hit 1.25% in coming months and 1.45% by the end of the year. They said this should help financial and energy companies, which are value stock stalwarts.

The best returns are expected in the U.K., where Citi forecasts 7% growth for the FTSE 100 UKX,

Their “mildly optimistic” view on global equities hinges on the success of COVID-19 vaccines in restarting the world economy. Citi’s economists are predicting a 5% increase in global gross domestic product in 2021, after 2020’s 3.9% contraction.

Both of these factors should boost the recovery in corporate profits, with earnings per share in the most battered sectors rebounding the most.

The Citi strategists said that much of their forecast on recovery may already be priced into the market, because the MSCI All Countries World Index is trading at 20 times consensus earnings per share — far higher than the long-term median of 15 times. By that measure, the U.S. is the most expensive of the major markets, and the U.K. the cheapest.

As for sentiment, Citi said we’re deep into euphoria territory in the U.S. Panic/Euphoria index, indicating that corrections may be coming. Their suggestion? Buy the dip.

The buzz

President Donald Trump acknowledged defeat in the U.S. presidential election, saying there will be an “orderly transition” of power. His concession came after Congress certified Joe Biden and Kamala Harris’ win, voting into the night after a violent pro-Trump mob stormed Capitol Hill on Wednesday.

Also: Why the stock market rallied even as a violent mob stormed the Capitol

Technology giants Facebook FB,

Senior members of Trump’s administration have discussed the possibility of invoking the 25th Amendment of the Constitution, according to CBS. If invoked — for the first time in history — it would remove Trump as president and make Vice President Mike Pence the commander-in-chief.

Read more: Re-impeach? 25th Amendment? Various ideas floated to end the Trump era now

U.S. officials are considering banning Americans from investing in Alibaba and Tencent, China’s two most valuable publicly-listed companies. That would mark an expansion of the Trump administration’s late-stage effort to blacklist investments in Chinese companies linked to the country’s military.

Sports betting stocks like DraftKings DKNG,

The market cap of all cryptocurrencies has topped $1 trillion, with bitcoin BTCUSD,

Bed Bath & Beyond shares are down close to 14% in the premarket, after the retailer posted worse-than-expected sales and profit figures for its fiscal third quarter ending Nov. 29.

The markets

Stock markets have opened higher DJIA,

The market is reacting positively to the Democratic sweep ushered in by the two Senate runoff wins in Georgia, which improve the chances of more fiscal stimulus, as Vice President-elect Harris would cast tiebreaking votes.

In economic news, initial state jobless claims dropped by 3,000, to 787,000, during the week ended Jan. 2, and the U.S. trade deficit widened in November.

Read more: Democrats win Georgia’s runoff elections, giving their party control of U.S. Senate

The chart

U.S. Treasury yields, shown in our chart of the day from Marshall Gittler at BDSwiss, rose sharply as the two Senate runoff races in Georgia were called for Democrats. 10-year yields TMUBMUSD10Y,

The tweet

Research from YouGov found that one in five voters approved the storming of Capitol Hill, and that a majority of Republicans blamed President-elect Biden for it.

Random reads

New pub does roaring trade during lockdown after opening in a care home.

On the llam: ‘Very chill’ llama found wandering off highway in Massachusetts.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.