While BEV’s scope is broad, it is mostly focused on “clean” products and technologies, such as greener steel and cement, long-haul transport and energy storage.

To be eligible for BEV’s money, a start-up needs to showcase a scientifically sound technology that has the potential to reduce annual global greenhouse-gas emissions by at least 500 million tonnes a year. Global emissions currently measure about 34 billion tonnes a year, partly thanks to curtailment of global economic activity and mobility in 2020 due to the covid-19 pandemic.

Investors’ new favourite

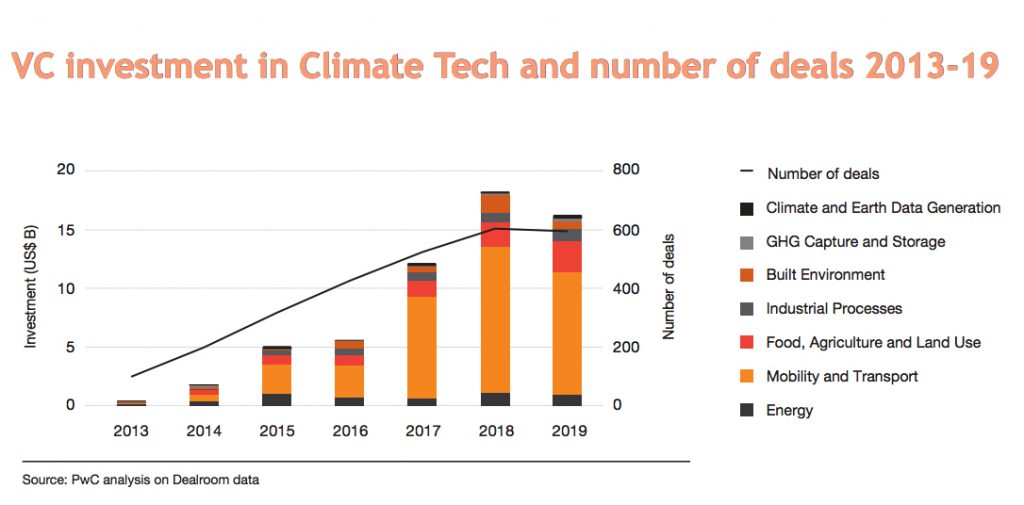

Investment in green technologies has soared in the past two years. According to the latest PwC report on the matter, venture capital money flowing into start-ups that can help cut emissions hit $16 billion in 2019 from $400 million in 2013 — a 40-times increase.

BEV’s first billion was directed to companies developing complex technologies to support clean cobalt and lithium mining, electric aviation, hydropower turbines and, most recently, emissions-free steel.

“We have built a great technical team and our ability to close a second fund is a testament to their good work,” Eric Toone, BEV’s technical lead, told Bloomberg News.

The fund has had some newsworthy wins. QuantumScape (NYSE: QS), which makes next-generation lithium-ion batteries, listed on the New York Stock Exchange in September. Its market capitalization is currently close to $20 billion, up from $3 billion, even though its batteries won’t be available before 2025.