GE earnings: Can record Q4 stock rally be supported by earnings, FCF guidance?

General Electric Co. investors will soon get some confirmation on whether the big bet they made on the industrial conglomerate’s stock over the last few months will actually pay off, now and down the road.

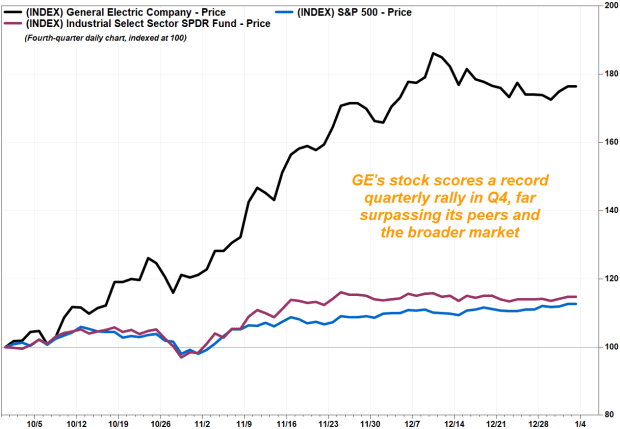

GE is scheduled to report fourth-quarter results on Tuesday, Jan. 26, before the market opens. One might argue that this quarterly report and management’s outlook for 2021 will be among the most important for investors in years, as it follows a record quarterly rally in the stock.

The stock GE,

Helping fuel the rally, GE reported in late October a surprise third-quarter adjusted profit and positive free cash flow, as well as hopes that GE would benefit greatly from a recovery from the COVID-19 pandemic. Before GE’s third-quarter report, some analysts touted the stock as a COVID-19 vaccine play, with UBS analyst Markus Mittermaier saying it was “the most vaccine-levered stock” that he covered.

GE’s aviation business looked poised to get a boost from a recovery in air travel, health care was seen as benefiting from an expected recovery in elective procedures and an economic recovery was seen boosting crude oil prices, which should in turn support GE’s power business. And President Joe Biden’s clean energy agenda should help fan GE’s renewable energy business.

Don’t miss: GE’s stock jumps after two Wall Street analysts raised their targets by more than 40%.

Also read: GE stock rallies after analyst turns bullish on growing confidence in aviation recovery.

But stock has stalled recently, as new COVID-19 cases and deaths continued to surge, and as the dissemination of the vaccines fell well short of what was hoped for and expected. That has given investors some reason to question whether they over-bet the “vaccine-levered” play. See Coronavirus Update column.

GE’s stock rose 0.4% to close Friday at $11.11. It has lost 5.7% since closing at an 11-month high of $11.78 on Jan. 12, while the S&P 500 has gained 1.1% over the same time.

Meanwhile, UBS’s Mittermaier doubled down on his bullish call ahead of earnings, saying GE remains a “top pick” in 2021. He said earnings reports and GE’s outlook presentation in early March should provide catalysts for further gains.

“With expected near-term volatility as COVID-19 containment efforts evolve, investors are increasingly looking at 2022+, with discussions focusing on power (upside options, e.g. China and hydrogen), renewables (offshore), capital, de-levering and the long-term case on aviation (cash conversion, etc.),” Mittermaier wrote in a note to clients. “GE has proven that its balance sheet could weather the storm of the pandemic.”

Here is what Wall Street is expecting GE to report for earnings, revenue and free cash flow (FCF). But like BofA Securities analyst Andrew Obin said, management guidance for FCF in 2021 could be the key metric that determines the stock’s fate.

The numbers

Earnings: The average estimate of the 18 analysts surveyed by FactSet is for adjusted earnings per share of 9 cents, down from 21 cents a year ago but up from 6 cents in the sequential third quarter. Estimize, a crowdsourcing platform that gathers estimates from buy-side analysts, hedge-fund managers, company executives, academics and others, has a higher consensus EPS estimate at 11 cents.

Revenue: The FactSet consensus for revenue is $21.77 billion. That’s down from $26.24 billion a year ago, but up from the $19.42 billion in the third quarter. The Estimize revenue consensus is also higher, at $22.15 billion. For GE’s business segments, the FactSet revenue consensus is $5.67 billion for Aviation, $5.31 billion for Power, $4.75 billion for Healthcare and $4.44 billion for Renewable Energy.

Free cash flow: In December, Chief Executive Larry Culp said there was “line of sight to at least $2.5 billion of Industrial free cash flow” in the fourth quarter, and he expected FCF to be “positive” in 2021. BofA’s Obin, who rates GE at buy, estimates that management will revise its guidance to a range of about $1.5 billion to $3.5 billion. “Guidance of [$0 to $2 billion] would be disappointing,” Obin wrote.

Stock movement: Since Culp was named CEO in October 2018, the stock has gained on the day that earnings were reported five times, by an average of 8.5%, and fell three times, by an average of 2.5%, according to FactSet data. Over the past 12 months, the stock has slipped 5.6%, while the industrial ETF has gained 5.4% and the S&P 500 has advanced 15.5%.

Some other analyst comments

Although GE’s Renewable Energy is the only segment expected to post a sequential decline in revenue, Oppenheimer’s Christopher Glynn, who rates GE at outperform, is optimistic regarding the business’s outlook, saying the offshore potential is taking shape.

“GE, now making money in onshore wind at an improving rate, targets a higher profitability offshore model in time,” Glynn wrote in a research note.

He added that under President Joe Biden’s administration, the “U.S. political backdrop favors incremental optimism for wind investment potential,” amid expectations for renewables-friendly mandates and incentives.

Meanwhile, long-time GE skeptic Stephen Tusa at J.P. Morgan, who has a neutral rating on the stock, has a downbeat view on GE’s Power business, amid a recent acknowledgment from management the trend away from electricity generation from fossil fuels, is “clear.”

“In essence, GE is saying that demand for the turbines that is the source of their $13 billion gas power business is in secular decline, and utilization/power generation from gas, one of the drivers of their $8 billion services business, which is 100%+ of profits, has peaked and is going down in the U.S., at least through 2022, below the 2% growth forecast by GE in investor materials last spring,” Tusa wrote.