Gold price recovers despite stronger dollar

Meanwhile, European equities and US futures remain under pressure. Global shares slipped over the past week on optimism surrounding a historic $1.9 trillion US aid package.

“Market sentiment is tilted toward the cautious side after US equities pulled back from their recent highs, despite robust corporate earnings,” Margaret Yang, a strategist at DailyFX, told Bloomberg.

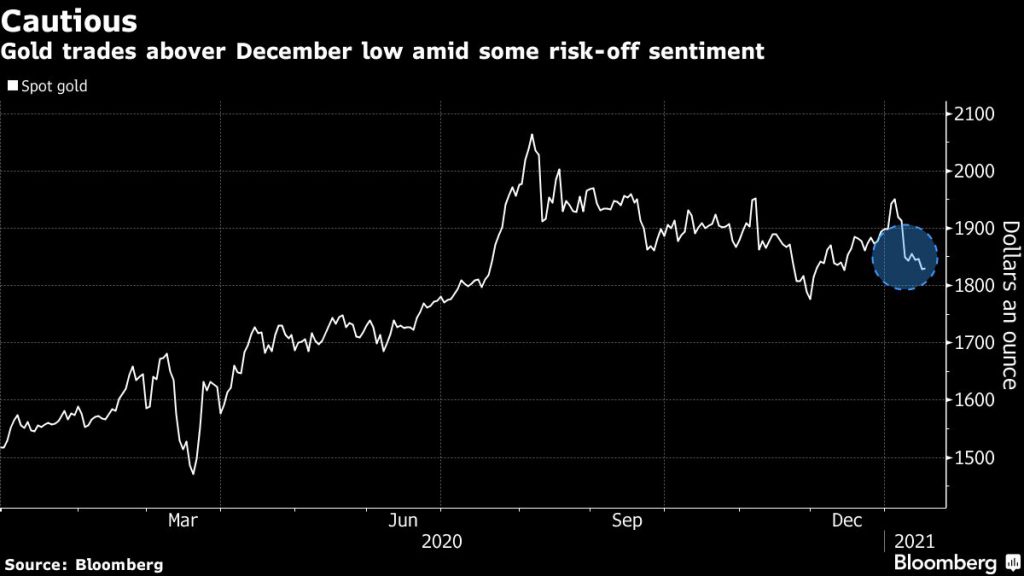

Bullion has fallen more than 3% this year as US Treasury yields and the dollar climbed on hopes that covid-19 vaccines and more fiscal stimulus will aid an economic recovery. Inflation expectations have increased steadily since March, though too slowly to compensate for the recent spike in bond rates, diminishing gold’s appeal in what has typically been a strong month for the metal in the past decade.

“We expect nominal yields to play some catch-up to the move breakevens have already had, lifting real yields and presenting a headwind for gold prices through 2021,” said Marcus Garvey, head of metals and bulks commodity strategy at Macquarie Group Ltd.

“The gold market remains relatively supported at these levels, as the current run of the US dollar has more to do with safe haven, rather than a discernible pivot to a stronger dollar,” Stephen Innes, chief global market strategist at Axi, told Reuters.

The US dollar continued its climb over the past two weeks, hitting a four-week peak against rival currencies on Monday, thus making gold expensive for holders of other currencies.

“The US stimulus (plan) is quite large, we’re going to get around $1.9 trillion or $1.5 trillion, and either scenario is good for gold,” Innes added.

(With files from Bloomberg and Reuters)