Gold price set for worst January in 10 years

Nevertheless, the precious metal has lost about 2.8% so far this month, on course for its worst January performance since 2011.

“If I look at gold, it seems the market was looking for a more dovish Fed,” Giovanni Staunovo, an analyst at UBS Group AG, told Bloomberg. “I still believe we will see a higher price this quarter, supported by low(er) US real rates and a weaker US dollar.”

Weak demand

Bullion’s slow start to the year may be explained by weaker demand for gold during the past quarter.

According to the World Gold Council’s latest Gold Demand Trends report, gold demand fell 28% year-on-year to 783.4t (excluding over-the-counter activity) in Q4 2020, making it the weakest quarter since the midst of the Global Financial Crisis in Q2 2008.

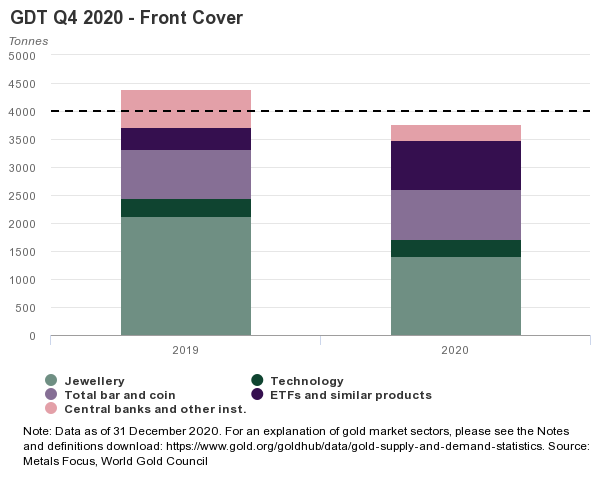

The coronavirus pandemic, with its far-reaching effects, was the driving factor behind weakness in consumer demand throughout 2020, culminating in a 14% decline in annual demand to 3,759.6t, the first sub-4,000t year since 2009.

Gold jewellery demand in Q4 declined 13% year-on-year to 515.9t, resulting in a full-year total of 1,411.6t, 34% lower than in 2019. This also marks a new yearly low for the Council’s data series. While demand improved steadily from the severely depleted Q2 total, the coronavirus continued to have an impact on consumer behaviour.

Despite 130t of outflows in Q4, gold-backed ETFs still saw record annual inflows as global holdings grew by 877.1t in 2020. In addition, evidence suggest that OTC activity, which is not directly captured in the WGC dataset, was also robust throughout the year.

Total gold supply of 4,633t was 4% lower year-on-year, the largest annual fall since 2013. The drop can be largely explained by covid-related disruptions to mine production, offset by a marginal 1% increase in recycling to 1,297.4t for 2020.

While 2021 will likely continue to be characterized by uncertainty, owing to the covid-19 pandemic, gold investment will remain well supported by the interest rate environment, the Council added.