Grantham Warns of Biden Stimulus Further Inflating Epic Bubble

(Bloomberg) — In the waning days of Donald Trump’s presidency, Jeremy Grantham warned that U.S. stocks were in an epic bubble. He now predicts Joe Biden’s economic-recovery plan will propel them to perilous new heights, followed by an inevitable crash.

“We will have a few weeks of extra money and a few weeks of putting your last, desperate chips into the game, and then an even more spectacular bust,” Grantham, the value-investing legend and co-founder of Boston-based GMO, said in a Bloomberg “Front Row” interview. “When you have reached this level of obvious super-enthusiasm, the bubble has always, without exception, broken in the next few months, not a few years.”

Data show risk-taking exploded following the last round of pandemic-relief checks. Grantham has “no doubt” at least some of the $1.9 trillion in federal aid Biden is seeking from Congress will end up being spent on stocks instead of food or shelter.

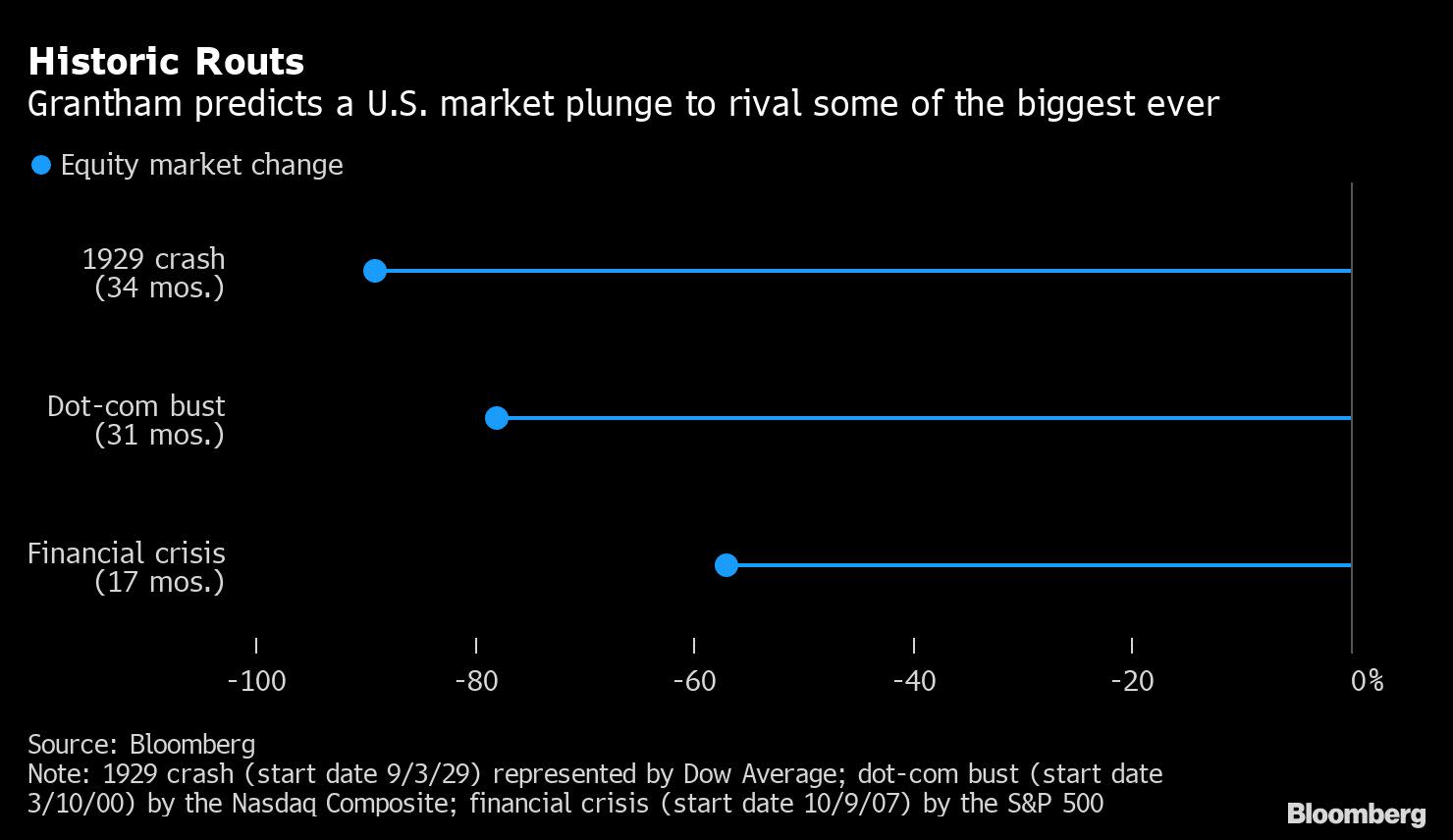

He envisions a collapse rivaling the 1929 crash or the dot-com bust of 2000, when the Nasdaq Composite Index plunged almost 80% in 31 months.

Many investors argue today’s valuations are justified by the growth potential of transformative technologies and new business models. Grantham, 82, dismisses that argument as fanciful, and he rejects the popular theory that the Federal Reserve can cushion or even reverse the next slide with bond-buying that pumps more liquidity into financial markets.

“At the lowest rates in history, you don’t have a lot in the bank to throw on the table, do you?” he said.

Perma-Bear

For now, however, stocks keep rising to records and Grantham’s reputation as a perma-bear who misses out on rallies only grows.

GMO’s cautious stance has been costly. Assets under management fell by tens of billions of dollars during the decade-long bull market, as the firm steered clear of growth stocks. Then in April, GMO doubled down, insulating its portfolios from directional bets on the market and largely missing out on the second leg of the 2020 rebound.

Read more: Grantham’s Bear Market Call Tests Patience of GMO Fund Investors

Even before the pandemic, Grantham thought the economy was on shaky ground. He was concerned about the steady decline in U.S. productivity, skeptical that Fed policy had achieved much beyond widening the inequality gap and worried that the profit-at-all-costs nature of American capitalism was destroying the environment and fraying the social fabric.

For Grantham, the combination of fiscal stimulus and emergency Fed programs led to “spectacular excesses” and pushed an already overvalued market into bubble territory.

Inflation Threat

It could have other consequences, too.

“If you think you live in a world where output doesn’t matter and you can just create paper, sooner or later you’re going to do the impossible, and that is bring back inflation,” Grantham said. “Interest rates are paper. Credit is paper. Real life is factories and workers and output, and we are not looking at increased output.”

Grantham, who considers himself a student of bubbles, has been right before — if early. GMO exited Japan in 1987 and reduced its exposure to U.S. stocks in late 1997, dodging the dot-com wipeout. Grantham also raised concerns about housing prices ahead of the 2008 financial crisis.

This time, there may be few places to hide. If Grantham is right about the threat of inflation, bonds are risky. He also has reservations about gold because it generates no income. And in his view Bitcoin is make-believe nonsense.

Selling everything and holding cash is one option. But Grantham said his best advice for long-term investors is to focus on low-growth stocks that are cheap relative to benchmark indexes, emerging markets and companies fighting climate change with renewable energy and electric-car technology.

See also: Grantham Calls for Marshall Plan for Climate Change

“You will not make a handsome 10- or 20-year return from U.S. growth stocks,” he said. “If you could do emerging, low-growth and green, you might get the jackpot.”

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.