Here are analysts’ 10 favorite clean-energy stocks to buy now

The Democrats appear set to enjoy majority control of both houses of Congress, handing President-elect Joe Biden power to enact policies that will favor certain industries.

Based on Biden’s comments, we can expect more stimulus spending by the federal government — possibly a lot more, which means an increase in the Federal Reserve’s purchases of U.S. Treasury notes. That could very well mean another plunge in long-term interest rates and a continued flow of new money into the stock market.

But what about more particular policy points? If you look at stock market action Jan. 6, it is clear that investors expect Biden and Congress to do a lot for companies producing clean energy, or developing technology and services to enable other companies to do so.

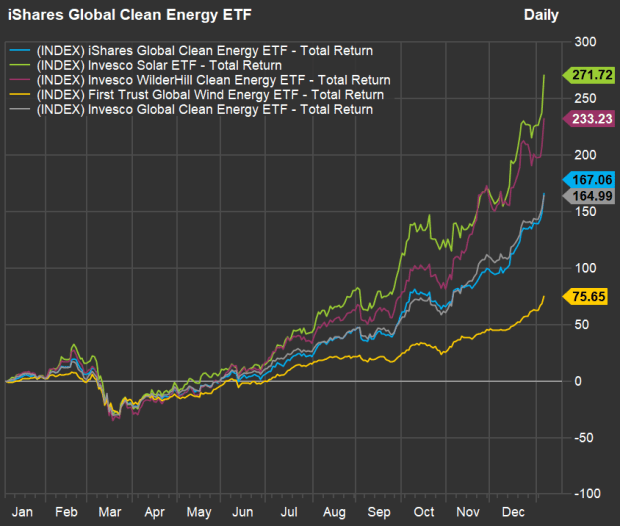

Shares of clean-energy ETFs soared on Jan. 6.

Clean-energy ETFs are an easy way to play a long-term trend that is being pushed by governments around the world, with diversified portfolios. There are many of them, with different areas of focus and varying expenses.

Read: 5 high-growth themes and the stock-market ETFs that can deliver big gains in 2021

But what about individual stocks? In order to put together a list, we looked at five of the largest clean-energy ETFs, listed all their holdings and filtered out the 20 rated highest by sell-side analysts (the ones employed by brokerage firms) polled by FactSet.

There is variety in the space. Some ETFs focus on particular industries, such as wind- or solar-power generation, and geographic focuses vary. We looked at five of the largest ETFs in the space:

- iShares Global Clean Energy ETF ICLN,

+9.49% — This is the largest clean-energy ETF, with $4.78 billion in assets. It holds a market-capitalization-weighted portfolio of 30 liquid companies involved in the industry. It has annual expenses of 0.46% of assets. - Invesco Solar ETF TAN,

+10.99% — This is a concentrated play with $3.63 billion in assets, holding 30 stocks, also cap-weighted, with 54% of the portfolio in U.S. names. Its annual expense ratio is 0.69%. - Invesco WilderHill Clean Energy ETF PBW,

+9.45% — This ETF has $2.17 billion in assets, holding 32 stocks of companies that are listed in the U.S., with a modified equal-weighting. Its expense ratio is 0.70%. - First Trust Global Wind Energy ETF FAN,

+4.88% — This is another concentrated ETF, with $406 million in assets allocated 60% to “pure-play” wind-industry companies, with the rest of the portfolio made up of diversified companies involved in wind-power generation. That means it holds some large, traditional power companies, such Duke Energy Corp. DUK,+1.86% and NextEra Energy Inc. NEE,+5.40% . The portfolio has 50 stocks weighted by market capitalization. The expense ratio is 0.62%. - Invesco Global Clean Energy ETF PBD,

+6.20% — This ETF has $301 million in assets and it follows what FactSet describes as “more akin to an actively managed strategy than other funds in the segment,” because it follows an index designed to include companies with greater potential for stock-price appreciation. It holds about 100 stocks with a modified equal weighting. Its expense ratio is 0.75%.

One of the challenges in the alternative energy space is how well the stocks have been doing — many companies favored by analysts and investors have gotten well-ahead of consensus price targets.

Here are total returns for all five of these ETFs over the past 12 months:

So we narrowed the list of 160 stocks held by at least one of the five ETFs listed above to 10 that are covered by at least 15 analysts, have majority “buy” or equivalent ratings, and positive upside implied for the next 12 months, based on consensus price targets:

Scroll the table to see all the data. Share prices and targets are in local currencies.

As always, if you see any individual stocks of interest, your next step should be to do your own research to form your own opinion about a company’s ability to remain competitive over the next decade or longer.

Don’t miss: 20 of analysts’ favorite large-cap stocks for 2021, including GM, Facebook and Salesforce