Here’s another sign that markets have gone nuts and everyone is chasing everything

It doesn’t take a rocket scientist to discern that financial markets are full of juice at the moment, with the S&P 500 SPX,

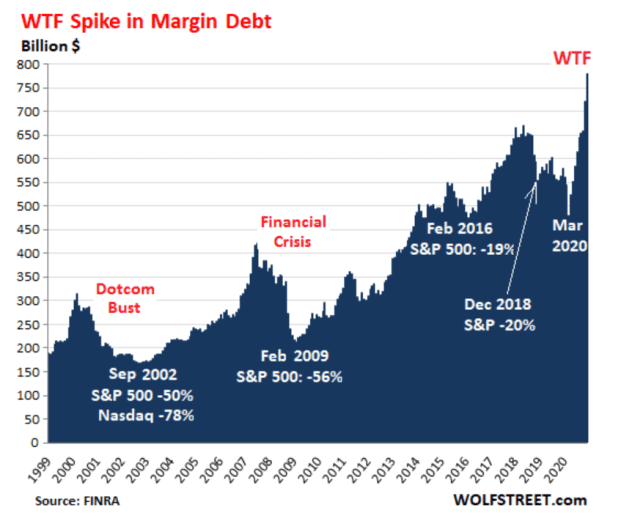

Here’s another sign. Margin debt tracked by member firms of the Financial Industry Regulatory Authority has spiked over the last two months. “We don’t know how much total stock market leverage there is, but margin loans indicate the trends, and we had another WTF moment,” says Wolf Richter, author of the Wolf Street blog.

“This spike in margin debt over the past few months is another sign that markets have gone nuts, and everyone is chasing everything, regardless of what it is, whether it’s a penny stock with a similar name to something [Tesla Chief Executive] Elon Musk mentioned in a tweet, or whether it’s Tesla’s TSLA,

As the chart shows, spikes in margin debt often precede major stock-market busts.

The good news — for those invested in the market — is that stock market leverage is an accelerator. “When stocks already rise, and investors feel confident, they borrow money to buy more stocks, and they can borrow more against their stocks because their value has risen. And this additional borrowed money is then chasing after stocks and thereby creating more buying pressure, and prices surge further,” Richter writes.

And the inevitable bad news: “Stock market leverage is an accelerator on the way down, when stock prices are already falling and brokers issue margin calls to their clients that then have to sell stocks to remain compliant, triggering a bout of forced selling, and many leveraged investors sell ahead of margin calls in order to avoid being forced into selling at the worst possible moment.”

The buzz

Intel INTC,

Intel rival Advanced Micro Devices AMD,

IBM’s IBM,

Alphabet’s GOOG,

Incoming Biden administration officials have been playing down expectations on getting the COVID-19 pandemic under control with Jeff Zients, the head of the effort, saying, “what we’re inheriting is so much worse than we could have imagined.” The White House said President Joe Biden will be signing executive orders extending federal nutrition programs and clarifying that workers can collect unemployment benefits while refusing to work in unsafe conditions.

The country furthest along in its vaccination efforts, Israel, is still struggling to get the coronavirus cases under control. European-listed airlines including Ryanair Holdings RYAAY,

The economics calendar features existing home sales and the flash readings of purchasing managers indexes. Those PMIs showed conditions in the eurozone and the U.K. deteriorating in January.

The market

U.S. stock futures ES00,

The chart

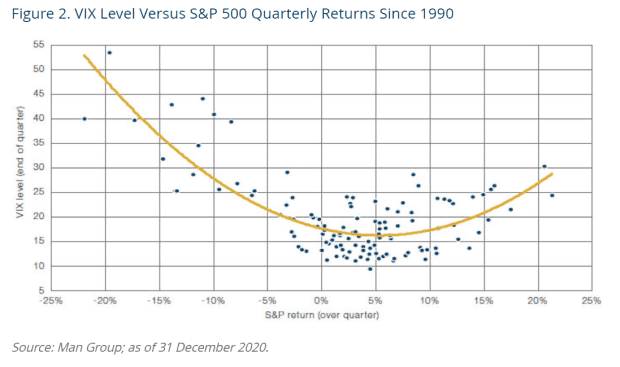

A general rule-of-thumb is that volatility VIX,

The tweet

Check out this “Hamilton”-esque song about Treasury secretary nominee Janet Yellen. Full lyrics are here.

Random reads

Comedian Dave Chappelle contracted coronavirus, days after being seen with talk-show host Joe Rogan, the singer Grimes, and Musk, who previously has had the virus.

Speaking of Musk, the latest SpaceX launch is scheduled for 9:24 a.m. Eastern, weather permitting.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch