Here’s what a ‘blue wave’ forming in Washington means for markets

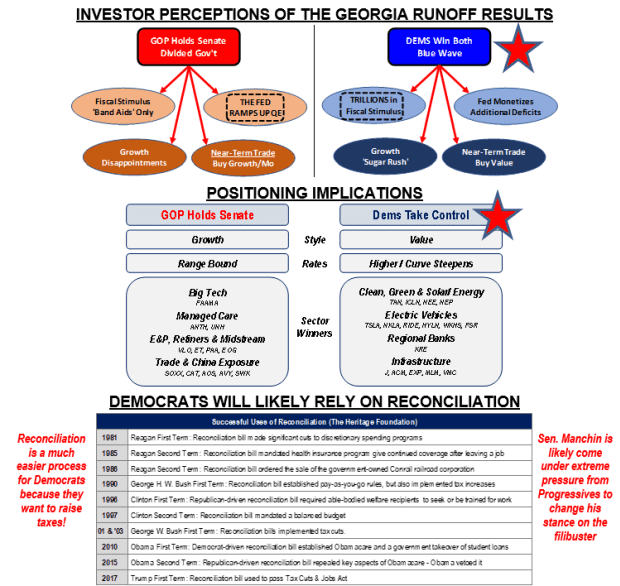

The “blue wave” is back on on Wall Street. Or maybe call it a mini wave, but either way, Democrats look likely to in pole position after key runoff U.S. Senate races in Georgia are tilting away from Republicans, with results already rippling through financial markets.

The Associated Press declared Democrat Raphael Warnock the winner over Republican Sen. Kelly Loeffler in one contest while, Democrat Jon Ossoff was leading Republican Sen. David Perdue in a second Senate runoff.

Democratic wins in both races would create a 50-50 Senate, giving Democrats control, as Vice President-elect Kamala Harris would break tied votes, and offer President-elect a clearer, but not unimpeded, runway to enacting legislative changes including hiking taxes on individuals and corporations and rolling out additional fiscal stimulus in the face of the COVID-19 pandemic.

Here’s how the markets are reacting to prospects of a thin Democratic majority, that some people are referring to as a blue wave or a mini wave.

Bond yields

U.S. bond yields are rising, with the 10-year Treasury breaking a barrier at 1% for the first time since around March, with fixed-income investors betting that Democratic-led initiatives will result in more debt and resulting in yields riding higher, at least in the short term.

Rising bond yields have knock-on effects in the broader markets also, making borrowing costs more expensive and raising the discount rate used to measure the value of equities versus bonds.

Broader market

The team at Wolfe Research, including Chris Senyek, chief investment strategist, are making the case that value stocks will prosper over growth names as the economy recovers.

However, they are expecting the rotation, unlike back in November, to be much faster, perhaps, because stocks already made considerably moves in this direction in the last few weeks of 2020.

Bank stocks

Major bank shares were seeing a bounce in pre-market action amid the rising bond yields and steepening of the yield curve, which is good for the business models of financial institutions.

Shares of JPMorgan Chase & Co. JPM,

Large-cap technology

Shares of U.S. technology giants tumbled in premarket action, with shares of Netflix NFLX,

The tech sector is suffering at least partly because bond yields are rising, delivering a hit to comparative value of those investments, but higher yields also can put a damper on corporate investments for capital-intensive technology firms.

Solar shares shine

Solar-related investments looked to jump on Wednesday because President-elect Biden ran on a platform for a clean energy revolution, which could be made easier to enact if Democrats win both Georgia Senate seats, as seems likely.

One of the president-elect’s plans is to invest over $400 billion into the clean energy industry over the next 10 years.

On Wednesday, shares of one popular exchange-traded fund, Invesco Solar ETF TAN,

Shares of companies like solar-panel installer Sunrun RUN,

Electric-vehicles get a jolt

Biden’s green initiative was also buoying companies like electric-vehicle maker Tesla Inc. The Palo Alto-based company’s shares were up nearly 4% in premarket, while those for China competitors Nio Inc. NIO,

Cannabis stocks

Democrats are expected to pursue a more cannabis friendly reform agenda under President-elect Joe Biden and Vice President-elect Kamala Harris, who have been more supportive of opening the banking sector and other needed services to the industry, which has been hampered by the tricky regulatory backdrop that has allowed the black market to continue to flourish.

The ETFMG Alternative Harvest ETF MJ,

Small-cap stocks

The small-capitalization Russell 2000 index RUT,

Investors are also likely to favor value-oriented investments that have lagged behind in performance compared to the tech-centric, growthy stocks that tend to populate the Nasdaq Composite.