SEC ‘Monitoring’ GameStop Frenzy as Warren Pressures Regulators

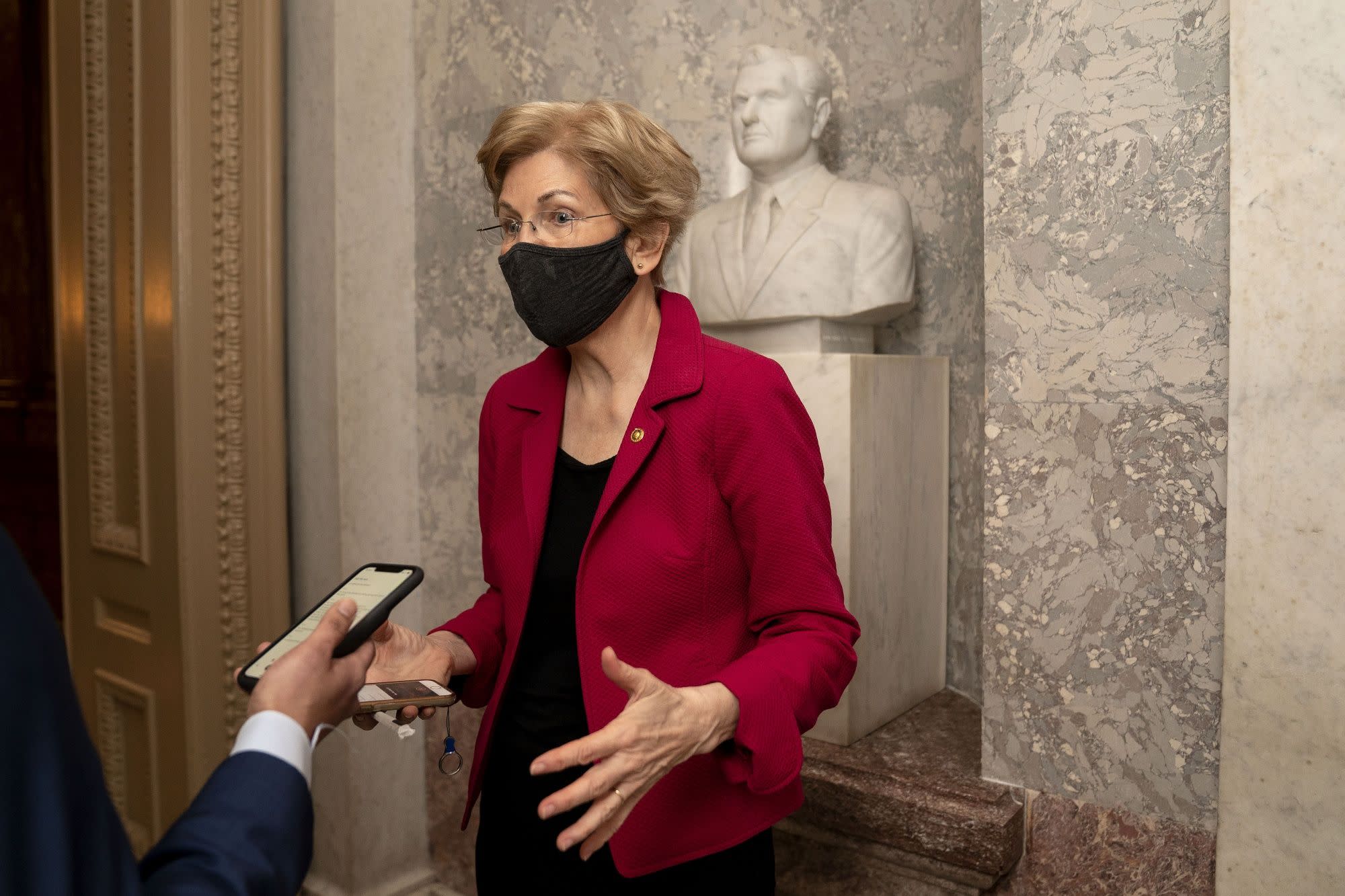

(Bloomberg) — The U.S. Securities and Exchange Commission said it is “actively monitoring” volatility in options and equities markets amid a surge in GameStop Corp. and other companies over the past week that prompted Democratic Senator Elizabeth Warren to demand action from regulators.

“Consistent with our mission to protect investors and maintain fair, orderly, and efficient markets, we are working with our fellow regulators to assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants,” the SEC said in a statement Wednesday.

Retail investors have rapidly driven up GameStop’s shares in recent days, squeezing hedge funds with large short positions in the company, in a twist that has grabbed attention on Wall Street and in Washington.

Shares in the video-game retailer more than doubled on Wednesday, triggering at least two volatility halts as it at one point notched its biggest-ever intraday advance. GameStop has surged eightfold in the past week, adding almost $20 billion to its market value.

The moves led Warren to pressure financial regulators to crack down on Wall Street, citing the frenzied activity.

In a sharply worded statement earlier Wednesday, the Massachusetts Democrat and longtime corporate foe expressed astonishment at the rally while also criticizing hedge funds and others with short positions in company.

‘Personal Casino’

“For years, the same hedge funds, private equity firms, and wealthy investors dismayed by the GameStop trades have treated the stock market like their own personal casino while everyone else pays the price,” Warren said. “It’s long past time for the SEC and other financial regulators to wake up and do their jobs — and with a new administration and Democrats running Congress, I intend to make sure they do.”

Warren’s comments came after White House Press Secretary Jen Psaki said that Treasury Secretary Janet Yellen and Biden’s economic team were watching stock market activity around GameStop and other heavily shorted companies.

“Our team is of course — our economic team including Secretary Yellen and others — are monitoring the situation,” Psaki told reporters at the White House on Wednesday. She called the trading in the video-game retailer “a good reminder, though, that the stock market isn’t the only measure of the health of our economy.”

A Treasury Department spokesperson declined to comment. Federal Reserve Chairman Jerome Powell also declined to weigh in on the activity around GameStop.

“I don’t want to comment on a particular company or day’s market activity or things like that. It’s just not something really that I would typically comment on,” he told reporters at a Wednesday afternoon news conference.

Read More: GameStop Rally Hits New Extremes as Short Sellers Surrender

GameStop’s meteoric rise has captivated Wall Street, as an army of small traders spurred on by Reddit posts have pushed the company’s stock price to unheard-of levels. Shares in the company began the year at just $19. Hedge funds that held short positions in GameStop, such as Melvin Capital, have closed out of them as the rally continued, suffering billions of dollars in losses.

Representative Alexandria Ocasio-Cortez, a New York Democrat, said in a tweet that Wall Street and those posting online have taken a similar approach to the economy and markets.

“Gotta admit it’s really something to see Wall Streeters with a long history of treating our economy as a casino complain about a message board of posters also treating the market as a casino,” she wrote.

While some commentators have cast the frenzy as a populist uprising against Wall Street institutions, others see a dangerous play that could eventually leave investors exposed to major losses. Some wondered if it was the result of purposeful market manipulation.

Earlier: Michael Burry Calls GameStop Rally ‘Unnatural, Insane’

Investor Michael Burry, who previously championed GameStop in 2019, called the current phenomenon “unnatural, insane and dangerous.”

“What is going on now — there should be legal and regulatory repercussions,” tweeted Burry, who made his name for his bet against mortgage-backed securities before the 2008 financial crisis.

Burry’s tweet tagged the SEC’s Division of Enforcement.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.