A perfect storm is brewing for interest rates to surge, says this bond expert

Chatter of a taper tantrum has tailed off, after the big move at the start of the year in the 10-year Treasury.

But the factors that led to that brief selloff in Treasurys are very much still at hand. Chief among them are the rollout of COVID-19 vaccines as well as the huge fiscal stimulus already enacted with more in the pipeline, the pent-up spending power in household savings, and easy monetary policy.

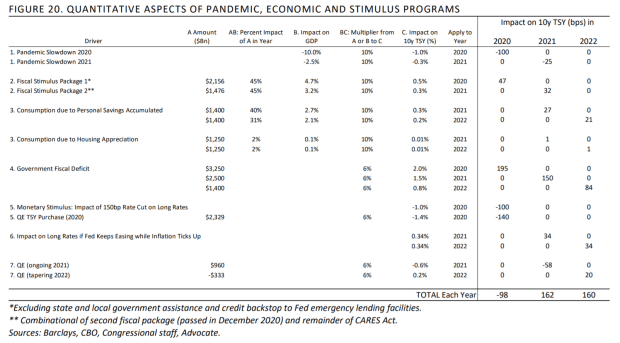

Scott Peng, the founder and chief investment officer of New York investment manager Advocate Capital Management, says a perfect storm is being unleashed. His model estimates the 10-year Treasury yield TMUBMUSD10Y,

Peng, previously Citi’s chief interest-rate strategist and one of the first to spot pricing anomalies in Libor, says his model doesn’t even include any additional fiscal stimulus from the Biden administration, which has proposed a $1.9 trillion coronavirus relief plan as well as additional infrastructure spending.

Central to his view of a surge in interest rates is the historical correlation between nominal gross domestic product growth with both short- and long-term interest rates in the U.S., U.K., Germany and Japan. Long-term regression reflects a 50% ratio between GDP growth and the Treasury yield since 1960, though more recent history suggests the ratio may have declined to 27%.

Even that lower level of correlation would suggest the vaccine rollout, pent-up spending power, surge in government debt, and monetary stimulus would send yields higher.

Wouldn’t such a rise in rates raise alarm bells at the Federal Reserve? Peng calculates that the Fed would have to quadruple the size of its quantitative easing to offset the projected 2021 rise in rates. “A $300 billion per month QE pace would exceed the 2020 QE and is unlikely to be sustainable for any extended period, especially if the economy is recovering well,” he says.

Peng didn’t extend his analysis to stocks, but the implications would be straightforward. A spike in yields would make relative valuations far more unattractive — though it could create conditions for value stocks to thrive after a decade of underperformance.

The buzz

GameStop GME,

Online retail giant Amazon AMZN,

Alphabet GOOGL,

There is a raft of earnings on deck, including payment service PayPal PYPL,

On the coronavirus front, pharmaceutical GlaxoSmithKline GSK,

The economics calendar includes the ADP estimate of private-sector payrolls, and the Institute for Supply Management’s services index. A measure of China’s services sector came in below estimates.

The markets

The Nasdaq-100 NQ00,

Italian stocks I945,

The chart

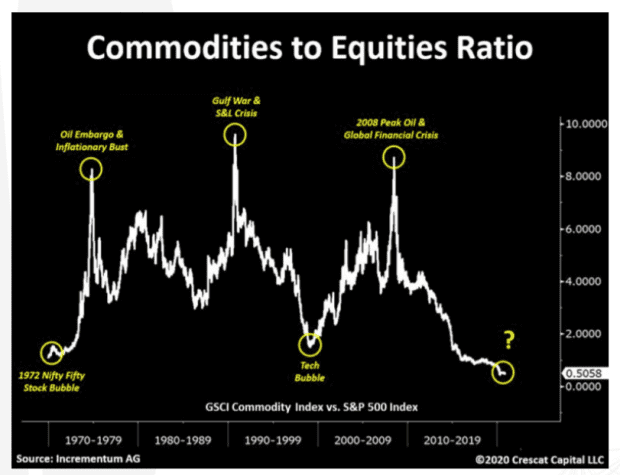

In a letter to investors, hedge fund firm Crescat Capital said the stage is set for a massive investor shift out of overvalued megacap growth funds and fixed income securities, and into undervalued materials, energy and other commodities. It said if it could only focus on one chart for the next three to five years, it would be of the commodities-to-equities ratio. “The opportunity for buying gold stocks and selling overvalued large cap growth stocks appears like 1972. In just two years in 1973-74, the S&P 500 SPX,

Random reads

Speaking of Reddit posts — a study finds language use on the platform could predict future relationship breakups.

Sounds like the beginnings of a script for a new Indiana Jones movie — mummies with golden tongues found in Egypt.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.