Are we in a bubble? How founder of world’s largest hedge fund says 2021 stock market stacks up

The stock market is feeling awfully frothy to some investors lately, a fact that has helped to weigh on the market’s bullish sentiment in the past week or so, but a report by Ray Dalio implies that equities aren’t as bubblicious as one might think.

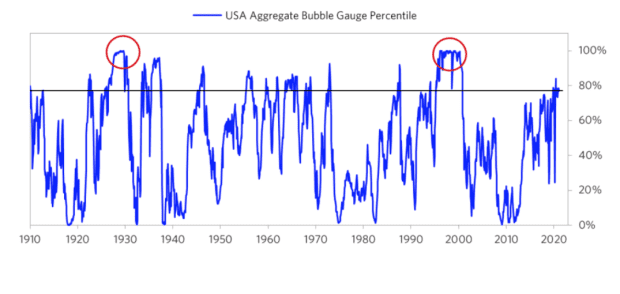

“In brief, the aggregate bubble gauge is around the 77th percentile today for the US stock market overall. In the bubble of 2000 and the bubble of 1929 this aggregate gauge had a 100th percentile read,” wrote Dalio in a blog post published on Monday on LinkedIn.

Dalio is the founder of Bridgewater Associates, the world’s largest hedge-fund firm, which has made him a billionaire and comments consistent attention grabbers.

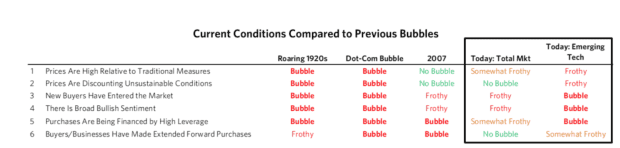

The hedge-fund investor says that he created an indicator to help him determine whether the stock market is in a bubble, which he defines as an unsustainably high price, by using six measures:

- How high are prices relative to traditional measures?

- Are prices discounting unsustainable conditions?

- How many new buyers (i.e., those who weren’t previously in the market) have entered the market?

- How broadly bullish is sentiment?

- Are purchases being financed by high leverage?

- Have buyers made exceptionally extended forward purchases (e.g., built inventory, contracted forward purchases, etc.) to speculate or protect themselves against future price gains?

Based on those factors, and using data that go back to the 1910s, Dalio’s indicator suggests that markets are frothy but not necessarily in a bubble by his definition.

Dalio’s note comes as stock-market investors are wrestling with rising bonds yields, with the 10-year Treasury note TMUBMUSD10Y,

Fiscal spending and market-favorable policies have been factors that investors have argued have kept the Dow Jones Industrial Average DJIA,