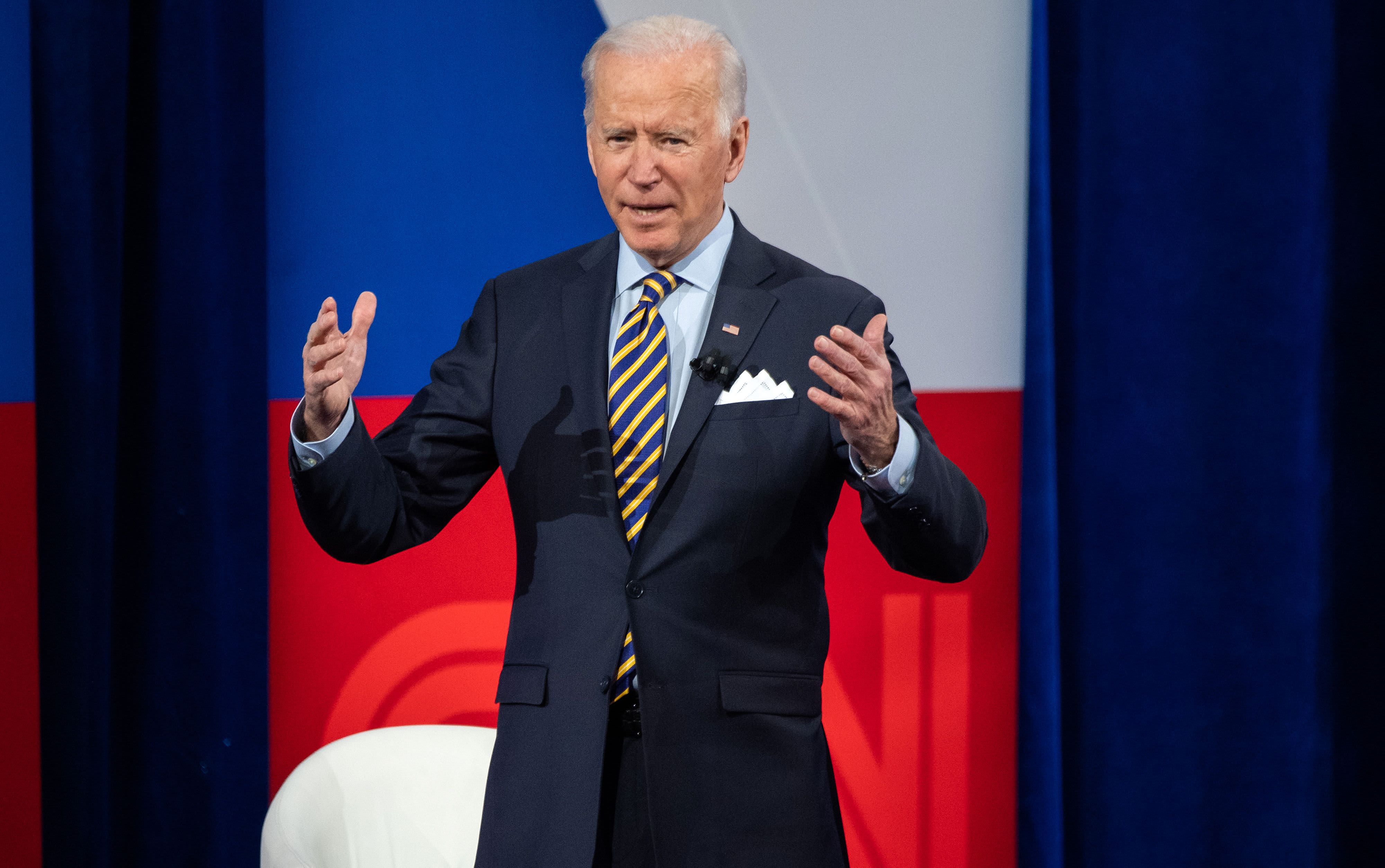

US President Joe Biden participates in a CNN town hall at the Pabst Theater in Milwaukee, Wisconsin, February 16, 2021.

SAUL LOEB | AFP | Getty Images

“We need student loan forgiveness beyond the potential $10,000 your administration has proposed,” Jocelyn Fish, a marketing director for a community theater, told President Joe Biden at CNN’s presidential town hall on Tuesday night. “We need at least a $50,000 minimum. What will you do to make that happen?”

“I will not make that happen,” the president replied.

Biden went on to suggest that it didn’t make sense to use money to forgive the student debt “for people who have gone to Harvard and Yale and Penn” rather than “to provide for early education for young children who come from disadvantaged circumstances.”

The exchange quickly rattled progressives, advocates and student loan borrowers who’ve been calling on Biden to increase the amount of debt forgiveness he supports to $50,000 from $10,000 and to cancel the loans through executive action.

More from Personal Finance:

What different amounts of student loan forgiveness could mean

Student borrowers with private loans get little Covid-era relief

Plan to forgive $50K in student debt would aid 36 million

The president’s statements suggested he still hasn’t come around to a broader student loan forgiveness plan like the ones his progressive rivals in the Democratic primary championed. (Biden has said he favors $10,000 in forgiveness and more for those who attended public colleges and historically black colleges and universities.)

His comments also echoed the arguments from Republicans and some moderate Democrats that student debt forgiveness is a handout to Americans with fancy college degrees.

“If you racked up $100,000 to study poetry at Bowdoin, and then you wind up selling coffee at Starbucks, you may regret some of your choices, and I sympathize with you, but I’m not sure why you’re deserving of a $50,000 check from taxpayers,” said Rick Hess, director of education policy studies at the American Enterprise Institute.

However, advocates say it’s largely a myth that people with student debt — particularly those struggling with it — have the benefit of a prestigious education behind them.

“The vast majority of students who graduate from the elite schools the president mentioned in the CNN town hall graduate with zero student loan debt,” said Eileen Connor, director of litigation at Harvard Law School’s Project on Predatory Student Lending.

Indeed, just 0.3% of federal student borrowers attended Ivy League colleges, according to estimations provided to CNBC by higher education expert Mark Kantrowitz.

“The Ivy League colleges are only eight colleges out of more than 6,000,” Kantrowitz said. “Ivy League colleges also have ‘no loans’ financial aid policies that significantly reduce the percentage of students who borrow.”

And only 12% of student loan borrowers attended very selective colleges and universities, Kantrowitz found. Around a quarter of borrowers are from private, non-profit colleges.

But by far the largest share of borrowers — 49% — came from public colleges.

“Public colleges aren’t cheap,” Kantrowitz said, adding that it still costs more than $22,000 a year to attend one, including tuition, room, board and fees.

Meanwhile, another quarter of borrowers attended for-profit schools, which have come under fire for misleading students about programs and career outcomes, as well as for preying on veterans and people of color. Nearly half of those who take out student loans at these schools end up defaulting.

“Well-off students who attend ‘elite’ schools are not typically struggling,” said Ashley Harrington, federal advocacy director at the Center for Responsible Lending.

“We have to look at what’s really happening with this crisis and who is actually being impacted,” Harrington said. “Student loan debt disproportionately impacts low-income, low-wealth people [and] Black and brown people are struggling the most.”