Bitcoin could hit $250,000 if U.S. companies opt to do this, says Cathie Wood

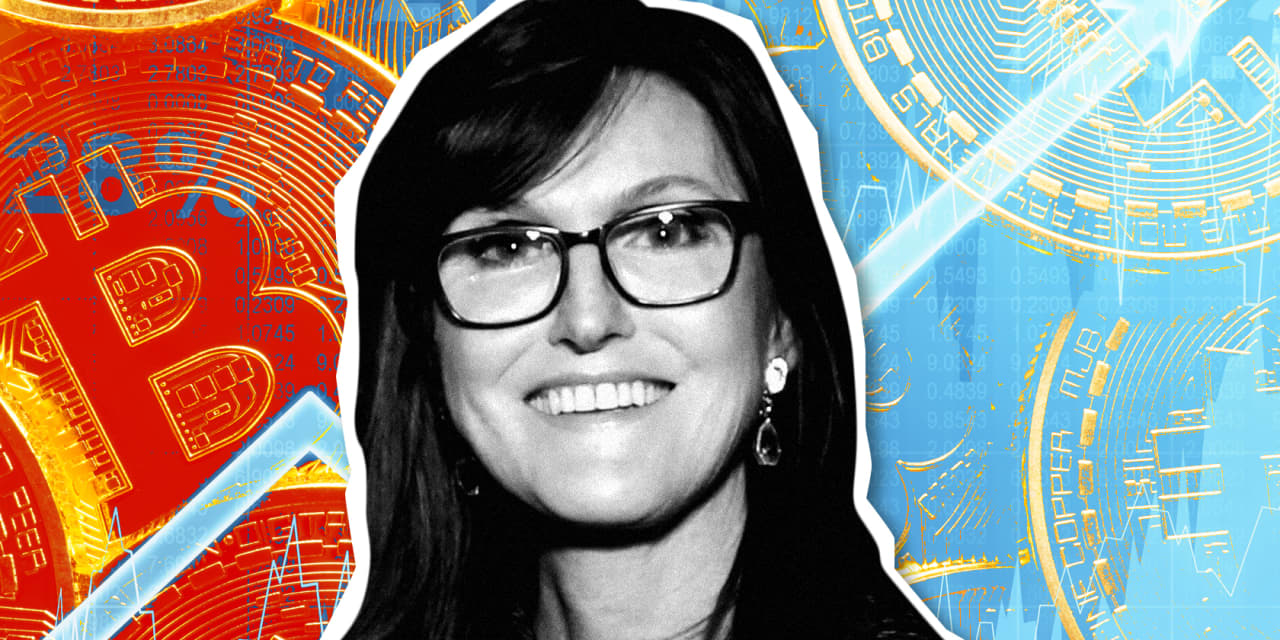

Cathie Wood, the chief executive of ARK Invest and manager of the popular ARK Innovation exchange-traded fund, said that a single bitcoin could be valued at $200,000 more than its current price if more corporations added the cryptocurrency to their balance sheets.

“If all corporations in the U.S. were to put 10% of their cash into bitcoin that alone would add $200,000 to the bitcoin price,” Wood told CNBC on Wednesday.

Wood said that she doubts that such balance-sheet moves by corporations will happen quickly and expects that bitcoin will need to further mature before there is broad-based inclusion. Wood said she was surprised, however, by the current pace of companies incorporating bitcoin in their books.

“We expected institutions to [buy bitcoin] but the way in which it has picked up has surprised us…the substitution of bitcoin for cash on corporate balance sheets,” Wood told CNBC.

“It has to mature a little bit before broad-based adoption can take place,” she said.

Comments from the ARK ETF ARKK,

Read: Why did Tesla buy bitcoin?

For her part, Wood has been viewed as a technophile, with her investments ranging from companies focused on electric vehicles to artificial intelligence, and she has been particularly enthusiastic about cryptos, which ARK gains exposure via Grayscale Bitcoin Trust GBTC,

Wood’s flagship fund has returned about 160% over the past 12 months and grown its assets by more than 10-fold, to $22 billion, FactSet data show. ARK Innovation is now the largest active ETF in the world.

Meanwhile, bitcoin prices were trading up 80% year to date, around a record above $52,000, while the Dow Jones Industrial Average DJIA,