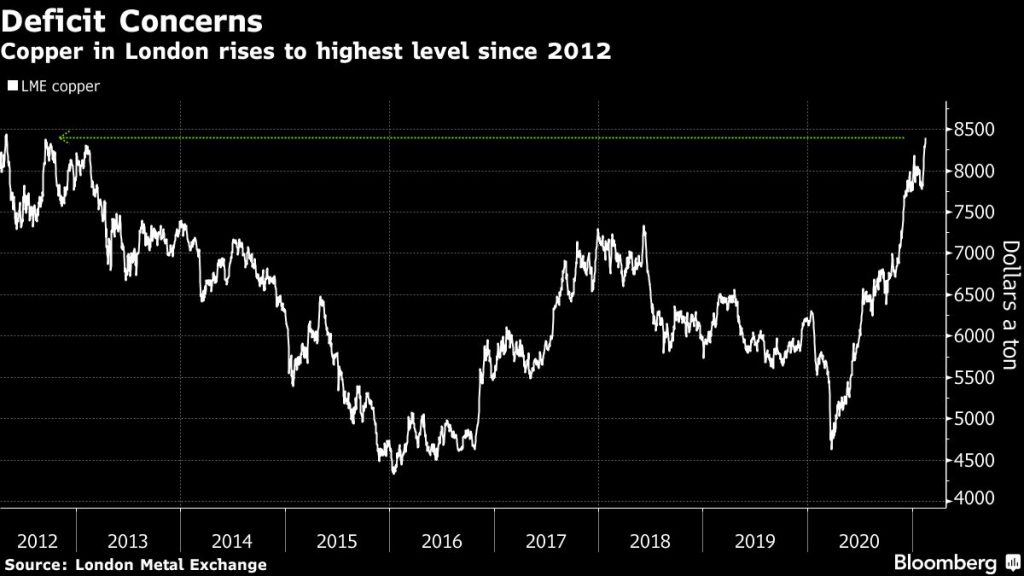

Copper price surges to new 8-year high on supply worries

Copper contracts advanced 1.0% to $3.8265 per pound (about $8,436 per tonne) by noon EST on the Comex. The base metal is on track for its 11th straight monthly gain and is up more than 8.8% since the beginning of the year.

According to Bloomberg Intelligence analysts Grant Sporre and Andrew Cosgrove, assuming their scenario of 5% demand growth is in the ballpark, production guidance from the top 25 copper producers indicates the market may be in a sizable deficit this year.

Aggregated mined supply guidance is more than 400,000 tonnes shy of BI estimates, the analysts said, suggesting a shortfall close to half-a-million tonnes.

Copper is “being driven by a cocktail of positive factors — including rising inflation expectations caused by US stimulus, a falling dollar and historically low stocks,” said Gavin Wendt, a senior resource analyst at MineLife Pty.

“The 2021 copper production outlook is likely to be negatively impacted as a result of covid in a number of major South American producing nations,” Wendt added.

(With files from Bloomberg)