GE has nearly halved its U.S. workforce in 3 years, with more job cuts likely

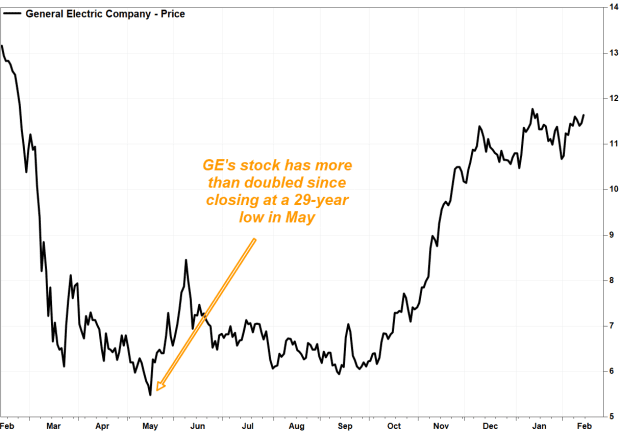

General Electric Co. stock is certainly in recovery mode, as it has more than doubled off its 2020 lows, but part of those gains have come at the expense of the industrial conglomerate’s workforce.

In a 10-K filing with the Securities and Exchange Commission on Friday, GE GE,

Among GE’s business segments, Aviation’s workforce was cut the most, by 23.1% to 40,000 employees, followed by Healthcare, which lost 16.1% of its workforce to 47,000 employees. Elsewhere, Power cut 10.5% of its jobs to 34,000 employees, while Renewable Energy’s workforce was reduced by 7.0% to 40,000 people.

But it isn’t all about COVID, as GE has now cut his total workforce by 139,000 people, or 44.4%, over the past three years.

In the U.S., the number of employees at the end of 2020 fell by 14,000, or 20%, to 56,000 from 70,000 at the end of 2019. And over the past three years, the U.S. workforce has been slashed by 50,000 people, or 47.2%.

GE recorded charges of $856 million in 2020, and roughly $2.6 billion over the past three years, related to workforce reductions, and indicated more job cuts are coming.

“We continue to closely monitor the economic environment and expect to undertake further restructuring actions to more closely align our cost structure with earnings goals,” the company stated in its latest 10-K.

The global and U.S. totals are now at the lowest levels since at least 1993, the last year for which 10-Ks were available on the SEC’s website.

U.S. jobs as a percent of GE’s total workforce dropped to just 32.2% in 2020, down from 53.7% in 2000 and 73.4% in 1993.

At GE’s workforce peak in 1999, there were 340,000 employees worldwide, with 57.9%, or 197,000 employees, in the U.S.

Meanwhile, GE’s stock rallied 1.6% in afternoon trading. It has climbed 7.8% so far this year, after rocketing a quarterly record 73.4% in the fourth quarter.

Since closing at a post-COVID low of $5.49 on May 15, which was the lowest close since December 1991, the stock has now rocketed 112.2%. In comparison, the SPDR Industrial Select Sector exchange-traded fund XLI,

The gains were supported by back-to-back earnings reports in which investors cheered GE’s progress on free cash flow, which surprisingly turned positive in the third quarter, then beat expectations by a wide margin in the fourth quarter.

In conjunction with the release of its 10-K Friday, GE Chief Executive Larry Culp issued a letter to shareholders, in which he praised the “meaningful progress” the company made, and the momentum it has for 2021, in the face of challenges from the COVID-19 pandemic.

“Together with our customers, the GE team kept power flowing, hospitals operating and planes flying,” Culp wrote in the letter.

He also wrote about “Lean,” which he described as a set of principles that emphasizes “customer focus, elimination of waste and ruthless prioritization of work to improve safety, quality, delivery and cost.”