Here’s what could trigger a market accident, says top economist Mohamed El-Erian

Investors in much of the country are waking up to Arctic temperatures and likely power outages, as a massive winter storm rips from the Ohio Valley down to San Antonio.

But it’s warming up on Wall Street, where futures are pointing to a post–Presidents Day rally. For that, we can thank signs of falling U.S. COVID-19 infection rates and a continued push by President Joe Biden’s team to get a $1.9 trillion stimulus package through Congress.

Market Snapshot: Dow carves out fresh record high to kick off trade after Presidents Day

“The only creeping nervousness at present appears to be around the prospects for significant inflation driven by a combination of the emergence from COVID, generous stimulus packages and rising raw materials costs,” said AJ Bell investment director Russ Mould, in a note to clients.

Otherwise, keep buying right? Our call of the day from Mohamed El-Erian, chief economic adviser at Allianz, lays out some pitfalls to this everything rally, along with a warning that investors could trip over a “market accident” if they are not careful.

“Investors are chasing what someone labeled the ‘rational bubble,’ ” El Erian, the president since last year of Queens’ College at the University of Cambridge, told CNN in an interview. While they are fully aware asset prices are high, they expect prices could go even higher thanks to massive central-bank liquidity and prospects of fiscal injections, he said. “Basically, investors feel confident riding what is a massive historical liquidity wave.”

Inflation is a bogeyman here, even if the data say otherwise. “When markets see the price levels go up by more than what the Fed is expecting, they will worry, and already you have seen bond yields on longer-dated securities go up, so there is concern, and you’re starting to see it in the marketplace,” he said.

The yield on the 10-year Treasury note TMUBMUSD10Y,

El-Erian said how the Federal Reserve responds is key and believes it will keep doing its thing, intervening further at the expense of distorted asset prices.

What else could stop that everything rally? A “market accident,” such as one that could have led to contagion a few weeks ago when retail investors and hedge funds clashed over shorted stocks, he said.

“So the first danger in all of this excessive risk taking becomes irresponsible risk taking and you get a market accident. The second risk is the bond market. If you destabilize the bond market, you take away two reasons why people are so keen on stocks. One, this notion there’s no alternative — well if yields go up there is an alternative, second with that low, floored forever, discounted cash flow models signal buy buy buy for equities,” he said.

El-Erian also weighs in on the bitcoin rally and where he sees the danger. It’s not adoption, rather “will the official sector allow this to continue?” But on the private side, he said more companies will probably follow the path of electric-car maker Tesla TSLA,

The markets

Stock futures ES00,

Read: Oil ends Friday’s session higher on Middle East tensions, with global prices up over 5% for the week

The buzz

Large parts of the U.S., are seeing subfreezing temperatures, with utilities ordering blackouts as reserves run low. As well, the storm is causing several states to delay vaccine distributions with deliveries delayed and centers forced to shut for the weather.

As for upbeat news on the pandemic, U.S. daily coronavirus cases dropped below 100,000 on Friday and stayed there on Saturday, though experts remain wary due to fears over spreading variants.

Biden will be in Wisconsin on Tuesday, making a public case for his stimulus plan.

The Empire State manufacturing index hit the highest level in seven months.

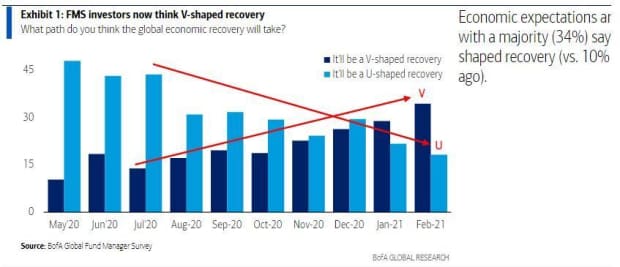

The chart

Hopes for a V-shaped recovery — a quick and sustained bounce — are looking up.

Random reads

Prince Harry and Meghan, Duchess of Sussex, head to Oprah’s couch.

Get your Krispy Kreme Mars doughnut while supplies last.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.