Mesa Air stock soars to pre-COVID highs after BofA double upgrade to buy

Shares of Mesa Air Group Inc. soared to pre-COVID highs, after BofA Securities analyst Andrew Didora swung to bullish from bearish, saying the regional air carrier is well positioned to capitalize on the return to travel.

The stock MESA,

The stock’s rally Wednesday comes while the U.S. Global Jets exchange-traded fund JETS,

Didora raised his rating on Mesa by two notches to buy from underperform, while boosting his stock price target more than sevenfold to $15 from $2.

He said Mesa is a “large beneficiary” of the U.S. government’s support of the airline industry, as it received more than $140 million in grant funds and a $195 million load to refinance higher debt costs.

And with long-term contracts at larger carriers United Airlines Holdings Inc. UAL,

Separately, Didora was also upbeat about Mesa’s recent partnership with United in placing a $1 billion order for all-electric vertical takeoff and landing aircraft (eVTOL) from Archer Aviation Inc.

Archer announced last week it was going public through a merger with special-purpose acquisition company Atlas Crest Investment Corp. ACIC,

Atlas Crest’s stock surged 8.8% in midday trading.

Didora said that investment “gives Mesa equity exposure to a high-growth segment to balance out its more stable regional airline model.”

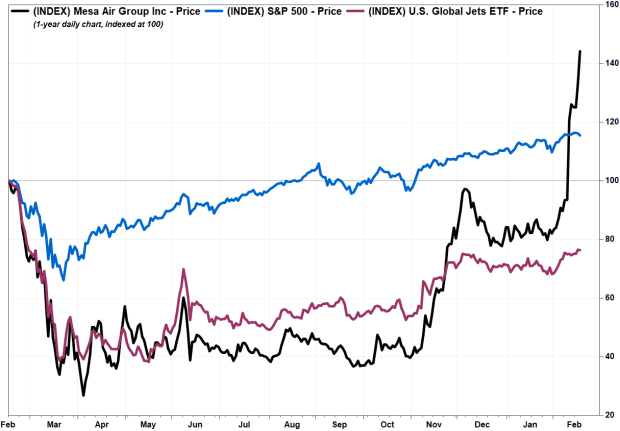

Mesa’s stock has more than doubled (up 127.8%) over the past three months, while the Jets ETF has advanced 15.1% and the S&P 500 has gained 8.3%.