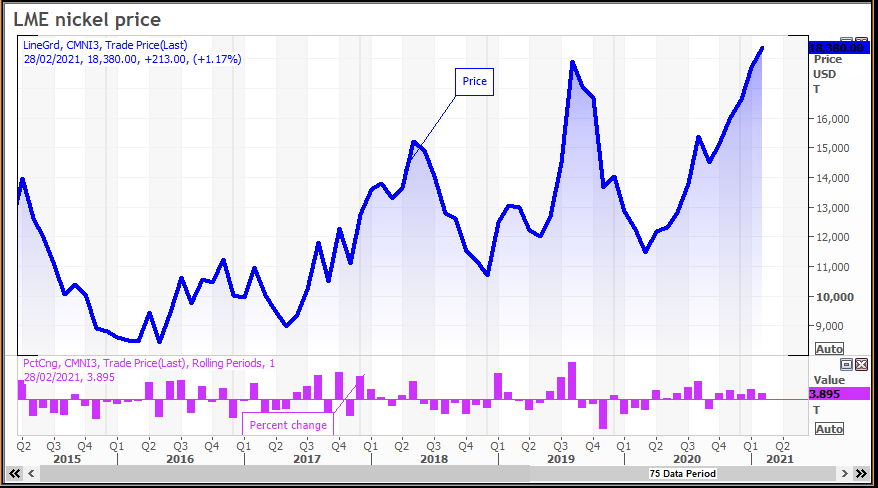

Nickel price at highest since 2014 amid growing EV battery demand

Year-on-year, the contract has gained 30% amid rising demand expectations pertaining to the electric vehicle battery sector, as well as strengthening macroeconomic conditions that led to higher consumption of raw materials for making stainless steel.

Market participants have long been eyeing the $20,000/t threshold for nickel as critical to unlocking fresh supply.

Supply running short

While the nickel market is expected to be in a surplus of around 75,000 tonnes this year, supply would still need to increase by 4% to keep pace with demand, according to Nornickel, the world’s no.2 producer.

According to a report prepared by Roskill on behalf of the European Commission, global nickel demand from the EV sector is expected to reach 2.6 million tonnes in 2040, a significant increase from the 92,000 tonnes last year.

“Automotive electrification is expected to represent the single-largest growth sector for nickel demand over the next twenty years,” the report says.

Demand dynamics

This is also expected to change the market dynamics for nickel, with automotive electrification making an increasingly larger share of the demand.

Nickel pig iron (NPI) producers in Indonesia are also considering converting their nickel products into materials suited for the EV market, namely nickel sulfate.

While import data from China, the top consumer, shows that nickel usage is still being dominated by stainless steel, that may not be the case years down the road.

In fact, this alternative demand stream has started to show up in China’s nickel trade. Imports of nickel sulphate registered the second-highest year-on-year growth by nickel product, up 30% at 5,600 tonnes.