Roku posts surprise profit, gives upbeat outlook

Roku Inc. benefited from improved advertising spending in the fourth quarter while also delivering a surprise profit for the period.

The company on Thursday posted a fourth-quarter profit of $67.3 million, or 49 cents a share, versus a loss of $15.7 million, or 13 cents a share, a year earlier. Analysts surveyed by FactSet were expecting a 5-cent loss per share.

Roku ROKU,

Shares were up 2.8% in after-hours trading Thursday.

Revenue for the fourth quarter increased to $649.9 million from $411 million, while analysts were calling for $619 million. The company generated $178.7 million in revenue from its player business and $471.2 million in revenue from its platform business, which includes licensing and advertising.

“Despite a pandemic-related advertising slowdown in the U.S., our advertising business proved resilient, with Q4 Roku monetized video-advertising impressions more than doubling year-over-year, as advertisers increasingly followed users from traditional pay-TV to streaming,” the company said in its letter to shareholders.

Roku noted in the letter that the six biggest agency holding companies more than doubled their investment with Roku during the fourth quarter relative to a year earlier, “while also committing to significantly larger 2021 upfronts with Roku.”

Roku’s average revenue per user was $28.76, up from $23.14 a year prior.

The company disclosed 51.2 million active accounts as of the fourth quarter after it added a net of 5.2 million accounts on a sequential basis. Roku users streamed 17 billion hours worth of content during the quarter.

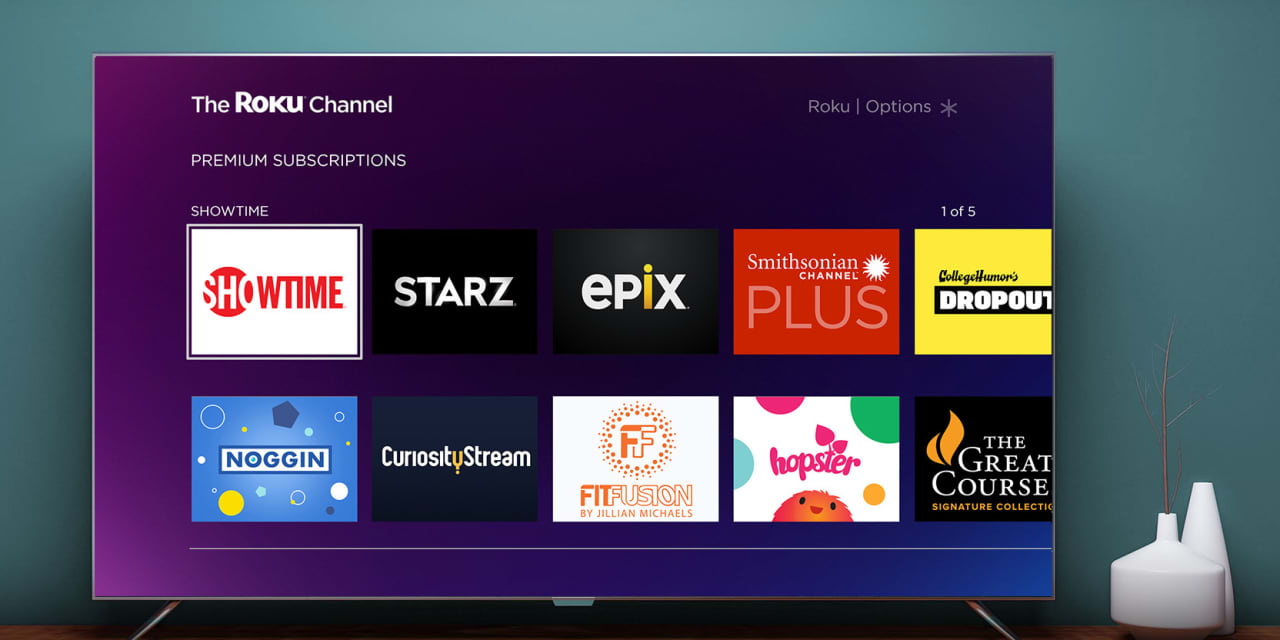

Roku disclosed that The Roku Channel, which aggregates ad-supported content on the platform, more than doubled its reach during the fourth quarter, with its usage growing nearly twice as fast as the overall Roku platform.

The company announced earlier this year that it would be acquiring a catalog of original programming from Quibi, which Roku planned to showcase on The Roku Channel. Chief Financial Officer Steve Louden said on a media call with reporters following Roku’s earnings report that as the scale of the platform grows, the company “will continue to look at different ways to onboard content” in a way that fits with the company’s ad-supported video-on-demand model.

“We just have more options now that we’re bigger,” he continued.

For the first quarter, Roku expects revenue of $478 million to $493 million. The company projects a net loss of $16 million to $23 million. Analysts were predicting $463 million in revenue and a net loss of $52 million.

Looking at the full year, Roku declined to give a quantitative forecast but told investors in its shareholder letter that it expects stronger comparisons in the first half of the year, given COVID-19 impacts in the early part of last year, and tougher comparisons in the second half of the year.

“Thus, for the full year, our overall year-over-year revenue growth will fall below levels we expect to see in the first and second quarters of 2021,” Roku said in the letter.

Shares of Roku have gained 95% over the past three months as the S&P 500 SPX,