Sen. Elizabeth Warren asks Robinhood to explain why it restricted GameStop trades after hedge funds losses

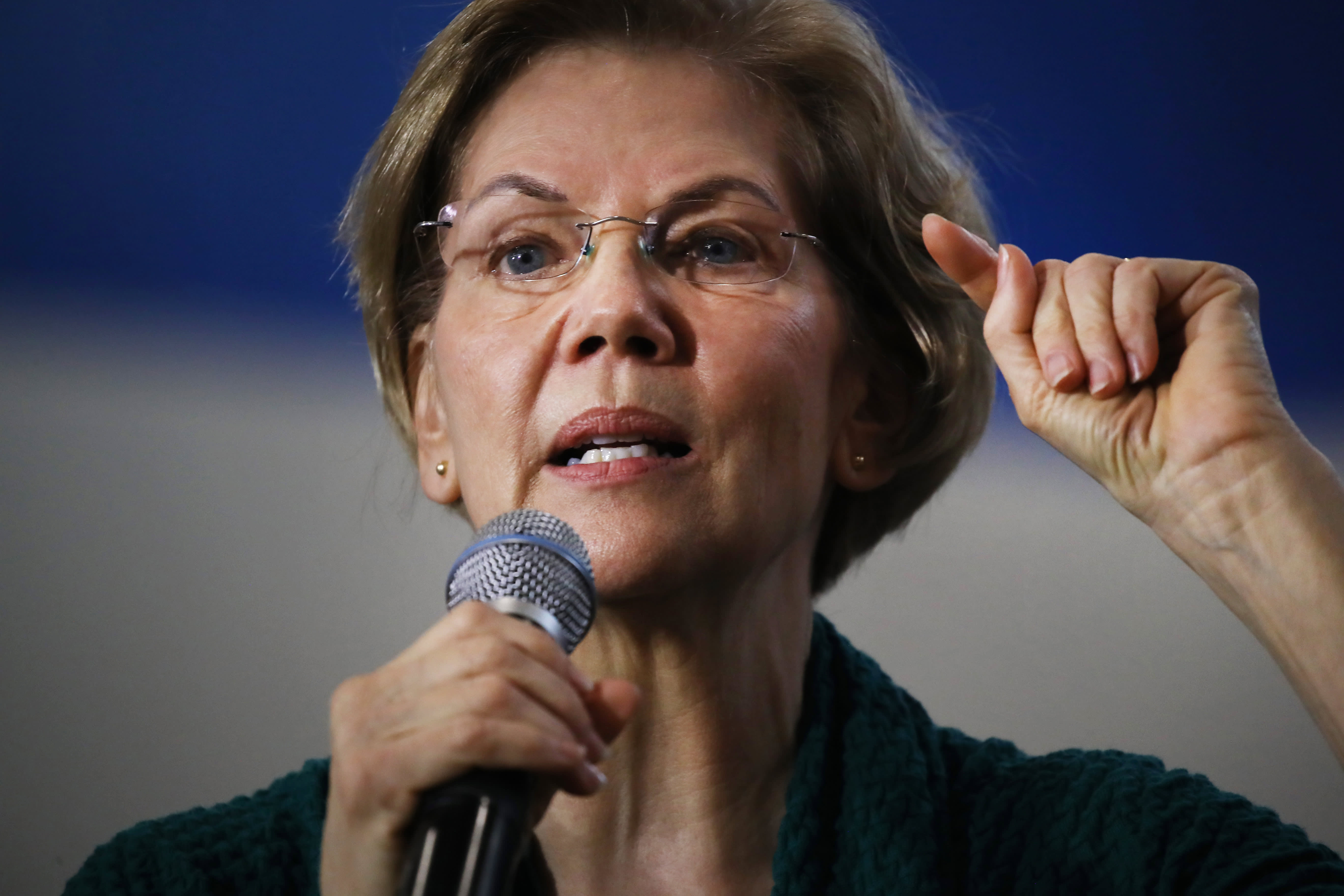

Democratic presidential candidate Sen. Elizabeth Warren (D-MA) speaks during a town hall event at Weeks Middle School on January 19, 2020 in Des Moines, Iowa.

Spencer Platt | Getty Images

Sen. Elizabeth Warren on Tuesday asked Robinhood in a letter to explain why it restricted trading in red-hot shares of GameStop after hedge funds suffered huge losses in a short squeeze.

Warren, D-Mass., noted that the online brokerage last week abruptly changed trading rules for individual investors in certain stocks on its no-fee platform, while hedge funds and Wall Street institutional investors were allowed to keep trading in GameStop and the other companies.

“Robinhood has a responsibility to treat its investors honestly and fairly, and provide them with access to the market under a transparent and consistent set of rules,” Warren wrote in her letter.

“It is deeply troubling that the company may not be doing so.”

The letter asks Robinhood to disclose what led it to impose tight trading restrictions on Gamestop and other stocks, and whether its hedge fund investors or other financial services partners who had big stakes in such trading affected the app company’s decision.

Robinhood had sharply limited the buying of a handful of stocks, in some cases only allowing customers to buy just a single share. It also hiked margin requirements on certain stocks and options.

“The public deserves a clear accounting of Robinhood’s relationships with large financial firms and the extent to which those relationships may be undermining its obligations to its customers,” Warren wrote.

Many individual traders and politicians on both sides of the aisle have criticized Robinhood’s decision to restrict buying in certain stocks like GameStop that are at the center of the controversy.

Last week’s heavy trading volumes put pressure on online brokerages like Robinhood, which are required to pay customers cash when they close a position.

The brokerages also needed additional cash to supply their clearing facility with additional capital to protect trading partners from outsized losses.