Treasury yields climb as investors watch for stimulus progress

U.S. Treasury yields rose on Tuesday morning, after Democratic congressional leaders pushed forward with the first step to getting a coronavirus relief package passed without Republican support.

The yield on the benchmark 10-year Treasury note climbed to 1.095% at 3:45 a.m. ET, while the yield on the 30-year Treasury bond advanced to 1.871%. Yields move inversely to prices.

U.S. government bonds yields moved higher early on Tuesday, after Senate Majority Leader Chuck Schumer and House Speaker Nancy Pelosi introduced a budget resolution on Monday.

This is the initial step toward using the reconciliation process that requires only a majority vote in Congress to pass.

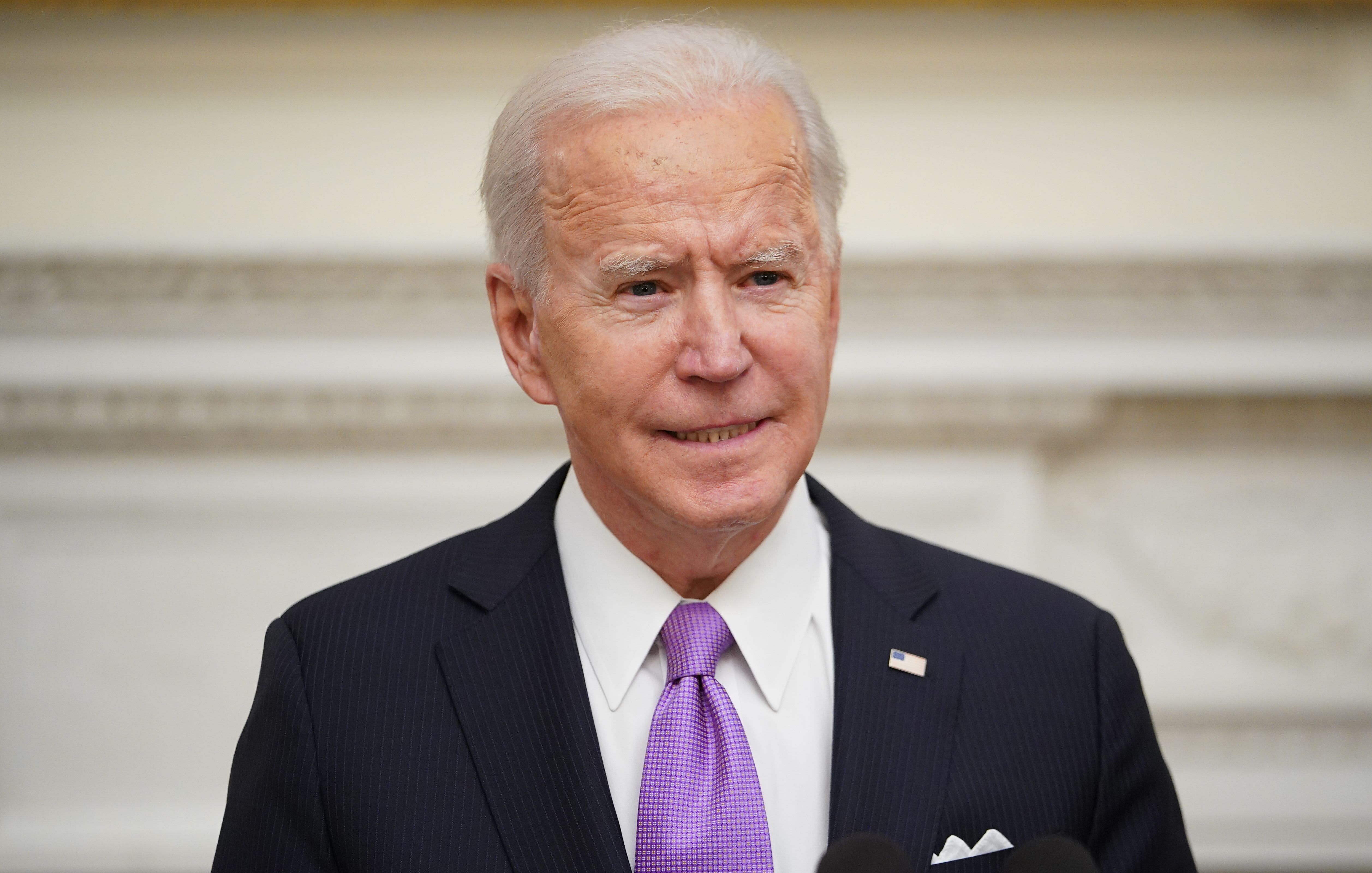

Meanwhile, President Joe Biden met with the 10 Republican senators on Monday that wrote to him over the weekend to put forward their alternative, smaller aid proposal to his $1.9 trillion package.

Senator Susan Collins said the meeting was “productive” and “cordial.”

February data out of the IBD/TIPP economic optimism index, which gauges consumer confidence each month, is due out at 10 a.m. ET.

John Williams, president of the Federal Reserve Bank of New York, is expected to make a speech at 2 p.m. ET, along with Cleveland Fed President Loretta Mester.

Weekly API crude oil stock change data will come out at 4:30 p.m. ET.

Data for total vehicle sales in the U.S. in January is expected to be released at 7 p.m. ET.

Auctions will be held Tuesday for $30 billion of 119-day bills and $30 billion of 42-day bills.

— CNBC’s Jacob Pramuk contributed to this report.