25 small-cap stocks that analysts expect to rise as much as 64% over the next year

Small-cap stocks have been rebounding as expectations grow for the post-pandemic economy.

Many may choose to ride that trend with large ETFs like the $68 billion iShares Russell 2000 ETF IWM,

But which make the most sense for stock pickers? The following screen emphasizes expected revenue increases and Wall Street analysts’ aggressive price targets.

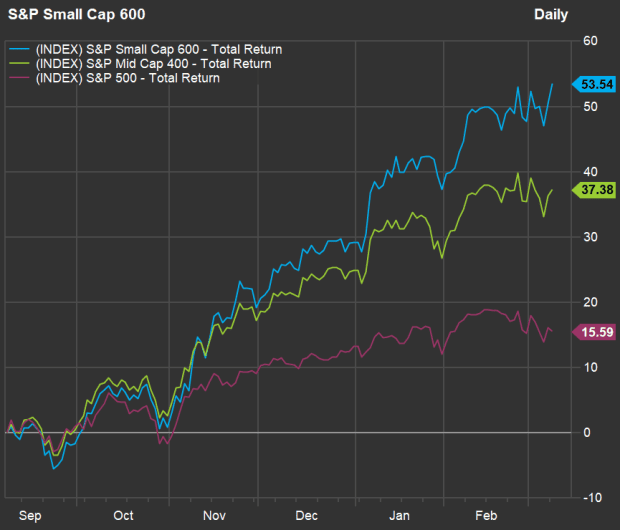

For starters, check out how well the S&P Small Cap 600 Index SML,

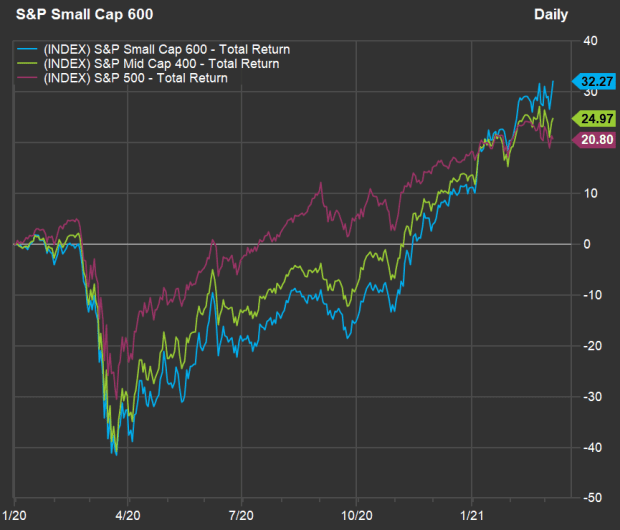

The small-cap fires are raging. If we look further back to the end of 2019, we can see how much worse the small-caps performed during the COVID-19 downturn in February and March 2020, when compared to the large-caps:

Small-cap companies tend to be much more domestically focused than large-caps. They may also be in industries that have been harshly affected by the pandemic, setting up rebound plays as sales recover. So the following list not only looks ahead over the next 12 months with analysts price targets but also takes sales estimates out through 2023.

Among the component of the S&P 500 index, there are 25 stocks that meet these criteria:

- Covered by at least five Wall Street analysts polled by FactSet.

- Majority “buy” or equivalent ratings among the analysts.

- Consensus revenue estimates available through calendar 2023.

- Expected three-year compounded annual growth rates (CAGR) for revenue of at least 15%.

The expected revenue growth rates will be of interest to longer-term investors. Other investors might be most interested in how well analysts expect the stocks to perform over the next year. So the list is ranked by implied 12-month upside potential based on consensus price targets:

Scroll the table to see the expected sales growth rates and stock price targets.

The table only shows percentages of “buy” ratings because none of the stocks on the list have any “sell” ratings among analysts polled by FactSet, except for U.S. Silica Holdings Inc. SLCA,

The stock with the most aggressive consensus price target is Cohu Inc. COHU,

Shares of Rent-A-Center Inc. RCII,

The company that analysts expect to boost revenue the fastest through 2023 is Innovative Industrial Properties Inc. IIPR,

Don’t miss: These energy stocks could yield big gains while you’re getting paid high dividends