Alternative financing remains underpenetrated avenue for miners – report

The report suggests there exists potential for the mining sector to raise alternative financing allocations. By diversifying the financial portfolio, miners can better maintain long-term-investment plans, ensure stronger balance sheets, and likely see more consistent returns and valuations, the report says.

The success of specialized alternative investment firms suggests that there are significant benefits for investors, McKinsey notes. For example, the major streamers have experienced 13% annual growth in earnings before interest, taxes, depreciation, and amortization (EBITDA) since 2014.

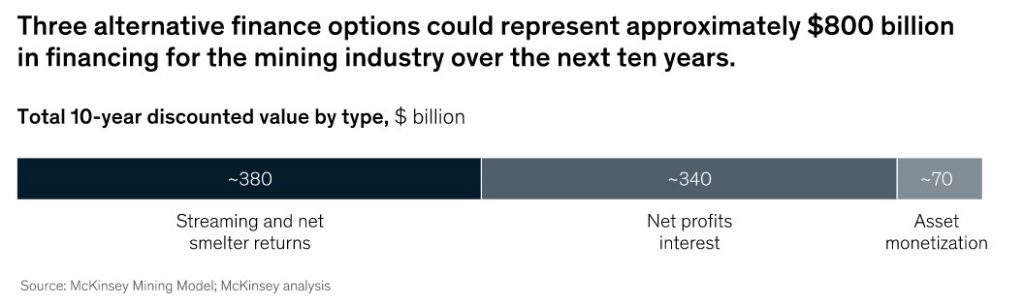

But there is also significant potential benefit for mining companies, McKinsey adds. “Using publicly available data, we estimate that the total alternative financing potential in mining is as much as $800 billion over the next ten years from three prioritized structures,” it says.

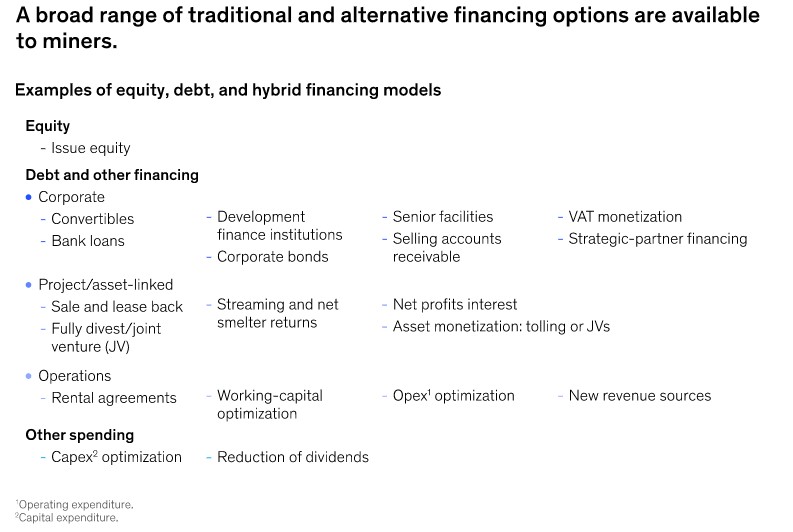

The firm brought up a broad range of alternative financing models available to mines (see chart below).

Of these, three alternative financing options that may be of particular interest were highlighted by the report:

- Streaming and net smelter returns (NSRs)—the sale of all or part of the future production of a mine at a discounted market price, and the sale of a right to a percentage of future revenues of a mine for an up-front payment, respectively.

- Net profits interest (NPI)—the purchase of a fixed percentage of mine profits in return for an up-front payment, typically after capital costs have been paid.

- Asset monetization: tolling or joint ventures (JVs)—the sale of a portion of the value of an existing or new asset in exchange for a revenue stream (toll or dividend).

Overall, the three financing options account for approximately 15% of total financing for the mining industry, McKinsey estimates, but this share is likely to rise as covid-19-related risk increases corporate bond spreads, and as many mining companies (especially juniors) seek alternative financing.

Taking an outside-in view, the firm estimates a potential in total alternative financing of up to $800 billion over the next decade, drawing on ten-year anticipated revenues and spending, as well as potential tolls. This is equivalent to approximately 40% of the industry’s estimated capital investment needs over the period.