Betting on the post-pandemic boom? Bank of America has 17 stock recommendations

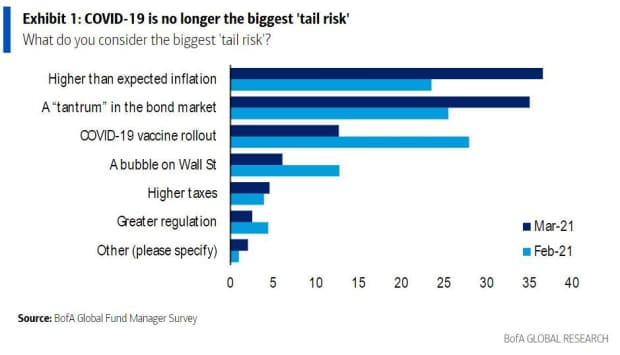

Here’s one possible all-clear signal. COVID-19 is no longer a “tail risk” for investors, the first time since February 2020, says Bank of America in its latest fund manager survey. A tail risk is an unlikely event that could cause outsize losses or gains.

Scroll down for that chart.

Meanwhile, the Federal Reserve’s two-day policy meeting begins on Tuesday, and investors will be on the lookout for any hawkish signals that could take some steam out of stocks. The premarket is showing some mixed action, though many remain stuck into the idea of a post-pandemic boom, at least in the U.S. as vaccinations roll out.

Read: Value stocks are making a comeback. Don’t get left behind, these analysts say

That has kept the records coming for the Dow Jones Industrial Average DJIA,

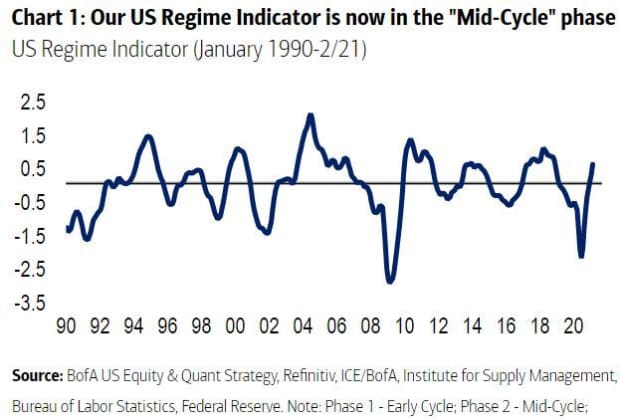

Strategists Jill Carey, Savita Subramanian and Ohsung Kwon say the economy has reached the mid-cycle phase, where inflation typically is strongest. In prior such phases, excluding the technology bubble, small-caps have outperformed larger ones, and value has beaten growth.

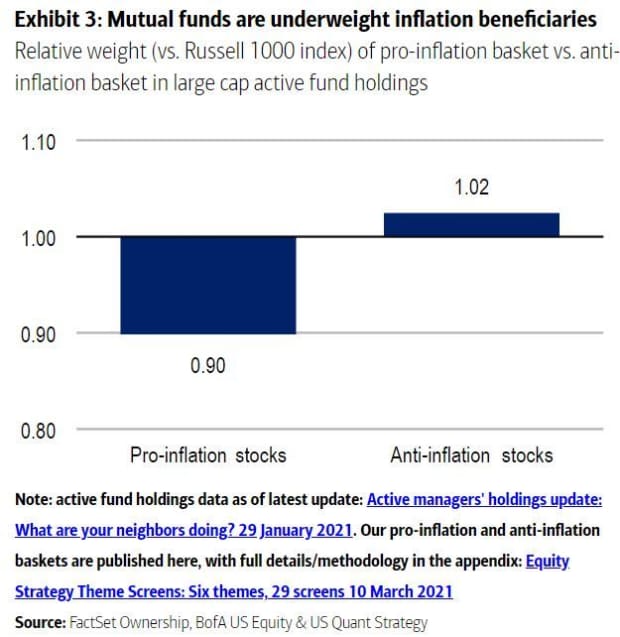

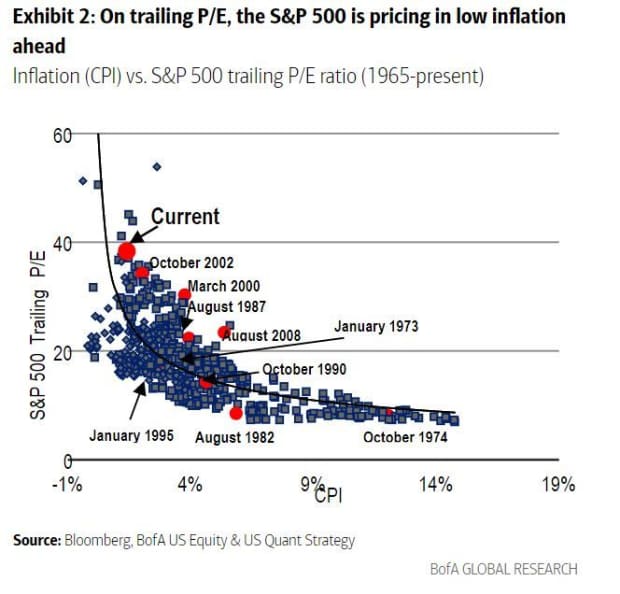

The Bank of America team says there are two reasons to like those stocks: many of the companies they highlight are still not expensive, and active funds aren’t positioning for that rising inflation, with heavier exposure to mega than smaller caps.

Onto the stocks (nearly half are small-to-midcap companies)…

Alcoa AA,

Axalta Coating Systems AXTA,

Broadcom AVGO,

Hess HES,

Marriott International MAR,

Walt Disney DIS,

As for the rest, they like CNH Industrial CNHI,

The chart

Here’s that “tail risk” chart from the latest BofA monthly fund manager survey. Bigger risks are higher-than-expected inflation and a “tantrum” in the bond market.

The markets

Stock futures YM00,

The buzz

Retail sales and import prices are due ahead of the market open, followed by industrial production and a National Association of Home Builders index. Aside from the Fed meeting kickoff, investors will also be watching the outcome of a an auction of 20-year Treasury bonds.

Ray Dalio, the founder of Bridgewater, the world’s biggest hedge fund firm, declares investing in bonds as “stupid” and investors should stick to a “well-diversified portfolio.”

AstraZeneca AZN,

Finnish telecoms group Nokia NOKIA,

A team from the U.S. government’s highway safety agency is headed to Detroit to investigate a “violent” crash after a Tesla TSLA,

Random reads

Office nostalgia — Redditers swap coworkers-from-hell stories.

When a hacker gets all your texts for $16.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.