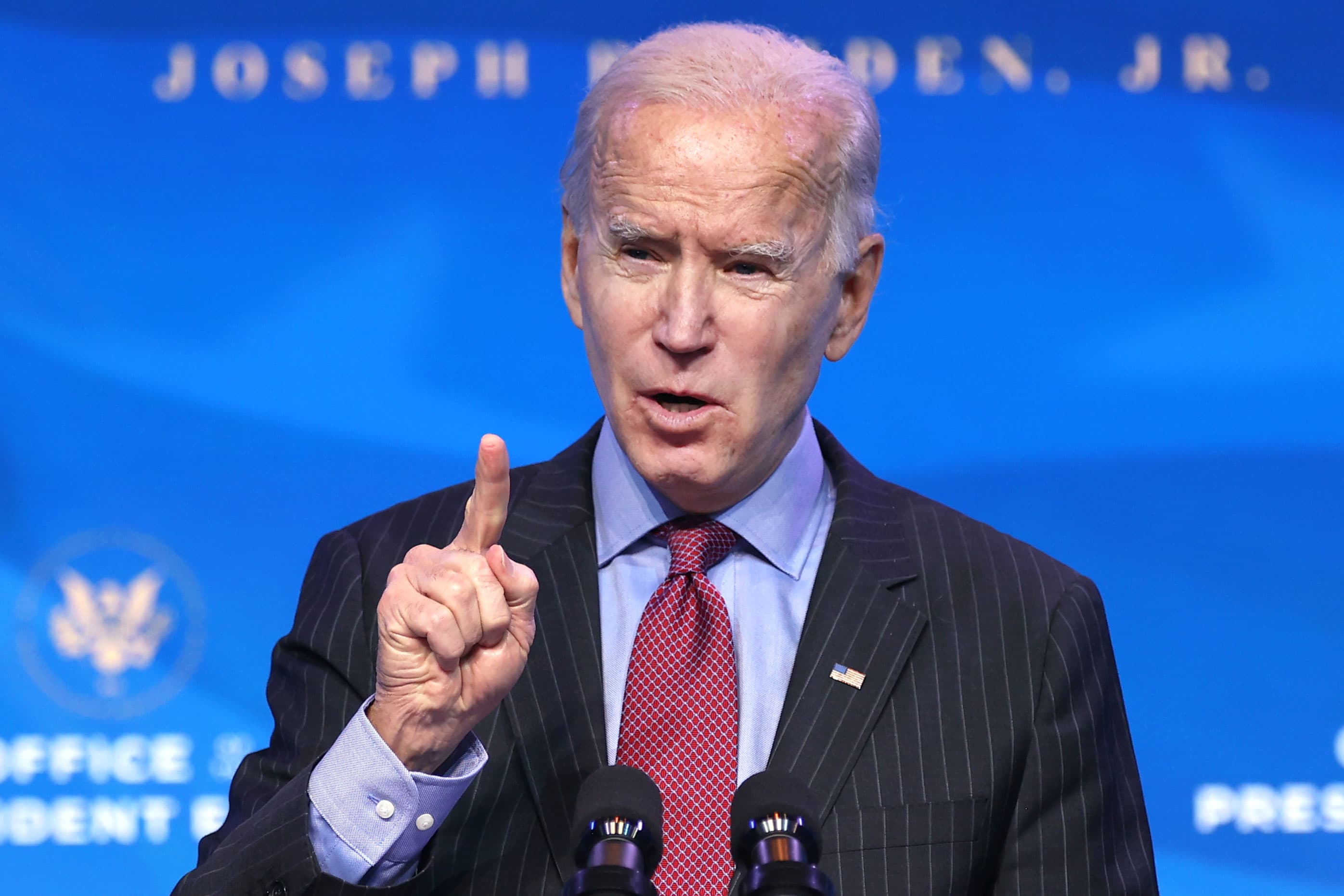

Biden targets global corporations to fund landmark infrastructure plan

The Biden administration will attempt to generate $2 trillion over 15 years to help fund a once-in-a-generation infrastructure plan through stricter corporate tax policies and a crackdown on offshoring.

As part of the landmark infrastructure plan, President Joe Biden will on Wednesday propose a tax strategy that would increase the U.S. corporate tax rate to 28% from 21% in what would amount to a partial rollback of former President Donald Trump’s 2017 tax cuts.

Biden’s plan, if adopted, would also make it harder for multinational companies to qualify for federal tax deductions based on tax payments to certain foreign governments. Biden is scheduled unveil his infrastructure plan at 4:20 p.m. ET in Pittsburgh, the birthplace of his 2020 presidential campaign.

The administration said that it would try to work with other nations to halt a global “race to the bottom” on corporate tax rates that allows countries to gain a competitive advantage by attracting businesses with lower duties. That would allow the U.S. to hike its corporate rate to the proposed 28% without a broad exodus to countries with more competitive rates.

Barring collaboration with other countries, a corporate tax rate of 28% would put the U.S. toward the higher end of the global corporate tax rate spectrum among major economies.

These proposed tax plans are designed to stop “unfair and wasteful profit shifting to tax havens, and ensures that large corporations are paying their fair share,” the White House said in a fact sheet released Wednesday.

Reception of the Biden was mixed, with fans of a more progressive tax code lauding the plan.

“The President has rightfully proposed to begin dismantling the nation’s rigged corporate tax system, which for too long has allowed huge corporations to dodge paying their fair share of taxes and encouraged offshoring of jobs and profits,” Frank Clemente, executive director of left-leaning Americans for Tax Fairness, said in a press release.

Though administration officials including Treasury Secretary Janet Yellen have repeatedly said any tax increases would be introduced gradually, Biden’s strategies to generate revenues are key to an infrastructure plan many Democrats campaigned on last year.

The president’s proposal would put $621 billion into transportation infrastructure like bridges, roads, public transit, airports and electric vehicle development. It would also include $300 billion for improving drinking water and $300 billion for building and retrofitting affordable housing.

Lobbying groups favorable to industry interests, as well the vast majority of the Republican caucus on Capitol Hill, are deeply skeptical of Biden’s plan in part because of their former enthusiasm for Trump’s tax cuts just over three years ago. The corporate tax rate at the time was 35%.

Senate Minority Leader Mitch McConnell, R-Ky, told reporters in on Wednesday that if the Biden plan is “going to have massive tax increases and trillions more added to the national debt, it’s not likely” he would support it.

The U.S. Chamber of Commerce deemed the current initiative ill-advised and dangerous for an economy only just gaining momentum after the Covid-19 pandemic triggered a recession one year ago.

“We believe the proposal is dangerously misguided when it comes to how to pay for infrastructure,” the Chamber said in a release on Wednesday. “We strongly oppose the general tax increases proposed by the administration which will slow the economic recovery and make the U.S. less competitive globally.”

Critical to Biden’s “Made in America” tax plan will be efforts to discourage the offshoring of jobs and profits by strengthening the global minimum tax for multinational corporations.

Historically, incentives in the U.S. tax code incentivizes companies to invest and create jobs overseas. Democrats have for years pushed to close loopholes that allow U.S. firms to avoid federal taxes by reporting a significant portion of their total profits in havens such as Bermuda and the Cayman Islands.

The White House wants to increase the minimum tax on U.S. corporations to 21%, up from 10.5% that Trump’s 2017 introduced. Biden would require companies to calculate that tax on a country-by-country basis “so it hits profits in tax havens.”

The plan would change a provision that lets companies exclude 10% of their tangible foreign assets from the calculation of the base of the minimum tax. Democrats argue that the existing provision rewards companies to locate factories abroad, though it’s unclear how large a role the provision plays in companies’ capital investments overseas.

The infrastructure plan does not include any of the headline income tax increases Biden promised during his campaign. The proposal leaves out raises to taxes on top earners’ individual income, capital gains, estates and noncorporate businesses.