Biggest Bitcoin Fund’s Woes Worsen as Discount Hits Record

(Bloomberg) — Bitcoin’s worst selloff since December is dealing a particularly harsh blow to the biggest fund tracking the cryptocurrency.

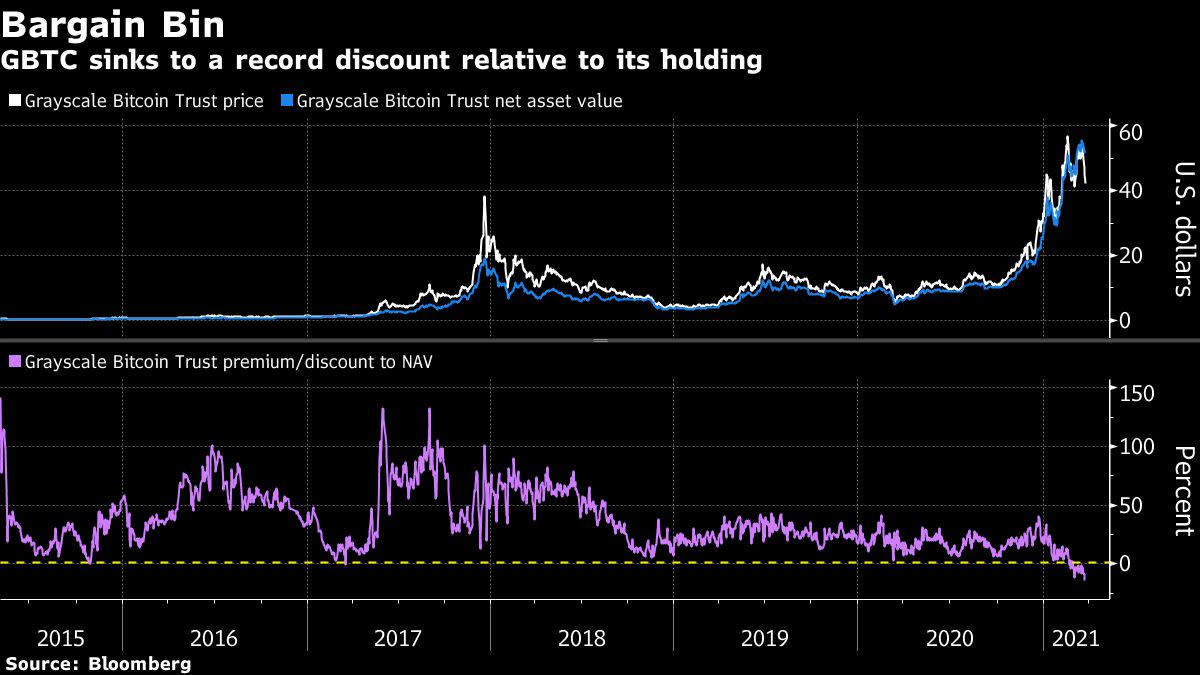

The $29.4 billion Grayscale Bitcoin Trust (ticker GBTC) has dropped about 20% so far this week, nearly double the decline in the world’s largest cryptocurrency. GBTC closed over 14% below the value of its underlying holdings on Wednesday as a result — a record discount, according to data compiled by Bloomberg. The dislocation has deepened despite Grayscale Investment LLC parent Digital Currency Group Inc.’s plans to purchase up to $250 million worth of GBTC shares.

The GBTC free-fall highlights the extent to which the latest leg of the retail-driven crypto craze is cooling. The trust has persistently traded at a premium to its net asset value since launching, with investors willing to pay up for a piece of Bitcoin as it rockets higher. However, given that GBTC doesn’t allow redemptions — meaning that trust shares can only be created, not destroyed like in conventional funds — the number of shares outstanding has ballooned to a record 692 million. With Bitcoin’s price now stalling, that’s created a supply and demand imbalance as accredited investors in the trust seek to offload their shares in the secondary market

“GBTC has a fixed supply and acts like a leveraged play on Bitcoin,” Bloomberg Intelligence analyst James Seyffart said. “As price goes down, sentiment goes down, GBTC is going to fall further than Bitcoin. Same thing happens on the way up.”

Bitcoin fell for a fifth day on Thursday to a two-week low, its longest losing streak since December. Demand for crypto has sank amid emerging signs that retail traders are retreating from markets, with everything from call options volume to GameStop Inc. shares to the mega-popular Ark Innovation exchange-traded (ticker ARKK) fund faltering.

In addition to individual investors stepping back, demand from institutions may be cooling with the debut of several Bitcoin ETFs in Canada. While U.S. regulators have yet to approve the structure, high-profile issuers such as Fidelity Investments have filed plans.

“The addition of ETFs in Canada likely pulled away some capital from GBTC,” Seyffart said. “Mainly institutional money, because most retail can’t easily buy a Canadian ETF.”

(Updates with Digital Currency Goup’s plans to buy GBTC shares in the second paragraph.)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.