Bonds Rebound, U.S. Futures Gain; Dollar Falls: Markets Wrap

(Bloomberg) — Sovereign bonds extended a rebound, U.S. equity futures rose and the dollar dipped Monday, signaling the return of some calm in markets after the turmoil sparked by last week’s slide in government debt.

Treasury yields edged lower at the open after Australian and New Zealand debt surged. The Reserve Bank of Australia said it will buy A$4 billion of longer-dated bonds, double the usual size.

U.S. equity futures advanced and stocks in both Japan and Australia jumped. On Friday, a rally in Treasuries drove the 10-year yield back to 1.40%, while the S&P 500 slipped and technology stocks staged a modest rebound.

The Australian dollar reversed some of the prior session’s losses along with its New Zealand counterpart, despite data showing China’s economic recovery slowed in February. Oil climbed above $62 a barrel.

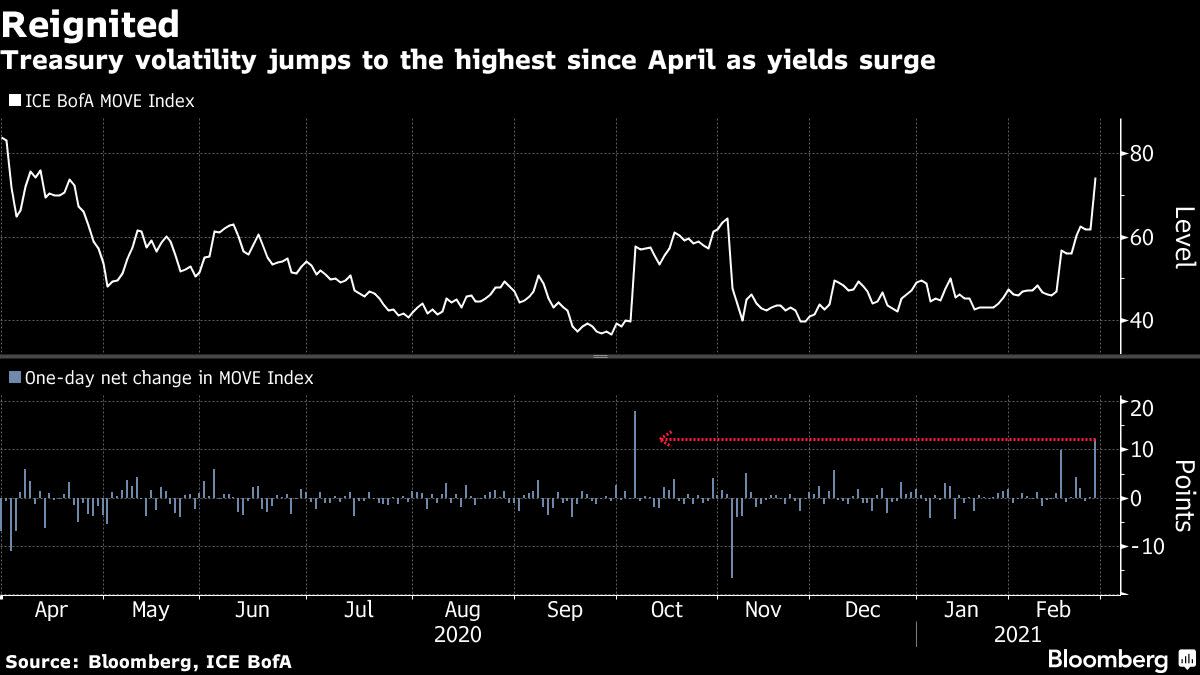

Last week’s selloff in global bonds stabilized after central banks from Asia to Europe moved to calm turmoil that sent Treasury yields to their highest level in a year and spurred a selloff in stocks. Investors were getting increasingly worried that accelerating inflation could trigger a pullback in monetary policy support, despite assurances from the Federal Reserve that higher yields reflect optimism about the outlook for growth.

“The market is testing the Fed and global central banks as to how serious they are here,” Al Lord, Lexerd Capital Management chief executive officer, said on Bloomberg TV. “There are growth expectations and growing inflation concerns, and that’s playing out in the markets.”

Over the weekend, the U.S. House of Representatives passed President Joe Biden’s $1.9 trillion Covid-19 aid package. The bill heads to the Senate, where Biden will need to woo Republican support or avoid losing a single Democratic vote.

Read: Traders on Yield Watch in Bond Markets ‘Not for Faint-Hearted’

Meanwhile, China’s economic recovery slowed in February as factories shut during the Lunar New Year holidays and virus restrictions dampened what’s usually a busy travel season.

There are some key events to watch this week:

Caixin China manufacturing PMI is due Monday.Reserve Bank of Australia sets monetary policy Tuesday.U.S. Federal Reserve Beige Book is due Wednesday.OPEC+ meeting on output Thursday.Fed Chair Jerome Powell to discuss the economy at a Wall Street Journal event on Thursday.The February U.S. employment report on Friday will provide an update on the speed and direction of the nation’s labor market recovery.Beijing is set to unveil its major economic goals on March 5, when the National People’s Congress convenes for its yearly meeting.

These are some of the main moves in markets:

Stocks

S&P 500 futures rose 0.7% as of 9:19 a.m. in Tokyo. The S&P 500 Index fell 0.5%.Japan’s Topix index gained 1.7%.Australia’s S&P/ASX 200 Index rose 1.2%.

Currencies

The yen traded at 106.46 per dollar.The offshore yuan was at 6.4707 per dollar, up 0.2%.The Bloomberg Dollar Spot Index fell 0.3%.The euro was at $1.2090, up 0.1%.The Aussie dollar rose 0.5% to 77.47 U.S. cents.

Bonds

Australia’s 10-year yield fell 30 basis points to 1.61%.The yield on 10-year Treasuries fell two basis point to 1.38%.

Commodities

West Texas Intermediate crude rose 1.8% to $62.58 a barrel.Gold rose 0.4% to $1,741 an ounce.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.